U.S. stock index futures edged higher on Friday, with investors piling on economically sensitive energy, banks and travel stocks ahead of key retail sales data that would shed light on the strength of the economic recovery.

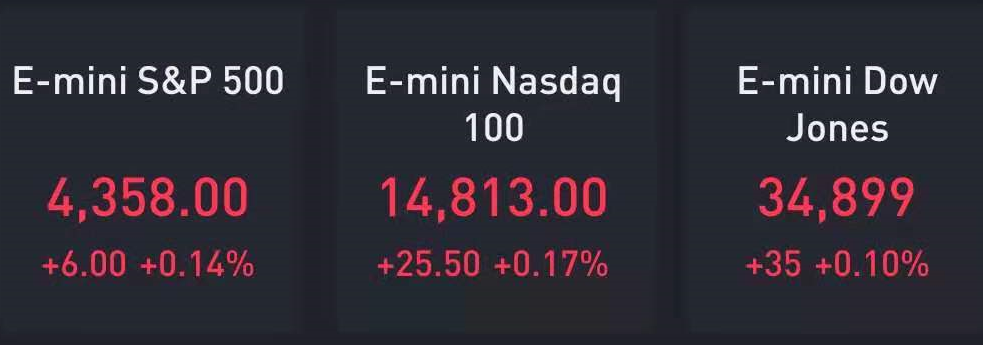

At 8:05 a.m. ET, Dow E-minis were up 35 points, or 0.10%, S&P 500 E-minis were up 6 points, or 0.14% and Nasdaq 100 E-minis were up 25.5 points, or 0.17%.

The Commerce Department’s report, due at 8:30 a.m. ET, is expected to show U.S. retail sales rose marginally in June after dropping 1.3% in May.

Markets have largely cheered a steady recovery in the labor market this year, but concerns about higher inflation due to a faster-than-expected rebound has hurt sentiment, with investors oscillating between “value” and tech-heavy “growth” names in the past few sessions.

Rate-sensitive lenders Citigroup Inc, JPMorgan Chase & Co, Goldman Sachs Group Inc, Morgan Stanley and Bank of America Corp rose between 0.2% and 0.3%, tracking a rise in benchmark 10-year Treasury yield.

Oil stocks Chevron Corp, Diamondback Energy Inc, Exxon Mobil Corp, Halliburton Co, Schlumberger NV and Occidental Petroleum Corp gained between 0.7% and 0.9%.

Stocks making the biggest moves in the premarket:

Moderna, Inc.– The drug maker's shares surged 7.3% in the premarket on news that the stock would be included in the S&P 500 as of July 21st. It will replaceAlexion Pharmaceuticals, which is being acquired byAstraZeneca(AZN).

DiDi Global Inc. – Shares of the China-based ride-hailing company slid 5.5% in premarket action after Didi was the subject of an onsite cybersecurity review from officials of at least 7 different government departments.

AMC Entertainment,GameStop– So-called "meme stocks" continued their wide swings in the premarket, with AMC up 4.6% and GameStop jumping 3.9%. The movie theater operator's stock rose for just the second time in ten sessions Thursday, while the videogame retailer is riding a five-session losing streak and its stock has been down in nine of the past ten trading days.

CarnivalRoyal Caribbean Cruises ,Norwegian Cruise Line – Cruise stocks rose in the premarket after Canada said it would allow large cruise ships to resume visiting the country in November. Carnival added 1.2%, Royal Caribbean gained 1.1% and Norwegian was up 1.7%.

Intel – Intel is exploring a deal to buy fellow semiconductor maker GlobalFoundries, according to people familiar with the matter who spoke to the Wall Street Journal. Such a transaction could potentially value GlobalFoundries at about $30 billion, although there is no guarantee a deal will be finalized. Intel rose 1% in premarket trading.

fuboTV Inc. – Shares of the live-sports video streaming company surged 4.7% in the premarket after its Fubo Gaming subsidiary struck a market access agreement with casino operator Cordish Companies for its planned mobile Fubo Sportsbook in Pennsylvania.

Molson Coors – The beer brewer announced it would resume paying quarterly dividends, with a planned payout of 34 cents per share payable on September 17 to shareholders of record as of August 30. Molson Coors had suspended its dividend last May as it dealt with the financial impact of the pandemic.

Lordstown Motors Corp. – The electric truck maker said it is under investigation by federal prosecutors in New York, who are looking into Lordstown's vehicle pre-orders as well as its merger with special purpose acquisition company DiamondPeak Holdings last October. Lordstown lost 1% in premarket trading.

Textron– The stock was added to the "Conviction Buy" list at Goldman Sachs, which points to a strengthening market for business jets and consensus estimates that it feels are too low.

The Honest Company, Inc. – Shares of Honest Company rose 2.4% in the premarket after the maker of personal care products was upgraded to "buy" from "hold" at Loop Capital Markets. Loop said shares are now at an attractive level after a recent pullback.

Live Nation Entertainment – The live entertainment producer was rated "buy" in new coverage at Goldman Sachs, which said Live Nation is poised to benefit from an expected surge in concert activity. Live Nation added 2.6% in premarket trading.

Comments