Market Overview

Wall Street's indexes ended down more than 1% on Friday after investors ran for the exits as they feared for the health of U.S. banks after the failure of a high-profile lender to the technology sector, overshadowing the February jobs report.

The Dow Jones Industrial Average fell 1.07%, the S&P 500 lost 1.45%, and the Nasdaq Composite dropped 1.76%.

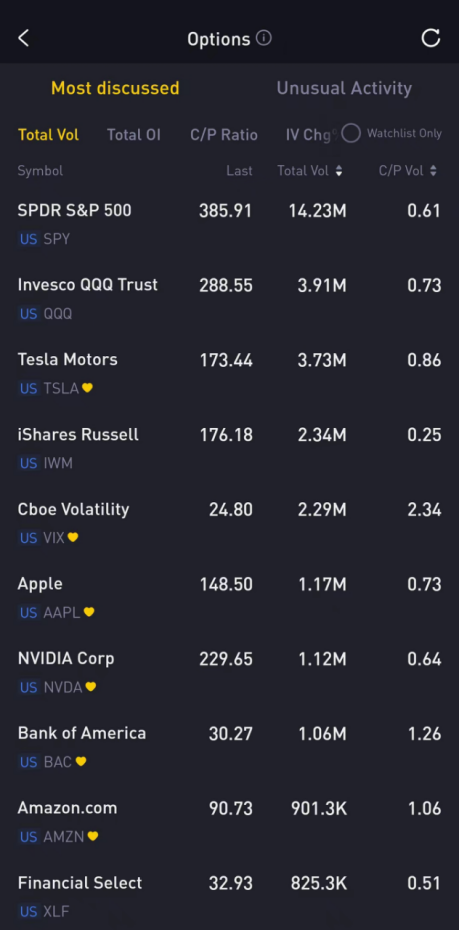

Regarding the options market, a total volume of 59,244,621 contracts was traded on Friday, up 33.21% from the previous trading day.

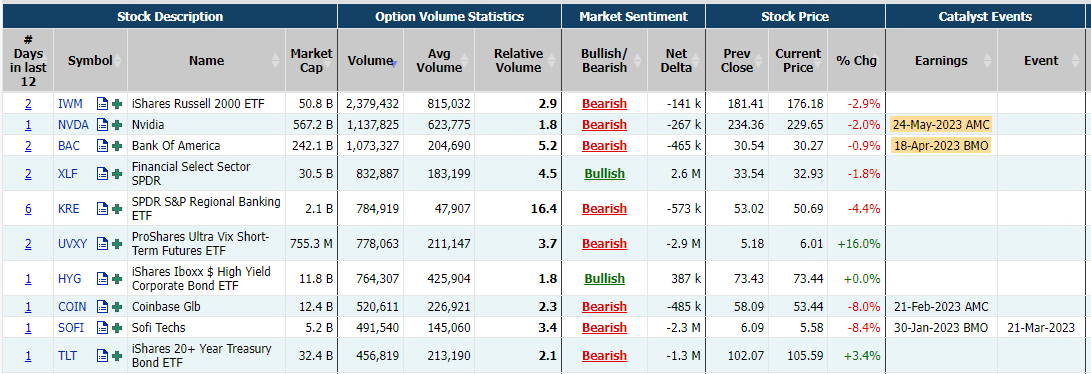

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, IWM, VIX, AAPL, NVDA, BAC, AMZN, XLF

Options related to equity index ETFs are popular with investors, with 14.23 million SPDR S&P 500 ETF Trust and 3.91 million Invesco QQQ Trust options contracts trading on Friday.

Total trading volume for SPDR S&P 500 ETF Trust and Invesco QQQ Trust jumped 26.26% and 10.14% separately from the previous day. 62% of SPDR S&P 500 ETF Trust trades bet on bearish options.

Financial Select Sector SPDR Fund fell 1.82% on Friday, U.S. officials said on Sunday SVB Financial Group customers will have access to their deposits starting on Monday, as the federal government announced actions to shore up deposits and stem any broader financial fallout from the sudden collapse of the tech startup-focused lender.

There were 825.3K Financial Select Sector SPDR Fund option contracts traded on Friday, jumping 19.09% from the previous day. Put options account for 66% of overall option trades. Particularly high volume was seen for the $32 strike put option expiring Mar 17, with 31,699 contracts trading.

Cboe Volatility Index surged 9.69% on Friday because of the SVB crisis and the February jobs report. The U.S. economy added 311,000 jobs in February, more than expected, while the unemployment rate ticked higher to 3.6% on a rise in labor force participation.

There were 2.29M Cboe Volatility Index option contracts traded on Friday, surging 132.51% from the previous day. Call options account for 71% of overall option trades.

Most Active Options

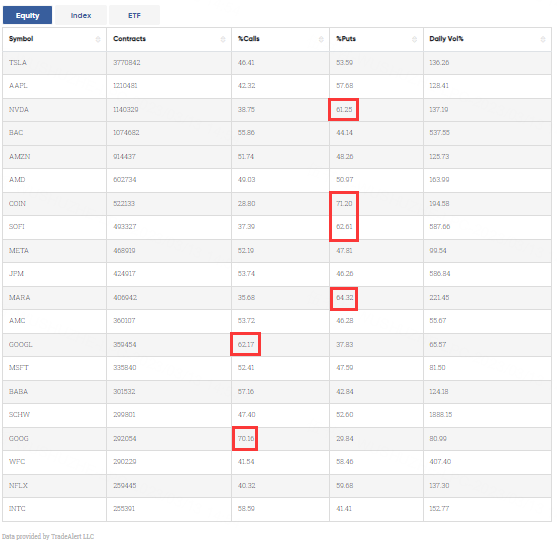

1. Most Active Trading Equities Options:

Special %Calls >60%: Alphabet; Alphabet

Special %Puts >60%: NVIDIA Corp; Coinbase Global, Inc.; SoFi Technologies Inc.; Marathon Digital Holdings Inc

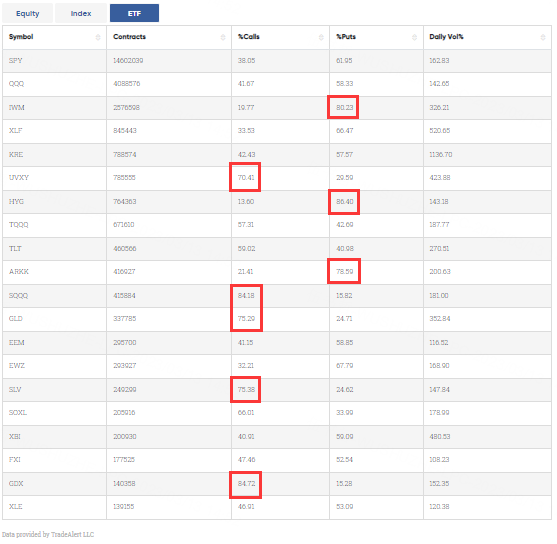

2. Most Active Trading ETFs Options

Special %Calls >70%: VIX Short-Term Futures 1.5X ETF; Nasdaq100 Bear 3X ETF; SPDR Gold Shares; iShares Silver Trust; VanEck Gold Miners ETF

Special %Puts >70%: iShares Russell 2000 ETF; $iShares iBoxx High Yield Corporate Bond ETF; ARK Innovation ETF

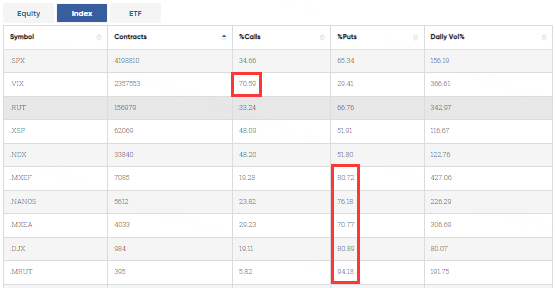

3. Top 10 Most Active Trading Indexes options

Special %Calls >70%: Cboe Volatility Index

Special %Puts >70%: MXEF; $Nanos Standard & Poor's 500(NANOS); MXEA; DJIA 1/100th; MRUT

Unusual Options Activity

Coinbase Global, Inc. fell 8% on Friday because of the SVB crisis. In 2014, when cryptocurrency projects and crypto-affiliated businesses were having a tough time securing financing from traditional sources, Coinbase gave a stock warrant to SVB Financial Group. This means that it was not only a SVB Financial Group client, but also one of SVB Financial Group's potential shareholdings.

Moreover, it said in a tweet on Sunday that it had about US$240 million in corporate cash balance with Signature Bank.

There were 522,133 Coinbase Global, Inc. option contracts traded on Friday. Put options account for 71% of overall option trades. Particularly high volume was seen for the $50 strike put option expiring Mar 17, with 9,941 contracts trading.

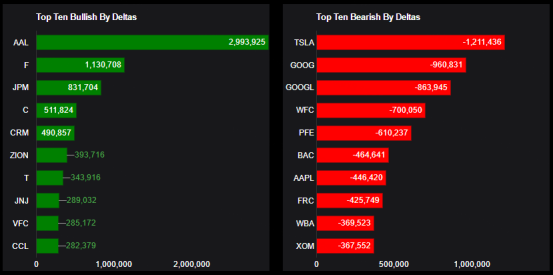

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: AAL, F, JPM, C, CRM, ZION, T, JNJ, VFC, CCL

Top 10 bearish stocks: TSLA, GOOG, GOOGL, WFC, PFE, BAC, AAPL, FRC, WBA, XOM

If you are interested in options and you want to:

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments