(Aug 20) U.S. stock index futures fell on Friday, as concerns over a slowing economic recovery and the possible tapering of monetary stimulus hurt economy-linked sectors and put the Dow and the S&P 500 on course for their worst week since mid-June.

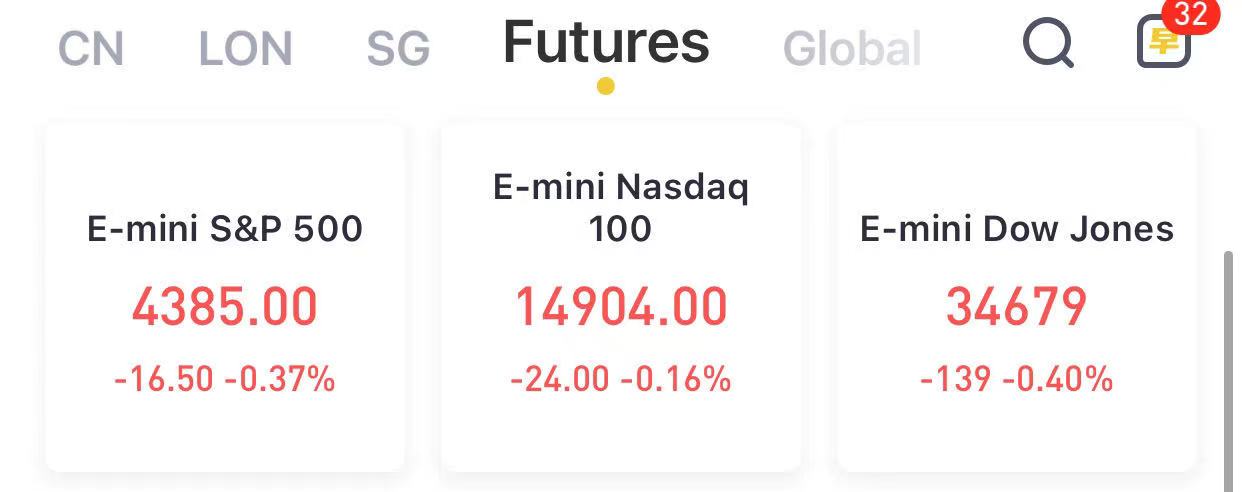

At 07:52 a.m. ET, Dow E-minis were down 139 points, or 0.40%, S&P 500 E-minis were down 16.5 points, or 0.37% and Nasdaq 100 E-minis were down 24 points, or 0.16%.

Stocks making the biggest moves premarket:

1) John Deere – The heavy equipment maker reported quarterly earnings of $5.32 per share, compared with a consensus estimate of $4.58, and its revenue beat forecasts as well. Deere was up 1.1% in premarket trading as it also raised its full-year earnings forecast on solid demand for farm equipment.

2) Foot Locker – Foot Locker shares surged 6.2% in the premarket after the athletic footwear and apparel maker reported better-than-expected second-quarter results. Foot Locker earned an adjusted $2.21 per share, compared with a $1.01 consensus estimate, and comparable stores sales rose 6.9%. Analysts had expected a slight decline in comp sales.

3) Buckle – The fashion accessories retailer beat estimates by 18 cents with quarterly earnings of $1.04 per share, and revenue above estimates as the company benefited from more in-person shopping. The stock jumped 4.6% in premarket trading.

4) Spotify Technology S.A. – The music streaming service announced that its board approved a $1 billion stock buyback. Chief Financial Officer Paul Vogel said the move demonstrates the company’s confidence in its business and long-term growth opportunities. Spotify added 1.1% in the premarket.

5) Applied Materials – The maker of semiconductor manufacturing equipment beat estimates by 13 cents with an adjusted quarterly profit of $1.90 per share and revenue also topping analyst predictions. It also gave a better-than-expected outlook, but Applied Materials shares fell 1.3% in premarket trading.

6) Ross – The discount retailer reported a quarterly profit of $1.39 per share, beating the 98 cent consensus estimate, and also reported better-than-expected revenue. However, its current-quarter and full-year earnings outlook fell short of analyst forecasts, and the stock slid 4% in premarket action.

7) Johnson & Johnson – Chief Executive Officer Alex Gorsky announced plans to step aside on Jan. 3, with company veteran Joaquin Duato taking over and Gorsky assuming the role of executive chairman.

8) Lordstown Motors Corp. – The electric vehicle maker’s shares rose 2.1% in the premarket, recovering a small part of the 9.5% Thursday drop that had sent the stock to its lowest since going public. That took place after the annual shareholder meeting that lasted only 10 minutes.

9) Adobe – The software maker announced a deal to buy cloud-based video collaboration platform Frame.io for $1.275 billion in cash. The acquisition will be used to expand the capabilities of Adobe’s Create Cloud software suite.

10) Petco Health and Wellness Company, Inc. – Petco added 2.1% in the premarket to Thursday’s 3.6% gain, with Credit Suisse upgrading the pet products retailer’s stock to “outperform” from “neutral”. Credit Suisse said it is more positive on the outlook for Petco’s business following the company’s upbeat earnings report.

11) Mosaic – The fertilizer producer was upgraded to “buy” from “hold” at HSBC, based on expected benefits from higher fertilizer prices.

In FX,the index continues to extend on the upside seen post-FOMC as the risk tone remains tilted towards caution/risk aversion. Overnight, the DXY found a floor at 93.500 before rising to 93.684 at best as sentiment in Europe is tainted in early trade. From a technical standpoint, the index eyes resistance around the 93.900 mark - which acted as a ceiling on several occasions during Q3 and Q4 2020. Above that, a breach of the psychological 94.000 mark could open the door to resistance around 94.300 (4th Nov 2020 high), 94.500 and thereafter the 100 and 200 WMAs at 94.650 and 94.807 - although these are still some way off. To the downside, yesterday’s low was at 93.214, the psychological 93.000, whilst the 21 DMA (92.674) and the 50 DMA (92.377) reside just below. Ahead, an empty state-side calendar but price action will likely be dictated by the risk tone. As a side note Fed Chair Powell is to speak on the economic outlook at the Jackson Hole Symposium on August 27th at 15:00BST/10:00EDT.

In commodities,WTI and Brent front-month futures are once again on a softer footing amid the continuing COVID concerns coupled with the cautious tone around the market. On the former, the overnight session saw an extension of the Kiwi nationwide lockdown alongside Australia's Sydney's curbs extended until the end of September. Aside from that news flow has been quiet for the complex and the market in general - with sentiment and Delta woes likely to take precedence in the absence of catalysts. WTI makes its way back towards UD 63/bbl (vs high 64.04/bbl) and Brent towards USD 66/bbl (vs 66.93 high). Elsewhere, spot gold and silver vary but remain flat in the grander scheme above USD 1,775/oz and north of USD 23/oz respectively. Base metals meanwhile see a mild rebound from yesterday's violent selloff, but benchmark LME copper remains sub-9,000/t after finding a ceiling at the mark.

Comments