Stocks rose Wednesday after the Federal Reserve delivered another widely expected 75 basis point rate hike and hinted at a possible shift in its tightening pace.

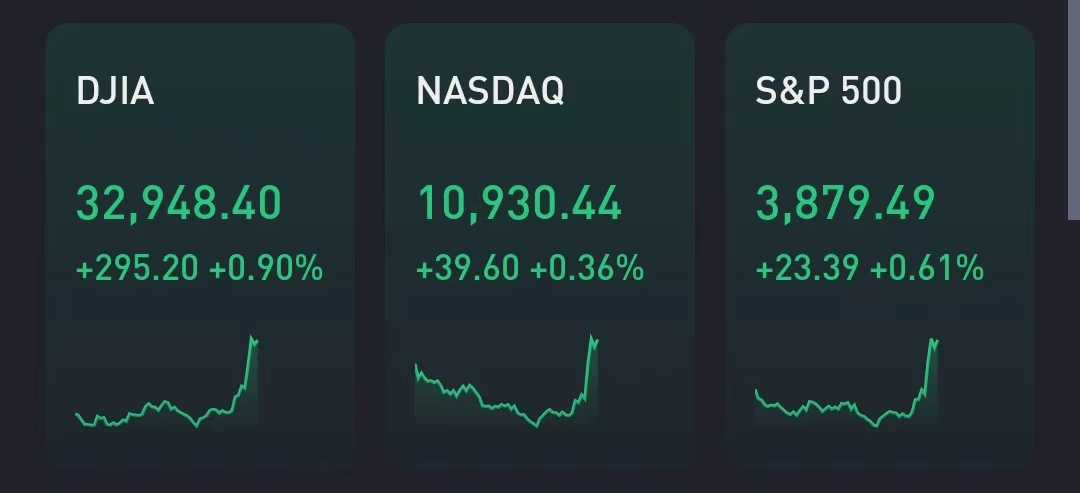

Stocks pared back earlier losses following the Fed decision. The Dow Jones Industrial Average traded surged 300 points, or 0.9%. The S&P 500 and Nasdaq Composite last traded 0.6% and 0.36% higher, respectively.

The new statement hinted at a possible policy change, saying the Fed “will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

The Fed implemented another widely expected 0.75 percentage point rate increase, its fourth hike in a row of that caliber, as it battles high inflation and signaled a potential shift in its policy stance.

Comments from the Fed and Chair Jerome Powell will play a key role in deciphering where stocks go in the months ahead and whether markets kick off a fresh bull run.

“Continuation of the year-end rally is contingent on the Fed delivering on the pivot narrative,” wrote Barclays’ Emmanuel Cau in a note to clients Wednesday. “Peak hawkishness may fuel more FOMO, but should not be confused with dovishness, as CBs continue to walk a fine line. Rate cuts have been a precondition for equities to start a new bull market in the past - we’re not there yet.”

The central bank’s decision will come after the release of strong jobs data, with better-than-expected private payrolls data for October painting a resilient labor market. The JOLTS report Tuesday also conveyed a tight jobs market despite the Fed’s aggressive tightening clip.

In other economic news, mortgage application data for last week came in flat despite a slight tick lower in rates.

Earnings continued with strong results from CVS Health. Advanced Micro Devices rose despite a top and bottom line miss, and Boeing shares gained on strong cash flow comments.

Comments