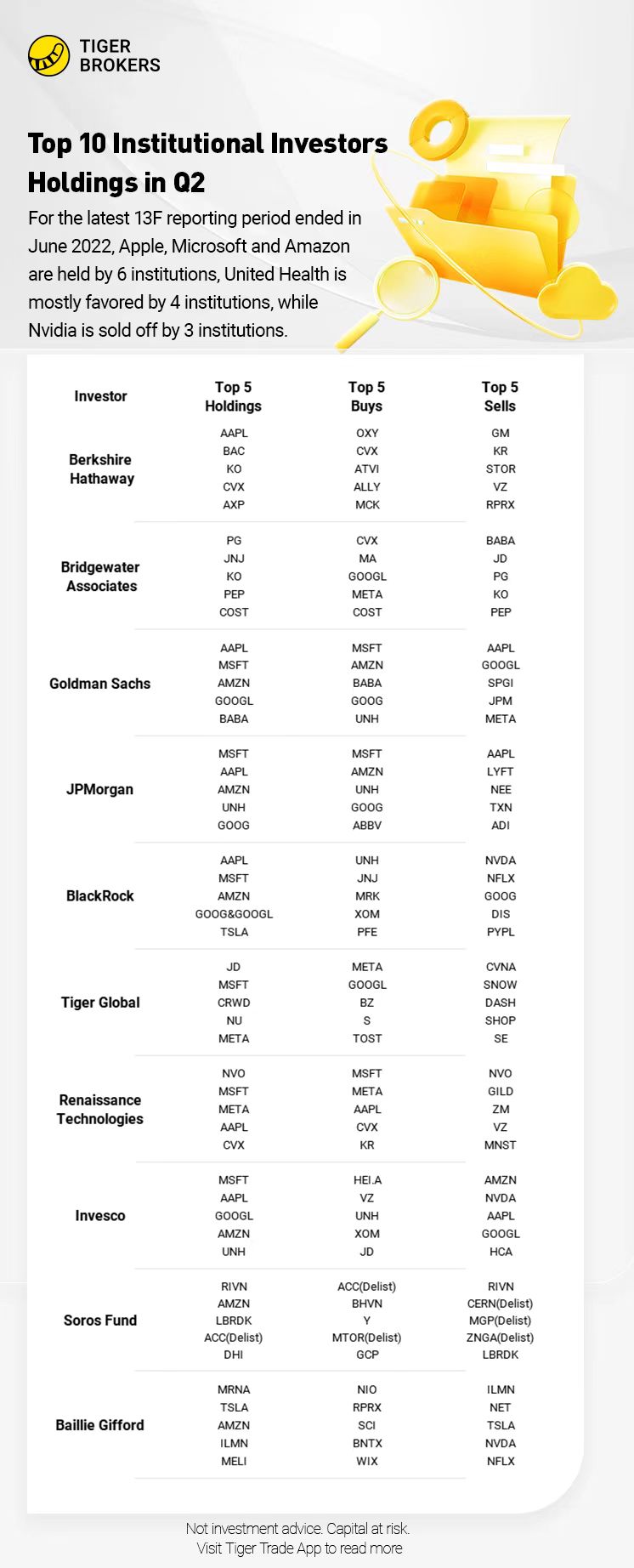

For the latest 13F reporting period ended in June 2022, Apple, Microsoft and Amazon are held by 6 institutions, United Health is mostly favored by 4 institutions, while Nvidia is sold off by 3 institutions.

Buffett’s Berkshire Cuts Verizon, Keeps Other Equity Stakes Mostly Unchanged

Berkshire Hathaway eliminated a Verizon Communications stake inQ2 as the conglomerate run by Warren Buffett made tweaks to its portfolio and dialed back on stock purchases.

Berkshire boosted other bets in Q2. Its stake in Paramount Global is currently valued at about $2.1 billion, and an investment in Celanese is at almost $1.1 billion.

Buffett’s firm made $3.8 billion in net stock purchases in Q2, down from $41 billion in the prior period. The company also spent less on share repurchases in Q2.

Ray Dalio's Bridgewater Takes Fresh Stakes in Rivian, Amazon, Exits Alibaba, JD.Com

Ray Dalio's Bridgewater Associates took new stakes in Rivian, acquiring 62.8K shares, Amazon, buying 149.2K shares and Sea with 459.2K shares in Q2. The fund exited stakes in Alibaba and JD.com.

It boosted its holdings in Meta Platforms to 586.6K shares from 10.9K shares, Alphabet to 49.1K shares from 1.7K shares, CVS Health to 3.14M shares from 1.21M shares, and Mastercard to 485.2K shares from 36.1K shares, and trimmed down its positions in PepsiCo to 3.81M shares from 4.17M shares, Linde to 52.5K shares from 276.3K shares, and Procter & Gamble to 6.74M shares from 6.82M shares.

Goldman Sachs Bought Microsoft and Amazon, Sold S&P Global and Meta

It included $443,378,724,000 in managed 13F securities and a top 10 holdings concentration of 16.44%. The top 5 holdings are Apple, Microsoft, Amazon, Google and Alibaba, the top 5 buys are Microsoft, Amazon, Alibaba, Google and United Health, while the top 5 sells are Apple, Google, S&P Global, JPMorgan and Meta.

JPMorgan Bought Microsoft and Amazon, Sold Apple and Lyft

It included $717,859,299,000 in managed 13F securities and a top 10 holdings concentration of 19.12%. Its largest holding is Microsoft with shares held of 91,034,485. The other top 4 holdings are Apple, Amazon, United Health and Google, the top 5 buys are Microsoft, Amazon, United Health, Google and Abbvie, while the top 5 sells are Apple, Lyft, NextEra, Texas Instruments and Analog Devices.

Blackrock Bought United Health and Johnson&Johnson, Sold Nvidia and Netflix

It included $3,117,359,647,000 in managed 13F securities and a top 10 holdings concentration of 18.91%.Its largest holding is Apple with shares held of 1,028,688,317. The other top 4 holdings are Microsoft, Amazon, Google and Tesla, the top 5 buys are United Health, Johnson&Johnson, Merck, Exxon Mobil and Pfizer, while the top 5 sells are Nvidia, Netflix, Google, Disney and Paypal.

Tiger Global Slashes Portfolio Amid Losses

Tiger Global Management, which lost billions of dollars in this year's technology meltdown, slashed or completely exited most of its holdings inQ2, potentially cutting its exposure to a recent stock rally.

Among the companies in which Tiger reduced positions are Carvana, Crowdstrike, Snowflake, Nu Holdings, JD.com, Doordash, Coinbase and Microsoft.

It also dissolved its investments in Robinhood, Zoom Video Communications and Docusign.

Renaissance Technologies Bought Microsoft and Meta, Sold Novo-Nordisk and Gilead Sciences

It included $84,467,497,000 in managed 13F securities and a top 10 holdings concentration of 10.97%. The largest holding is Novo-Nordisk A/S ADS with shares held of 17,529,671. The other top 4 holdings are Microsoft, Meta, Apple and Chevron, the top 5 buys are Microsoft, Meta, Apple, Chevron and Kroger, while the top 5 sells are Novo-Nordisk, Gilead Sciences, Zoom Video Communications, Verizon and Monster Beverage.

Invesco Bought Heico and Verizon, Sold Amazon and Nvidia

It included $330,037,936,000 in managed 13F securities and a top 10 holdings concentration of 11.32%.The largest holding is Microsoft with shares held of 31,448,141. The other top 4 holdings are Apple, Google, Amazon and United Health, the top 5 buys are Heico, Verizon, United Health, Exxon Mobil and JD.com, while the top 5 sells are Amazon, Nvidia, Apple, Google and HCA.

Legendary Financier George Soros Bets Big on Amazon and Alphabet

Soros began betting heavily on Amazon. As of June 30, his firm Soros Fund Management held 2,004,500 Amazon shares worth about $213 million, compared to 70,717 Amazon shares as of March 31.

The firm also boosted its Alphabet shares by 10.4% compared to March 31. Soros Fund Management held 53,175 Alphabet shares as of June 30 worth $5.8 million.

Besides Alphabet and Amazon, Soros also acquired additional shares in Salesforce and Qualcomm. Soros Fund Management holds 627,509 Salesforce shares, up 138.3% from March 31, and 229,582 Qualcomm shares, up 49% from three months earlier.

The value of Soros' U.S. equity portfolio rose 5.3% quarter over quarter to $5.6 billion.

Baillie Gifford Bought NIO and Royalty Pharma, Sold Illumina and Cloudflare

It included $97,508,008,000 in managed 13F securities and a top 10 holdings concentration of 35.7%.The largest holding is Moderna with shares held of 45,559,791. The other top 4 holdings are Tesla, Amazon, Illumina and MercadoLibre, the top 5 buys are NIO, Royalty Pharma, Service Corp., BioNTech SE and Wix.com, while the top 5 sells are Illumina, Cloudflare, Tesla, Nvidia and Netflix.

Comments