U.S. stock futures traded near the flatline Thursday, as Wall Street struggled to maintain the positive momentum from the previous session, and investors looked ahead to key jobs data.

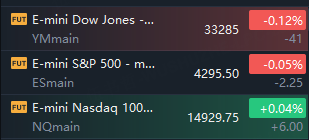

Market Snapshot

At 08:15 a.m. ET, Dow e-minis were down 41 points, or 0.12%, S&P 500 e-minis were down 2.25 points, or 0.05%, and Nasdaq 100 e-minis were up 6 points, or 0.04%.

Pre-Market Movers

Rivian Automotive, Inc. - Stocks crashed over 9% in premarket trading. It expects third-quarter sales of between $1.29 billion and $1.33 billion, in line with analysts' estimates, and said it plans to offer $1.5 billion worth of convertible notes.

VinFast Auto - Stocks gained over 5% in premarket trading. It reported a 159% rise in third-quarter revenue as it ramped up car deliveries and sought to boost sales by partnering with dealers in the United States. The company delivered 10,027 EVs in the third quarter ended Sept. 30.

Orchard Therapeutics Plc - Stocks surged over 98% in premarket trading. It agreed to be purchased by Japan's Kyowa Kirin for at least $16 per share in cash, plus an additional contingent value right of $1 per share. The total consideration will be as much as $478 million.

BlackBerry - Stocks rose over 3% in premarket trading. It would split into two separate businesses and planned to spin off its Internet-of-Things business in an initial public offering. The IPO would be targeted for the first half of the next fiscal year.

Clorox - Stocks fell nearly 4% in premarket trading. It sees a loss of 35 cents to 75 cents a share; on an adjusted basis it expects between a break-even result to a loss of 40 cents a share. It said it sees sales falling by 28% to 23% in the period from a year earlier. The company disclosed the cyberattack in mid-August.

Exxon Mobil - Stocks slid over 1% in premarket trading. It expects a change in liquids prices to boost profit in the period by between $900 million and $1.3 billion. A change in gas prices would add between $200 million and $400 million. Thinner margins at its chemicals business would reduce profit by $400 million to $600 million.

Tesla Motors - Stocks turned up in premarket trading though Cathie Wood-led Ark Invest made a significant move by selling over $25 million worth of its shares.

Costco - It said same-store sales in September rose 4.5% from a year earlier, accelerating from growth of 4.3% in August. E-commerce sales rose 3.7%. Higher gas prices helped drive Costco's same-store sales up by about 0.5% this month, the retailer said. The stock was down slightly.

Market News

Apple rolled out a software update Wednesday to address an overheating issue that plagued some early buyers of the iPhone 15 Pro line. The update, called iOS 17.0.3, is available as an over-the-air fix in the software update section of the iPhone settings app.

Amazon.com and Microsoft’s cloud services face an investigation by the UK’s antitrust watchdog over concerns the US firms may be abusing their market power. The Competition and Markets Authority said on Thursday it’s opening a market investigation into the supply of public cloud infrastructure in the UK.

Amazon.com is shutting down Amp, the live-audio app that allowed users to act like radio DJs by playing music and talking alongside the songs. The product launched in March 2022 following a frenzy around live-audio services during the pandemic.

Exxon Mobil likely got a $2.1 billion boost to earnings from higher oil prices and refining margins in the third quarter, which was only partially offset by a decline in chemicals profitability. Rising crude prices accounted for a gain of about $1.1 billion over the previous quarter, while refining increased profits by about $1 billion.

AT&T Inc has begun to explore options for its 70% stake in DirecTV as it approaches the end of an agreement upon which it can legally sell its interest in America’s third-largest pay-TV provider.

McDonald's’s raised it’s quarterly cash dividend to $1.67 a share from $1.52, representing a 10% increase. It said the dividend will be payable Dec. 15 to stockholders of record as of Dec. 1.

Rivian Automotive, Inc. plans to offer, subject to market and other conditions, $1.5 billion worth of “green” convertible senior notes due in 2030.That would be in a private offering to “qualified institutional buyers,” Rivian said. The plan is also to give the buyers the option to purchase up to an additional $225 million.

BlackBerry announced it planned to spin off its Internet-of-Things business in an initial public offering. Morgan Stanley and Perella Weinberg Partners acted as advisers on strategic alternatives for BlackBerry, the company said.

Comments