Wall Street's main indexes dropped on Wednesday, as rising Treasury yields pressured megacaps after upbeat December retail sales data, tempering hopes of the Federal Reserve kicking off its rate-cut campaign as early as March.

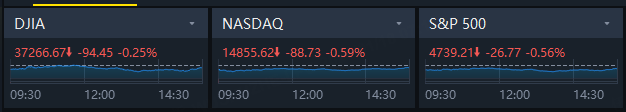

Market Snapshot

The Dow Jones Industrial Average slipped 0.25 percent to 37,266.67, while the broad-based S&P 500 ended 0.56 percent lower at 4,739.21. The tech-heavy Nasdaq Composite Index also shed 0.59 percent to 14,855.62.

Market Movers

Spirit Airlines was down 22% after falling 47% Tuesday after a federal judge blocked the budget carrier’s acquisition by JetBlue Airways, saying the deal would do harm to the airline’s cost-conscious fliers. JetBlue fell 8.7%.

SolarEdge Technologies was down 6.3% to $68.22. Barclays downgraded shares of the solar company to Underweight from Equal Weight and the price target was reduced to $50 from $74.

U.S.-listed shares of Alibaba were down 0.8%, JD.com slumped 4.9%, and PDD Holdings fell 0.7% after gross domestic product in China expanded 5.2% in the fourth quarter and for 2023. It was the slowest annual rate since 1990 excluding the three years of the Covid-19 pandemic, according to The Wall Street Journal.

Boeing shares rose 1.3% after the Federal Aviation Administration said it had completed inspections on 40 Boeing 737 MAX 9 airplanes out of the 71 that were grounded by the agency. The FAA said it would thoroughly review the data from the inspections before deciding whether the planes can fly again.

Impinj, the internet-of-things company, said it expects fourth-quarter revenue of more than $70 million, above its prior guidance of $65.5 million to $68.5 million. It also said it expects adjusted earnings before interest, taxes, depreciation, and amortization in the period to exceed $2.5 million, above its prior guidance of negative $900,000 to positive $700,000. Impinj rose 11%.

Albemarle was down 4.2% after the lithium miner said it would cut its headcount and reduce certain spending “in response to changing end-market conditions, particularly in the lithium value chain.”

Rivian Automotive was downgraded to Hold from Buy at Deutsche Bank and the price target was cut to $19 from $29. Rivian shares declined 6% to $16.76.

Ford Motor declined 1.7% to $11.27 after analysts at UBS downgraded the auto maker to Neutral from Buy and left their price target unchanged at $12.

Fisker closed down 7.5% to 89 cents after TD Cowen cut its rating on the electric-vehicle maker to Hold from Buy and slashed the target price to $1 from $11 a share. “Growing pains continue to grow,” wrote analyst Jeffrey Osborne, pointing out the company has missed delivery estimates amid a softening of the overall EV market.

Plug Power (NASDAQ: PLUG) declined 13% after it entered into an at market issuance sales agreement with B. Riley Securities relating to the sale of common stock. It may offer and sell shares of common stock having an aggregate offering price of up to $1 billion.

SurgePays, Inc. (Nasdaq: SURG) declined 9% after it announced that it has commenced an underwritten public offering of shares of its common stock.

H.B. Fuller (FUL) climbed 4.3% after it reported Q4 EPS of $1.32, $0.05 better than the analyst estimate of $1.27. Revenue for the quarter came in at $903 million versus the consensus estimate of $930.59 million.

Grab Holdings Inc. (GRAB) climbed 3.8% after JPMorgan upgraded the stock to ‘overweight’ from ‘neutral.’ Analysts think results in the first half of the year will drive upward revisions.

Market News

US Retail Sales Rise By Most in Three Months to Cap Holidays

US retail sales rose at the strongest pace in three months in December, capping a solid holiday season that suggests consumer resilience heading into the new year.

The value of retail purchases, unadjusted for inflation, increased 0.6% in a broad-based advance, Commerce Department data showed Wednesday. Excluding autos, sales rose 0.4%.

Nine of 13 categories posted increases, with the biggest gains in clothing, general merchandise stores — which include department stores — and e-commerce. Motor-vehicle sales were up 1.1%, matching the biggest increase since May, while those at gas stations fell for a third month as pump prices declined.

OPEC Sticks to 2024 Oil Demand View, Sees More Growth in 2025

OPEC on Wednesday stuck to its forecast for relatively strong growth in global oil demand in 2024 and said 2025 will see a "robust" increase in oil use, led by China and the Middle East, in an earlier than usual prediction.

The Organization of the Petroleum Exporting Countries, in a monthly report, said world oil demand will rise by 1.85 million barrels per day in 2025. For 2024, OPEC sees demand growth of 2.25 million bpd, which was unchanged from last month.

The 2025 prediction is OPEC's first in its monthly report. OPEC said publishing it earlier than usual is aimed at providing long-term guidance for the market.

Comments