Market Overview

Wall Street ended lower on Friday as investors assessed economic data and awaited a potential 50-basis point interest rate hike by the U.S. Federal Reserve at its policy meeting next week.

The S&P 500 declined 0.73% to end the session at 3,934.38 points. The Nasdaq declined 0.70% to 11,004.62 points, while Dow Jones Industrial Average declined 0.90% to 33,476.46 points.

Regarding the options market, a total volume of 35,402,022 contracts was traded on Friday, up 4.06% from the previous trading day.

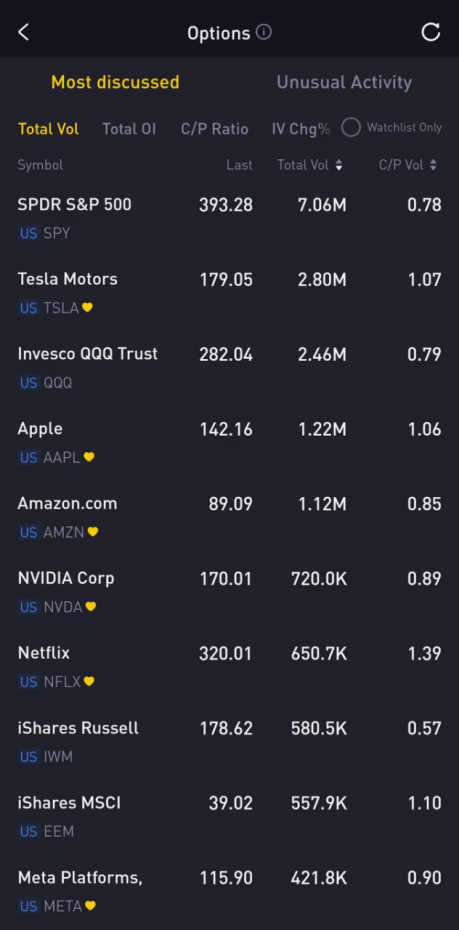

Top 10 Option Volumes

Top 10: SPY, TSLA, QQQ, AAPL, AMZN, NVDA, NFLX, IWM, EEM, META

There are 7.06 million SPY and 2.46 million QQQ options contracts trading on Friday.

SPY’s total trading volume slid 3.42% while QQQ’s volume rose 4.68% from the previous day. 56% of SPY trades bet on bearish options.

Netflix rose 3.14% on Friday as Wells Fargo analyst Steve Cahall boosted its price target to $400 from $300. He noted that there is still "scope" for the company's key performance indicators to exceed expectations in 2023. And with the stock down roughly 48% year-to-date, it looks like a good time for investors to jump in.

There were 650,700 Netflix options trading on Friday, its volumes surged 182.08% from the previous day. Call options account for 58% of overall option trades. Particularly high volume was seen for the $330 strike call option expiring December 16th, with 11,389 contracts trading on Friday.

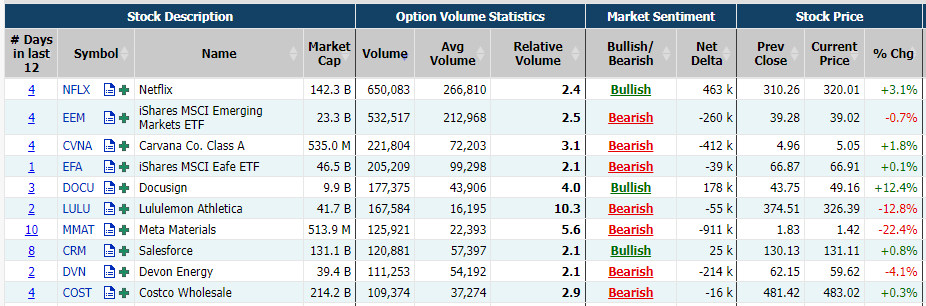

Unusual Options Activity

Docusign surged 12.37% on Friday after posting its financial results. The company reported adjusted earnings of 57 cents per share on $645 million in revenue where Wall Street expected adjusted earnings of 42 cents and revenue of $627 million.

There were 177,700 Docusign options trading on Friday. Put options account for 57% of overall option trades. Particularly high volume was seen for the $51 strike call option expiring December 16th, with 7,751 contracts trading on Friday.

Lululemon Athletica crashed 12.85% on Friday after posting its financial results. It reported earnings of $2.00 per share and $1.86 billion in revenue, and raised its sales forecast for the full year ending in January to as much as $7.99 billion.

There were 168,800 Lululemon Athletica options trading on Friday. Put options account for 54% of overall option trades. Particularly high volume was seen for the $330 strike put option expiring December 16th, with 1,904 contracts trading on Friday.

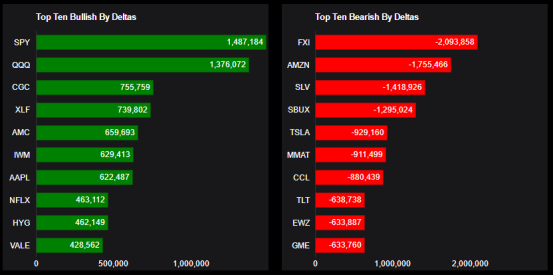

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: SPY, QQQ, CGC, XLF, AMC, IWM, AAPL, NFLX, HYG, VALE

Top 10 bearish stocks: FXI, AMZN, SLV, SBUX, TSLA, MMAT, CCL, TLT, EWZ, GME

If you are interested in options and you want to:

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments