Market overview

Affected by the tightening of loose monetary policy by the Federal Reserve and the continuous increase of cases in COVID-19, US stocks mixed, oil prices and copper prices fell, and the US dollar hit a nine-month high. NVIDIA Corp, Macy's and Robinhood released quarterly reports, with chip stocks rising, NVIDIA Corp up 3.98%, Macy's up 19.59% and Robinhood down 10.26%.

China Stocks continued to be under pressure, and American investors continued to reduce their position of China Stocks. According to the latest survey conducted by Bank of America, about 11% of the respondents believe that shorting Chinese stocks is the most crowded transaction, second only to long American technology stocks and long ESG. Since Hangzhou has the first official second-hand housing trading platform, with KE Holdings Inc. falling 14.86%, Alibaba falling 6.85%, JD.com falling 5.10% and Baidu falling 3.94%.

Three senators were diagnosed

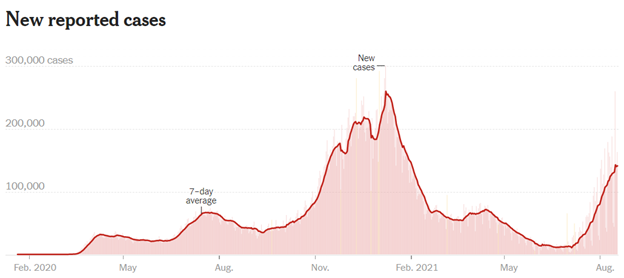

Today, the third senator announced that he had been diagnosed in COVID-19, and there was a breakthrough case after injecting COVID-19 vaccine. The confirmed senators include Senator Angus King, 77, from Maine, Senator Roger Wicker, 70, from Mississippi, and Senator John Hickenlooper, 69, from Colorado. Earlier, Texas Governor Abbott announced that he had been diagnosed with Novel Coronavirus, and was reported to be the 11th governor diagnosed with COVID-19 in the United States. According to Bloomberg News, the number of hospitalized deaths in the United States is close to the peak in February.

At present, there are 140,893 newly diagnosed cases in the United States in a single day, an increase of 47% compared with the average value 14 days ago; 809 new deaths were added in a single day, an increase of 97% compared with the average value 14 days ago; The number of new inpatients in a single day was 85,118, an increase of 56% compared with the average value 14 days ago.

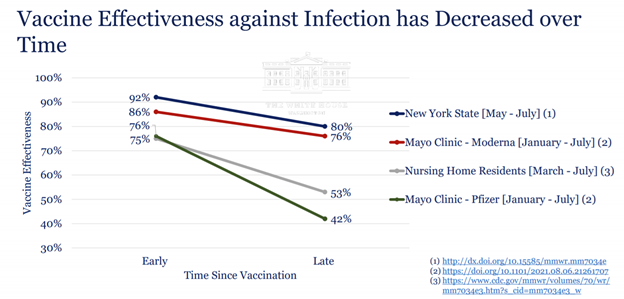

The Biden administration said on Wednesday that in order to take measures to combat the rising cases of COVID-19, it called for the third shot for all adults who have been vaccinated with two doses of COVID-19 vaccine from September this year. At the same time, the Biden administration also indicated that it would require nursing homes to vaccinate their employees with COVID-19 vaccine, otherwise they would lose medical insurance and Medicaid funds. Biden signed a memorandum instructing the U.S. Department of Education to take all measures to ensure that students can safely return to school in the fall, including ensuring that students wear masks when returning to school.

Vivek Murthy, an American public surgeon, said that although the current two-shot vaccine scheme is effective, as more studies show that the effectiveness of the vaccine will gradually decrease with the passage of time, and the vaccine against the Delta mutant strain needs additional boosters. At present, 51% of the population in the United States has been fully vaccinated with two shots of COVID-19 vaccine, and 80.9% of the population over 65 years old has been fully vaccinated with two shots. According to the Biden administration's vaccination strategy, the FDA will first vaccinate people over 65 years old from September 20th, and then extend it to other people. The third shot will use the same dose and vaccine as the first two shots.

US stocks suffered turmoil this week after hitting a series of all-time highs on Monday. Although the quarterly report shows that the company's earnings are growing rapidly, investors are generally optimistic about the stock price outlook; However, some investors remain cautious, fearing that as the Federal Reserve gradually shrinks its asset purchase program, the rising number of confirmed cases of COVID-19 in the United States and around the world will weaken the global economic recovery. Simmons, chief investment officer of UBS Group AG Global Wealth Management UK, said that people are trying to find out what Delta mutant strain means, whether it will lead to more epidemic blockade measures, and whether it will damage economic growth. Goldman Sachs economists lowered their economic growth forecasts for the third quarter and the whole year of the United States, while Mericle, an economist at Goldman Sachs, said that it has been proved that the Delta variant strain has a greater impact on economic growth and inflation than previously expected.

At the close, the DJIA Index fell 0.19% to 34,894.12 points; The S&P 500 index rose 0.13% to 4405.80 points; Nasdaq index rose 0.11% to 14,541.79 points.

Three companies issue quarterly reports

NVIDIA Corp's revenue in the second quarter was better than expected, mainly due to the continuous strong demand for its equipment from computer gamers and cryptocurrency miners, and its sales and net profit in the second quarter both reached record highs. Revenue in the second quarter was $6.51 billion, a year-on-year increase of 68%; Net profit was $2.37 billion, almost double that of the same period last year. Its new generation graphics card can provide high-quality images and fast frame rate, which is very popular among gamers. At the same time, this graphics card also meets the computing power requirements of cryptocurrency mining.

Although the global chip shortage has caused some automobile manufacturers to suspend production, the sales volume of chip companies as a whole is still rising steadily. Officials in the chip industry expect the situation that led to the production reduction of automobiles and pushed up the prices of some electronic products to ease in the coming months. CEO of Intel Gelsinger said that the imbalance between supply and demand in the chip industry will continue until 2023, and the shortage is pushing up the manufacturing costs of some Intel. The company is focusing on industry integration to increase profits.

As of the close, NVIDIA Corp rose 0.48%, Intel rose 0.48% and AMD rose 0.25%. The following figure shows the price trends of the three stocks this year.

Macy's, Kohl, and Tapestry, the parent company of Coach, all reported substantial sales growth in the second quarter. Macy's's sales in the second quarter were $5.65 billion, an increase of 62% compared with 2020 and a slight increase compared with the same-store sales in 2019. CEO Gennette of Macy's said that there is no evidence that sales are slowing down due to the surge in Novel Coronavirus, and the greater concern comes from the risks of supply chain and labor shortage. At the same time, Macy's is attracting new customers by adding new products, including selling toy business ToysToys "R" Us in 400 entities and online stores. Sales of Kohl and Tapestry also returned to pre-epidemic levels, and all three raised their annual performance guidelines. However, Siegel of BMO Capital Markets Stock Research said that no one predicted that the current high level of retail industry would be sustainable, and retail executives were worried about whether the bubble would burst, whether it was Delta mutant strain or something else.

Meanwhile, according to the Wall Street Journal, Amazon.com is opening large physical retail stores similar to department stores to enter the retail industry. The first batch of department stores will be located in Ohio and California, which will occupy less space than traditional retail stores. It is reported that it is uncertain which brands will be sold in these retail stores, but it is expected that Amazon.com's own brands will occupy a major position.

As of the close, Macy's rose by 19.59%, Kohl rose by 7.29%, and Amazon.com fell by 0.42%. The following figure shows the price trends of the three stocks in recent two months.

Robinhood recorded a net loss of $502 million in its first financial report, with total revenue of $5.65; In the second quarter of last year, the company had a net profit of $58 million and total revenue of $244 million. Robinhood said it made a huge loss in February when it raised $2. 4 billion in emergency financing. Among the users who use Robinhood platform to trade, nearly 14.2 million users have traded digital assets, accounting for about 63% of the company's customer base, with a profit of about $233 million; Among them, 2/3 traders are dogecoin traders. The increase in the proportion of users trading digital assets has helped alleviate the slowdown in other businesses of Robinhood, including the weakening interest of retail investors in meme stocks. As of the close, Robinhood fell 10.26%.

China stocks continue to be under pressure

The regulatory pressure on Chinese stocks in China and the United States continues to increase. On Monday, SEC Chairman Gensler once again issued a risk warning to American investors on investing in Chinese companies. On the 19th, the Supreme People's Court solicited opinions from the society on some issues of anti-unfair competition law. The NASDAQ China Index fell continuously after the implementation of the policy of the Beijing Municipal Education Commission on double reduction of education and training industries.

According to the latest survey of fund managers in Bank of America, about 11% of the respondents think that shorting Chinese stocks is the most crowded transaction, second only to long American technology stocks and long ESG stocks, and shorting Chinese stocks is higher than trading long US Treasury bonds. About 16% of the respondents said that China policy is the biggest risk at present, compared with almost zero in July, and the risk ranking of China policy is second only to inflation, deflation panic, COVID-19 pandemic, and asset bubble.

Cathie Wood said in an interview with CNBC today that the constraint by Chinese regulators will have a lasting impact on investor sentiment, and the affected stocks will not rise soon; The memory of nationalizing the online education industry will exist for a long time, and such measures are likely to appear in any other industry. According to Bloomberg reported on the 17th, SoftBank sold about $14 billion worth of shares in the second quarter, and Masayoshi Son withdrew more funds from the secondary market to invest in private start-ups.

At the same time, Hangzhou second-hand housing transaction supervision service platform officially launched the function of listing houses independently. According to the agency, this function is mainly to break the mode of selling houses by intermediaries and provide individuals with channels for publishing information on selling houses by independent transactions, the listing information is only open to individual real-name users, and brokers cannot view it. As of the close, KE Holdings Inc. fell 14.86%, Alibaba fell 6.85%, JD.com fell 5.10% and Baidu fell 3.94%.

Comments