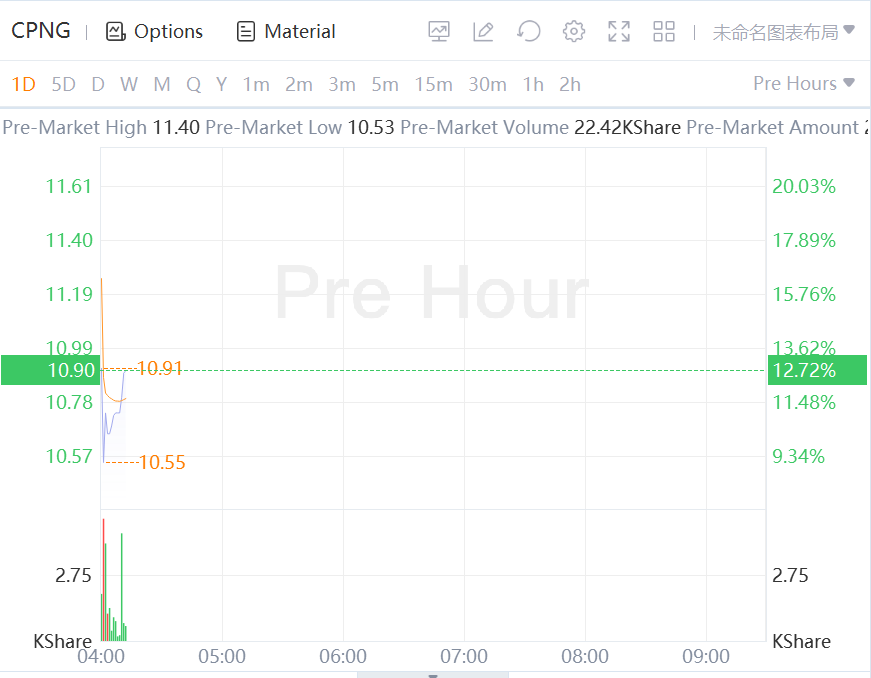

Coupang Shares Surged 12% in Premarket Trading.

Coupang narrowed its losses after ramping up cost cuts to weather a slowdown in online retail.

Global e-commerce is decelerating as consumers emerge from Covid-19 lockdowns or tighten their belts while the macroeconomic outlook remains uncertain. Amazon.com Inc. gave a gloomy forecast for sales last month and said it was monitoring whether rising inflation may affect shoppers’ appetites.

Coupang’s sales remained relatively resilient during the first quarter as record Covid cases spurred consumers in its home country to stock up, but the company’s focus has shifted to cost savings by increasing membership fees and halting some refunds of used products.

Its shares have still plunged 67% this year, hit by the broader tech sell-off. SoftBank’s own Vision Fund sold 50 million of the Korean company’s shares in March for $20.87 each, compared with its $35 IPO price.

“Coupang’s shares slid excessively as e-commerce platform companies are facing deratings globally,” said Park Sang-jun, an analyst at Kiwoom Securities. “The Korean e-commerce market growth has also fallen to single-digit percent growth as social distancing measures lifted. Coupang faces sluggish demand but it may outperform the market with its dominance in commodity goods sales.”

Comments