Market Overview

Major U.S. stock indexes ended lower on Thursday (Apr. 20th) after disappointing quarterly reports from companies including Tesla and AT&T, while investors sought clarity on the path of interest rates.

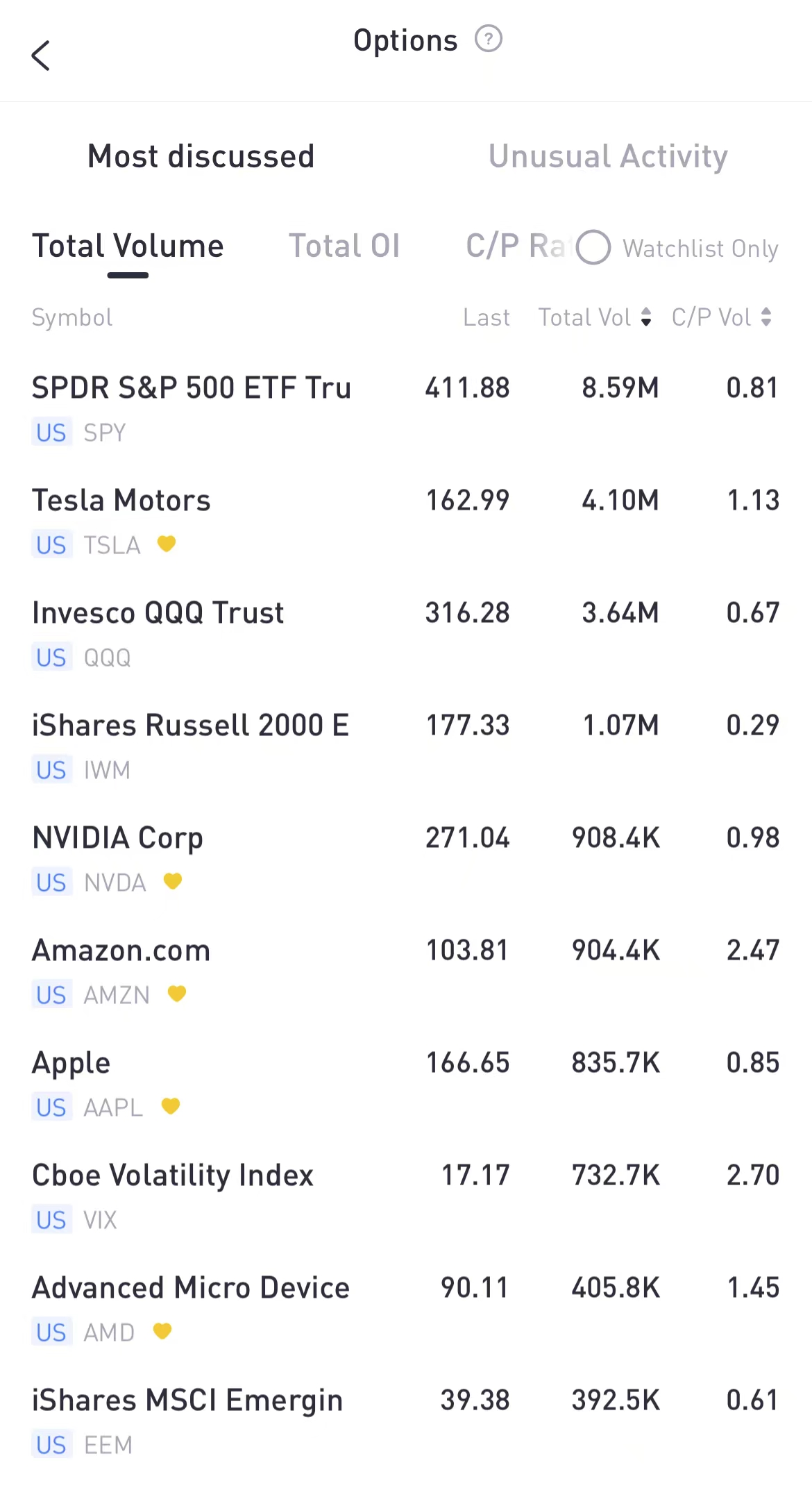

Regarding the options market, a total volume of 38,838,134 contracts was traded, up 16% from the previous trading day.

Top 10 Option Volumes

Top 10: SPY; TSLA; QQQ; IWM; NVDA; AMZN; AAPL; VIX; AMD; EEM

Source: Tiger Trade App

Options related to equity index ETFs are still popular with investors, with 8.59 million SPDR S&P500 ETF Trust and 3.64 million Invest QQQ Trust ETF options contracts trading on Thursday.

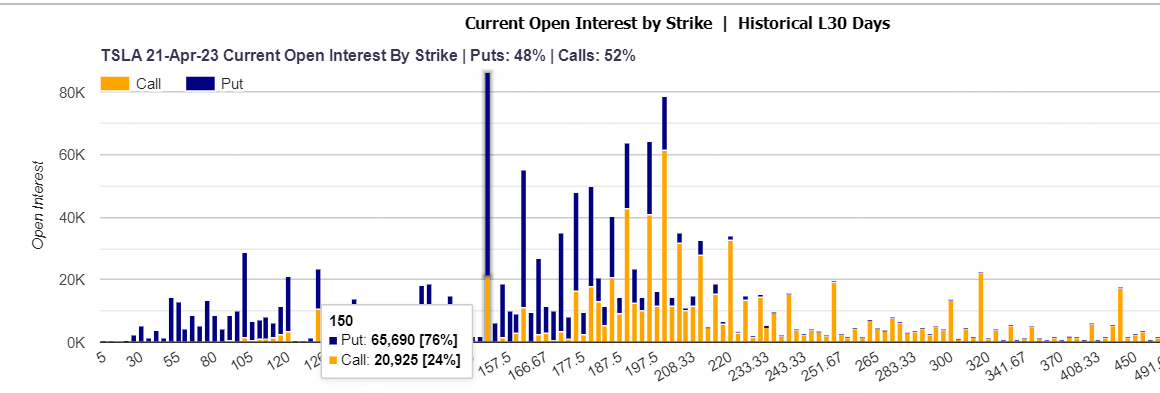

Tesla stock tumbled 9.75% on Thursday, hitting lows not seen since late January as the electric-vehicle maker reported gross margins below 20% for the first time in nearly three years. Analysts on Wall Street reacted to the EV-giant's earnings report yesterday, with profit sliding to $2.5 billion from $3.3 billion a year ago, with a slew of estimates cuts as concern grew over margin pressure.

A total volume of 4.1 million options related to Tesla was traded on Thursday, up 168% from the previous trading day. A particularly high open interest was seen for the $150 strike PUT option expiring this Friday. There were 65,690 open interests in this option chain as of Thursday, which accounted for 76% of the $150 strike option expiring this Friday.

Most Active Options

1. Most Active Trading Equities Options:

Special %Calls >70%: BBBY; GOOG; AMZN; NIO

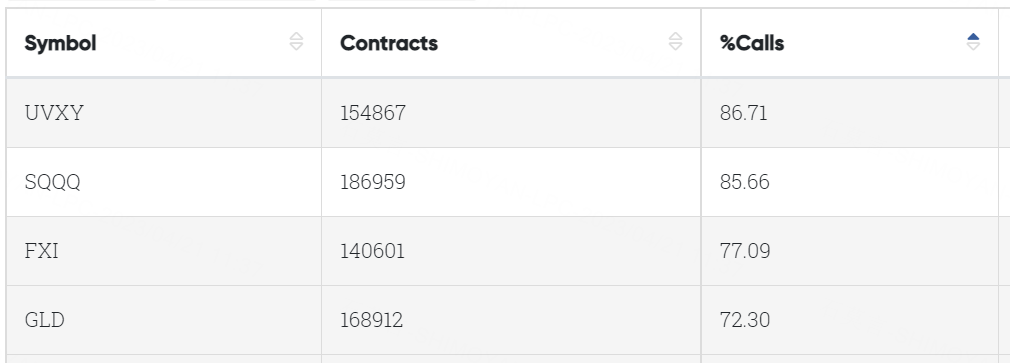

2. Most Active Trading ETFs Options

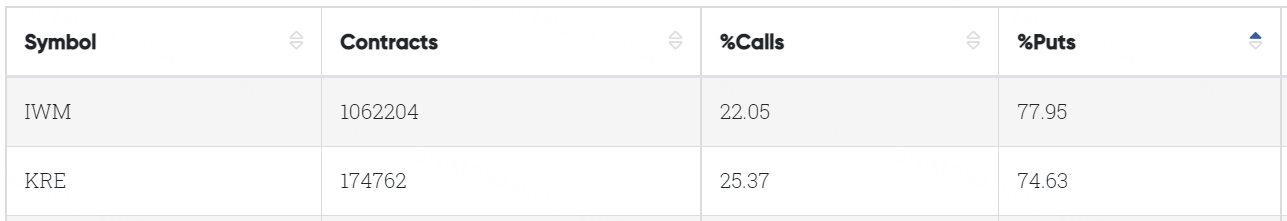

Special %Calls >70%: VIX Short-Term Futures 1.5X ETF; Nasdaq 100 Bear 3X ETF; iShares China Large-Cap ETF; SPDR Gold Shares

Special %Puts >70%: iShares Russell 2000 ETF; SPDR S&P Regional Banking ETF

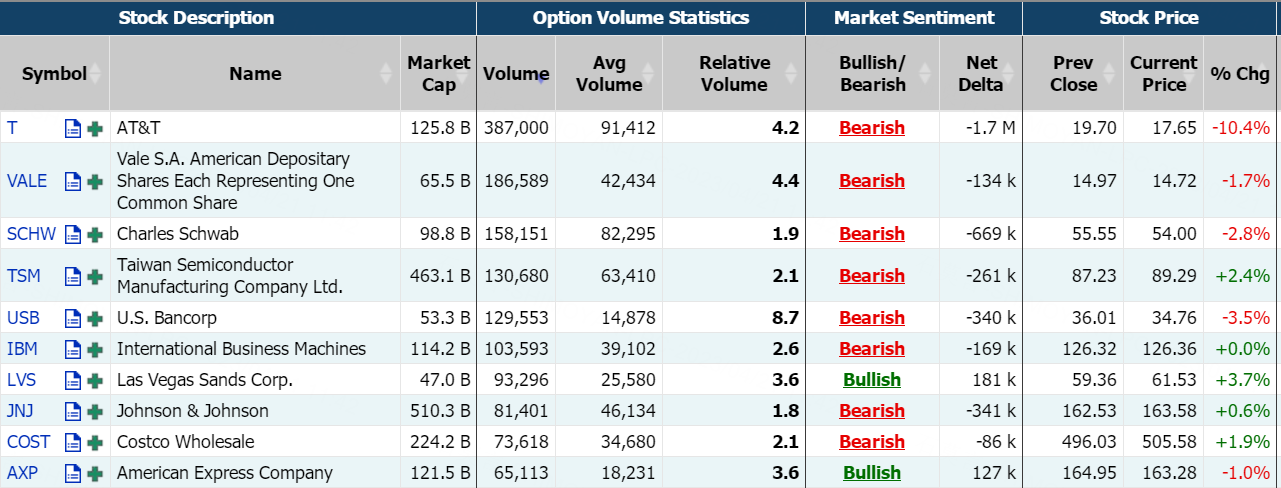

Unusual Options Activity

AT&T shares fell 10.41%, in the biggest one-day decline since July 2002, after the telecom giant reported weak subscriber growth and its revenue missed targets.

In its 2023 first quarter earnings report, the company said that it added 424,000 postpaid phone plans, representing the amount of consumers that pay their bills at the end of each month. While that was better than analyst projections, it was below the 691,000 postpaid phone subscribers it reported in the first quarter a year ago.

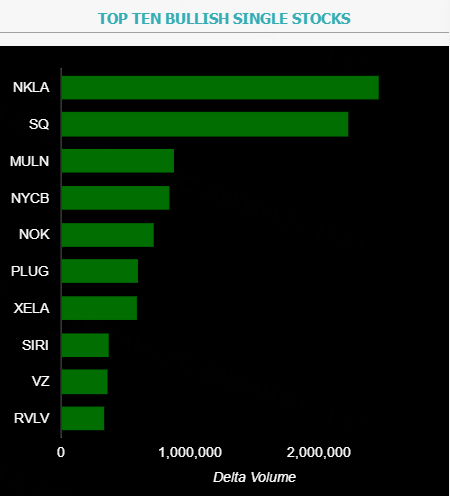

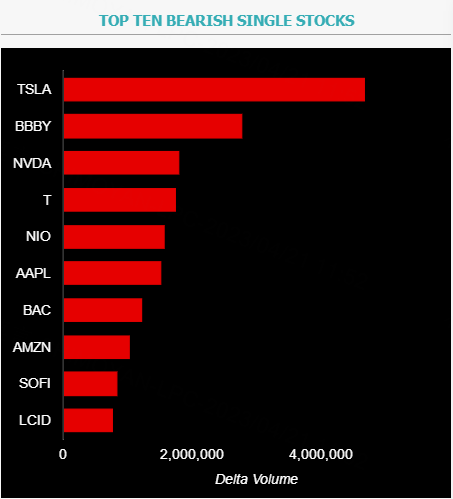

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: NKLA, SQ, MULN, NYCB, NOK, PLUG, XELA, SIRI, VZ, RVLV

Top 10 bearish stocks: TSLA, BBBY, NVDA, T, NIO, AAPL, BAC, AMZN, SOFI, LCID

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments