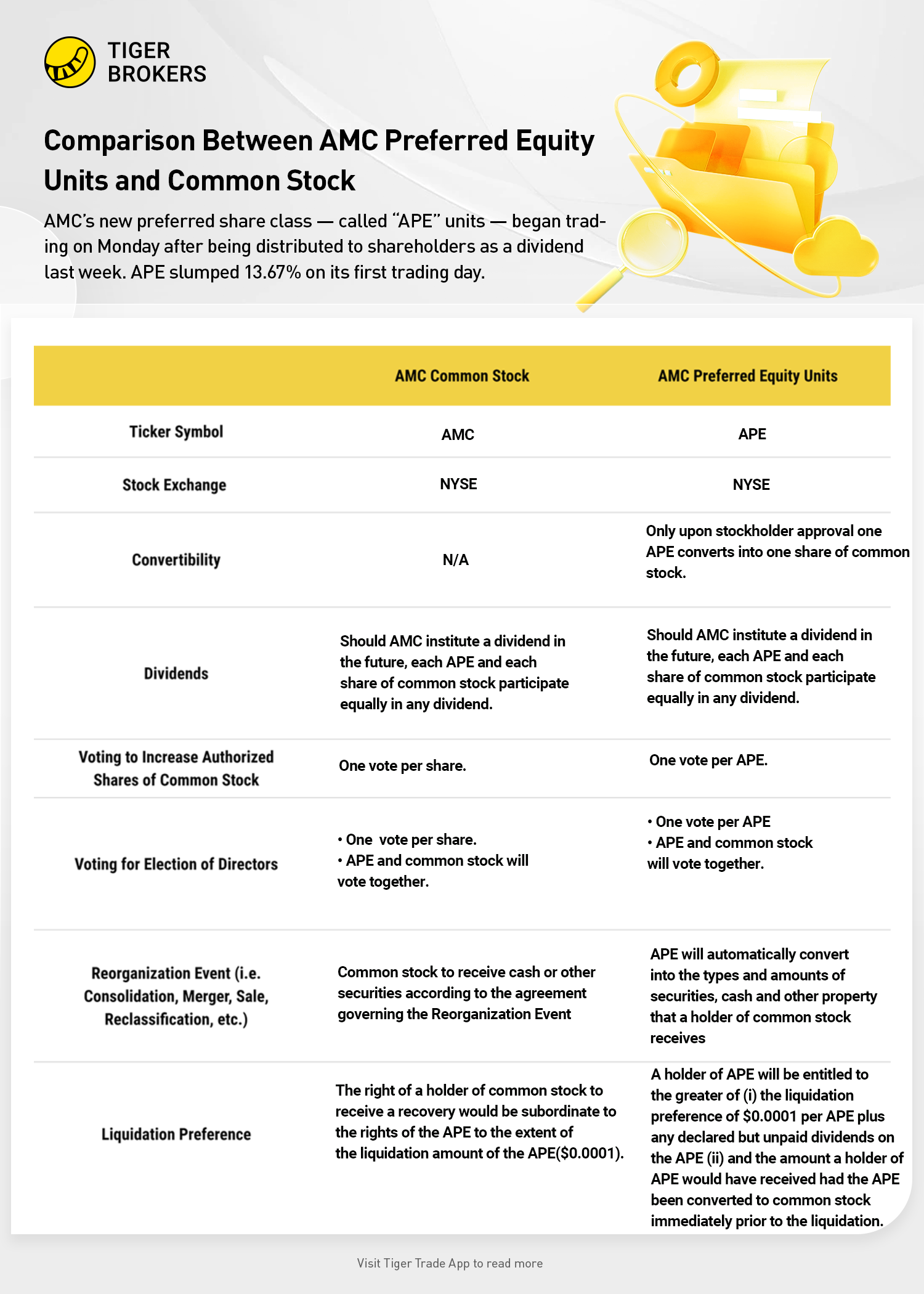

AMC’s new preferred share class — called “APE” units — began trading on Monday after being distributed to shareholders as a dividend last week.

APE slumped 13.67% on its first trading day. AMC also tumbled 41.95% after APE listing started trading and its UK-based rival Cineworld Group warned of a possible bankruptcy filing.

AMC Stock: 10 Things to Know About the APE Dividend

- Shares of AMC stock are falling lower today to reflect the value of the APE dividend. As Aron explained, an AMC investment is worth the combination of an AMC share and an APE unit.

- The units will be tradable on the NYSE under the “APE” ticker.

- AMC Entertainment will issue roughly 517 million APE units. A unit will be issued for each common share of AMC outstanding.

- Each unit will represent “an interest in 1/100th of a share” of preferred stock. As a result, each unit will have the same voting rights as one share of AMC common stock.

- AMC noted that the special dividend’s effect on AMC stock will “be similar to a 2/1 stock split.”

- B. Riley analyst Eric Wold believes APE and AMC will trade at “relatively equal prices” because the two classes of equity have “equal economic value and voting rights.”

- Another 4.5 billion APE units could be sold after the initial issuance, if the board approves.

- The APE units can technically be converted into AMC stock, pending a board proposition and shareholder approval. However, the company does not expect its board to propose a convertibility feature “any time soon.”

- The number of AMC common shares will not change, remaining at 516.82 million.

- CEO Adam Aron characterized today’s APE dividend news as “perhaps the single biggest action [the company] will take in all of 2022 to fundamentally strengthen AMC for the long term.”

Comments