Market Overview

U.S. stocks closed little changed on Monday(July 31), ending a strong July on upbeat company earnings and hopes of a soft landing for a resilient U.S. economy.

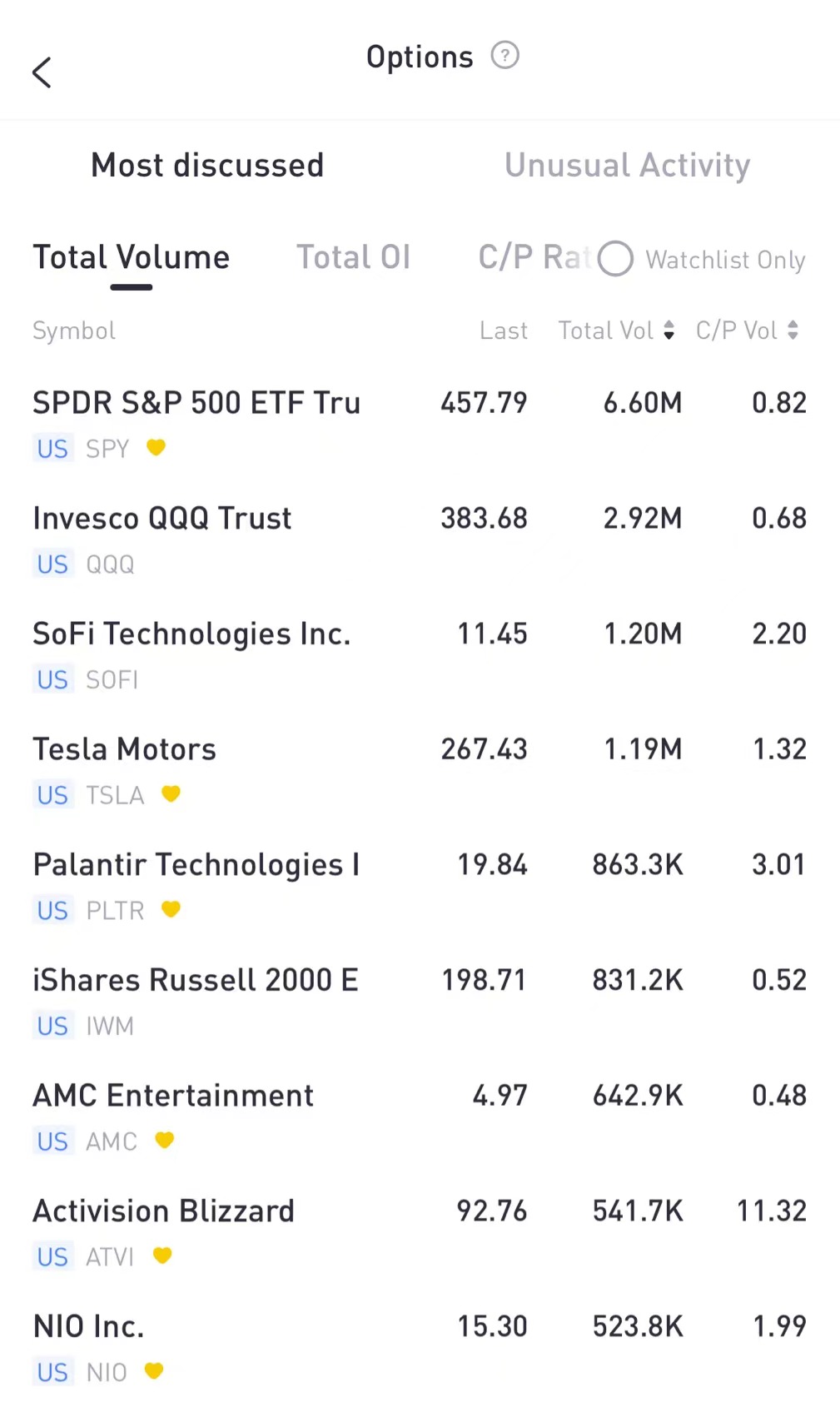

Regarding the options market, a total volume of 36,822,495 contracts was traded, down 6% from the previous trading day.

Top 10 Option Volumes

Top 10: SPY; QQQ; SoFi Technologies Inc. ; TSLA; Palantir Technologies Inc. ; IWM; AMC Entertainment ; Activision Blizzard ; NIO Inc.

Financial services provider SoFi Technologies added 19.9% after reporting better-than-expected quarterly revenue.

There are 1.2M SoFi option contracts traded on Monday. Call options account for 69% of overall option trades. Particularly high volume was seen for the $12 strike call option expiring Aug 4, with 87,355 contracts trading.$SOFI 20230804 12.0 CALL$

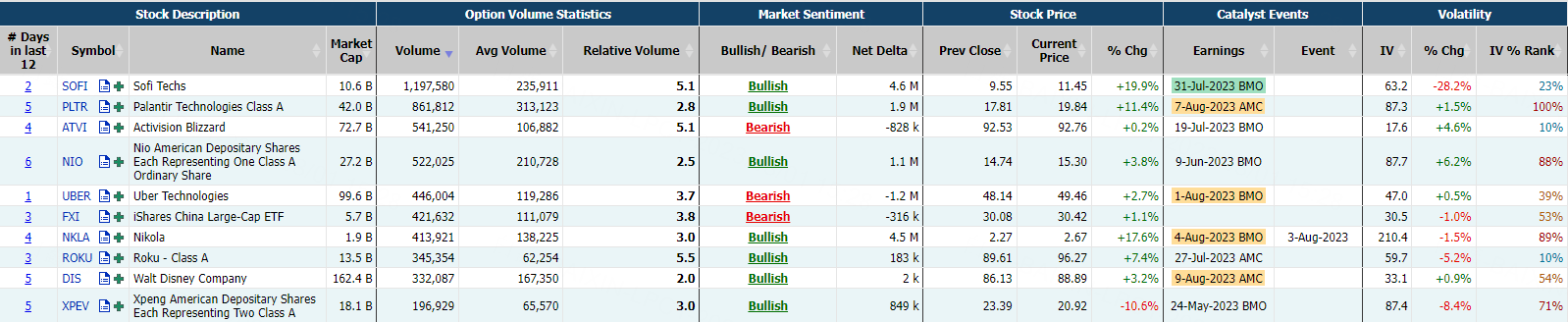

Most Active Equity Options

Special %Calls >70%: Activision Blizzard ; Palantir Technologies Inc. ; Alibaba ; Walt Disney

Unusual Options Activity

Shares of Palantir rose 10.3% on Friday and jumped another 11.4% on Monday. The company’s stock has risen 209% this year, outpacing the S&P 500’s gain of 19.5%.

There are 863.3K Palantir option contracts traded on Monday. Call options account for 75% of overall option trades. Particularly high volume was seen for the $20 strike call option expiring Aug 4, with 83,910 contracts trading.$PLTR 20230804 20.0 CALL$

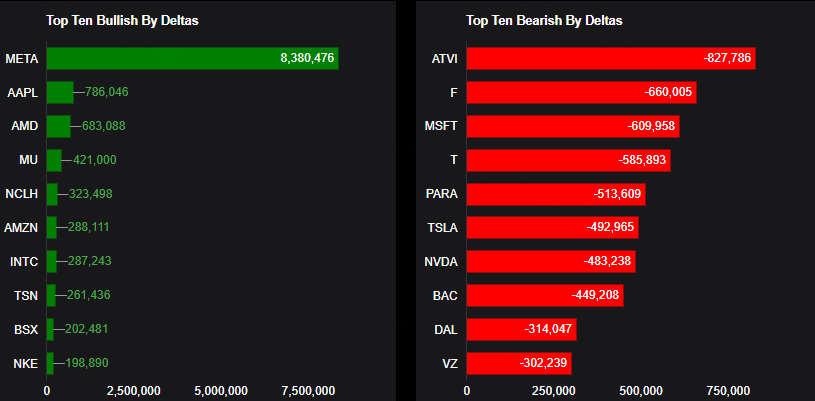

TOP 10 Bullish & Bearish S&P 500

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Based on option delta volume, traders bought a net equivalent of 8,380,476 shares of Meta stock. The largest bullish delta came from buying calls. The largest delta volume came from the 17-Nov-23 270 Call, with traders getting long 4,576,886 deltas on the single option contract.

Top 10 bullish stocks: META, AAPL, AMD, MU, NCLH, AMZN, INTC,TSN, BSX, NKE

Top 10 bearish stocks: ATVI, F, MSFT, T, PARA, TSLA, NVDA, BAC, DAL, VZ

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments