Market Overview

Wall Street's main stock indexes closed sharply lower on Tuesday after stronger-than-expected retail sales data.

The S&P 500 dropped 1.16%. The Nasdaq declined 1.14%, while Dow Jones Industrial Average declined 1.02%.

Regarding the options market, a total volume of 36,786,644 contracts was traded.

Top 10 Option Volumes

Top 10: SPDR S&P 500 ETF Trust, Invesco QQQ Trust, Tesla Motors, NVIDIA Corp, AMC Entertainment Cboe Volatility Index, Apple, Johnson & Johnson, iShares Russell 2000 ETF, Amazon.com

Options related to equity index ETFs are popular with investors, with 8.20 million SPDR S&P 500 ETF Trust and 3.20 million Invesco QQQ Trust options contracts trading on Thursday.

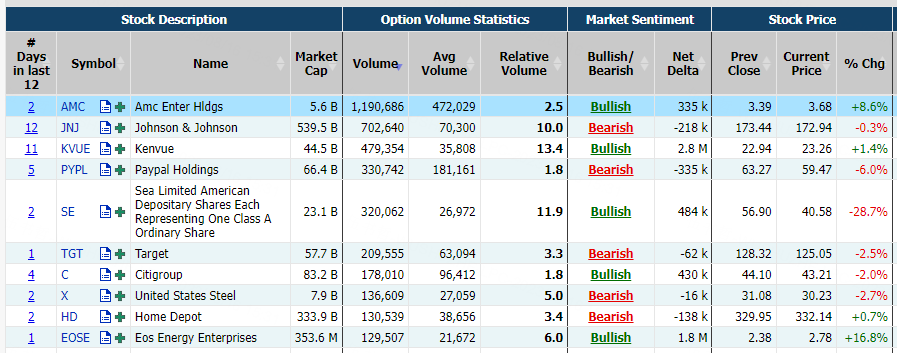

Johnson & Johnson slid 0.29% on Tuesday as it is offering its holders the opportunity to exchange their shares for Kenvue (KVUE) at a 7% discount to Kenvue's market price.

There were 707.4K Johnson & Johnson option contracts traded on Tuesday, surging nearly 60% from the previous trading day. Call options account for 50% of overall option trades. Particularly high volume was seen for the $170 strike put option expiring September 15, with 6,015 contracts trading. $JNJ 20230915 170.0 PUT$

Most Active Trading Equities Options

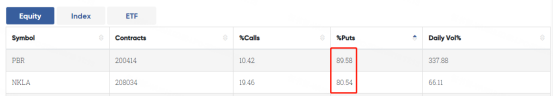

Special %Calls >70%: Microsoft; Palantir Technologies Inc.

Special %Puts >70%: Petroleo Brasileiro SA Petrobras; Nikola Corporation;

Unusual Options Activity

Sea Ltd tumbled 28.68% on Tuesday after posting mixed results in the three months ended June 30, as tepid consumer spending amid a challenging macroeconomic outlook pressured its e-commerce business and caused a steep decline in its mobile gaming unit.

There were 330.1K Sea Ltd option contracts traded on Tuesday, surging over 200% from the previous trading day. Put options account for 55% of overall option trades. Particularly high volume was seen for the $35 strike put option expiring September 15, with 15,105 contracts trading. $SE 20230915 35.0 PUT$

Nikola Corporation rebounded 4.95% on Tuesday after falling 6.67% on Monday; It announced a voluntary recall of 209 of its Class 8 Tre battery-electric vehicles due to a coolant leak within the vehicle battery pack last Friday.

There were 208K Nikola Corporation option contracts traded on Tuesday, surging over 50% from the previous trading day. Put options account for 80.54% of overall option trades. Particularly high volume was seen for the $2 strike put option expiring August 18, with 53,258 contracts trading.$NKLA 20230818 2.0 PUT$

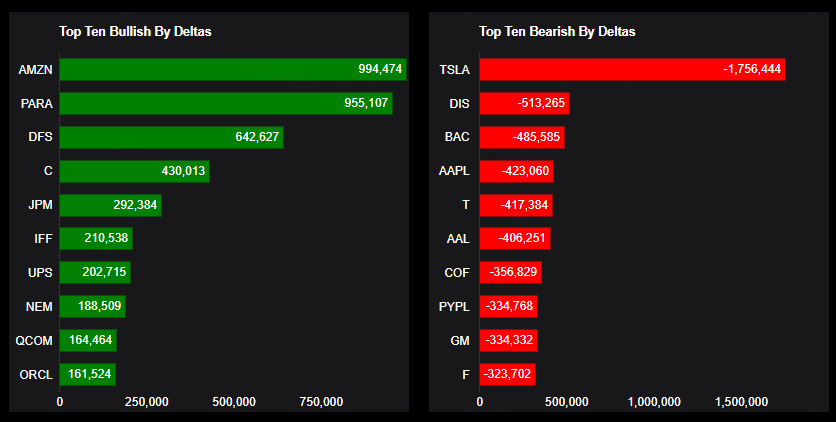

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: Amazon.com, Paramount Global, Discover, Citigroup, JPMorgan Chase, International Flavors & Fragrances, United Parcel Service Inc, Newmont Mining, Qualcomm, Oracle

Top 10 bearish stocks: Tesla Motors, Walt Disney, Bank of America, Apple, AT&T Inc, American Airlines, Capital One, PayPal, General Motors, Ford

Based on option delta volume, traders sold a net equivalent of -1,756,444 shares of Tesla Motors stock. The largest bearish delta came from selling calls.

The largest delta volume came from the 18-Aug-23 237.5 Call $TSLA 20230818 237.5 CALL$, with traders getting short 810,114 deltas on the single option contract.

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments