Investors are looking to Tesla's Q2 earnings report, expected on 19 July, with concerns over operating margins and the impact of price cuts on revenue. A further drop in margins could push the company into negative cash flow territory.

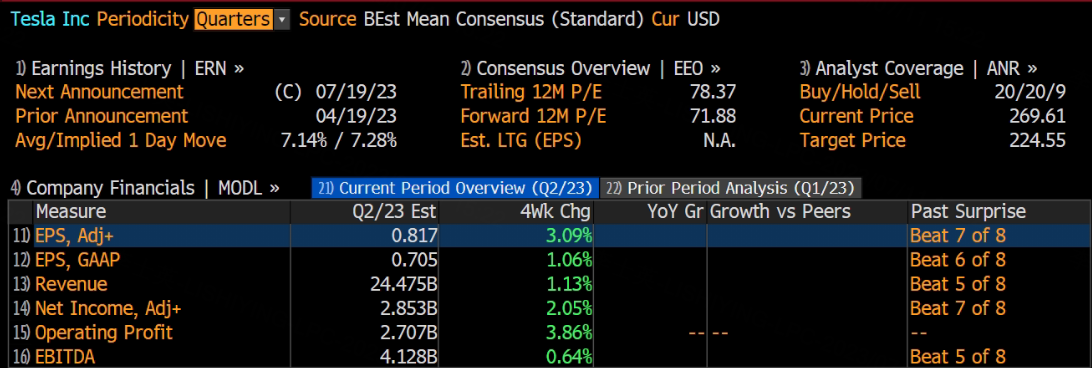

Tesla is expected to publish its Q2 2023 earnings after the bell on July 19, reporting on a quarter that saw the company report a record number of deliveries. Analysts expect Tesla’s revenues to come in at $24.475 billion, marking year-over-year growth of about 45%. Adjusted earnings are likely to come in at about $0.817 per share, according to Bloomberg's unanimous expectations.

Tesla stock has soared by nearly 120% this year. So, what are some of the trends that are likely to drive Tesla’s results?

Previous quarter review

Tesla reported a lower-than-expected gross margin for the first quarter of 2023 as a series of aggressive price cuts aimed at spurring demand in a sagging economy and fending off rising competition took their toll. As a result, the company's total gross margin stood at 19.3%, compared to analysts' expectations of 22.4%, marking the lowest level since Q4 2020.

Earnings per share: 85 cents adjusted vs 85 cents expected, according to the average analyst estimate compiled by Refinitiv

Revenue: $23.33 billion vs $23.21 billion expected, according to Refinitiv estimates

Tesla said net income fell 24% to $2.51 billion, or 73 cents a share, from $3.32 billion, or 95 cents a share, a year ago.

Tesla boss Elon Musk doubled down on the price war he started at the end of last year, saying the electric vehicle (EV) maker would prioritize sales growth ahead of profit in a weak economy.

In 2023, Tesla expects to produce 1.8 million vehicles, Musk reiterated, or possibly an “upside” volume of 2 million vehicles this year.

What will we focus on in Q2?

Record-breaking delivery and price war

Tesla has already reported delivery numbers for Q2 2023, easily beating expectations as the effects of the electric-vehicle maker’s price cuts, combined with federal EV tax credits, are boosting sales. For the quarter, Tesla reported global production of 479,700 units with deliveries of 466,140. The delivery figure easily topped Wall Street consensus estimates of 448,599 units, as well as the prior quarter’s total of 422,875. Both production and delivery totals for the second quarter were all-time records for Tesla.

This news is that Tesla has shaken off the bearish gloom on Wall Street and many analysts have turned bullish.

While the growth rates were driven in part by a favorable comparison with Q2 2022 when the company’s Chinese business declined sharply amid strict Covid-19-related lockdowns, Tesla has also likely benefited from price cuts on popular models and an expansion of manufacturing capacity. For perspective, Model Y presently sells at more than 20% below last year’s prices. Moreover, the Model 3 and Y are also eligible for the $7,500 tax credit under the Inflation Reduction Act in the U.S. and this is also making Tesla’s EVs more accessible to a broader customer base. The ramp-up of production at Tesla’s factory in Texas is also helping supply to an extent.

Executives from the largest brands signed a truce over "abnormal pricing" this month in China. Tesla's sales bump in the first half of 2023 may now start to slow if prices normalize. It is worth observing how long Tesla can sustain sales growth through price reductions.

Auto gross margins likely “troughed“ in Q2

While higher volumes are positive, Tesla’s average selling prices are likely to trend meaningfully lower and this is also likely to impact margins over Q2. Automotive gross margins over Q1 2023 stood at 19.3%, down almost 10% compared to the year-ago quarter and we should see a similar year-over-year decline over Q2 as well.

“We join a consensus view that Q2 will be a trough in auto gross margin,” Jefferies analyst Philippe Houchois wrote. For the second quarter, Houchois expects the automotive gross margin to slip to 18.6%, which would be a substantial 40 basis points below the Q1 level.

As for those huge Tesla price cuts, Houchois says the jury is still out on whether the cuts proved the elasticity of demand for Tesla vehicles since Q2 deliveries only rose 10%. In economics, a product with elastic demand would see sales rise or fall in relation to moves in price.

Houchois believes product refreshes, like the much-rumored Model 3 “Highland” version, and Tesla’s small share overall of the mid-size car segment means there’s still room to grow despite price cuts.

Inventory is also an issue for this quarter with Tesla producing excess vehicles for a fifth-consecutive quarter. The cumulative total is 91,000 vehicles at a cost of around $38,000 each or a total of around $3.5 billion. The latest deliveries would add $500 million to that figure.

Increasing inventory led to a rise in working capital that hurt free cash flow in Q1.

Intense Competition and Charging Standards

Tesla’s fast-charging standard is becoming the predominant standard in the U.S., boosting Tesla’s stock and opening up new revenue streams for the electric-vehicle maker.

Tesla is fresh from inking deals with several automakers, including Ford Motor and General Motors, in which the Supercharger network, clusters of Tesla’s fast-charging ports usually off major highways, will be open to the other companies’ EV owners.

In terms of rising competition, as legacy automakers and startups such as Rivian Automotive Inc. offer more EVs, Tesla is the only one with a share to lose. All other players are gaining market share at its expense.

The company’s dominant market position is likely to become thinner thanks to stiff competition,” and there are also concerns in the Chinese market, with plenty of home-grown players like NIO, XPeng, and Li Auto Inc., among others. Chinese players are seeing strong growth in their home turf and are getting ready to expand in international markets, mainly Europe and other Asian countries.

Analyst opinion

Tesla price target raised to $278 from $215 at Citi

Tesla has a "neutral-to-slightly negative" setup heading into its upcoming earnings report, according to a Citi Research analyst. Citi's Itay Michaeli said that bears worry that Tesla's "stretched valuation" will make the stock "vulnerable going into a quarter that will again be impacted by price cuts, with any margin shortfall or even just unimpressive numbers possibly dampening sentiment." Conversely, he notes consensus expectations for the year don't seem particularly aggressive, while "the Q2 delivery beat leaves room for an upward guidance revision." He boosted his price target on Tesla shares to $278 from $215 but kept a neutral rating on them.

Tesla price target raised to $265 from $185 at Jefferies

Jefferies analyst Philippe Houchois maintained Tesla a Hold rating and upped the price target from $185 to $265. The second quarter will mark a trough in Tesla's auto gross margin, said Houchois in a note released. The analyst said he expects second-quarter revenue to come in at $24.7 billion, up 6% sequentially and 46% higher than a year ago.

Houchois forecast a gross auto margin of 18.6%, 40 basis points below the first quarter. He sees some mitigating impact coming from easing commodity costs, fixed cost coverage, and IRA support to battery costs.

Tesla price target raised to $300 from $230 at Mizuho

Mizuho analysts' Tesla price target goes from $230 up to $300 on the Buy-rated stock after they raised estimates for the June quarter and the year. The analysts are raising June quarter revenue estimates from $23.1 billion to $23.9 billion and EPS from $0.83 to $0.86. They are raising FY 2023 revenue estimates from $95.7B to $96.5B and EPS from $3.52 to $3.55, versus the consensus of $100B and $3.47.

The Mizuho analysts continue to see Tesla as the global EV leader for the next decade as the Berlin/Texas gigafactories ramp and amid the $7,500 tax credit tailwinds. In addition, a $7,500 tax credit for the purchase of EVs in the US is also a great incentive for further development. Tesla is one of the biggest beneficiaries.

Tesla price target raised to $300 from $225 at BofA

Bank of America has reaffirmed its Neutral stance on Tesla, while lifting their 12-month price projection for the stock from $225.00 to $300.00, citing improved volumes and reduced costs among auto suppliers in 2023.

Bank of America analysts are anticipating Tesla’s robust 2Q results and raised 2023 outlooks, specifically from suppliers.

Comments