Stock futures rose Tuesday, as the Dow Jones Industrial Average and S&P 500 tried to bounce back from their lowest closing levels in nearly two years.

Market Snapshot

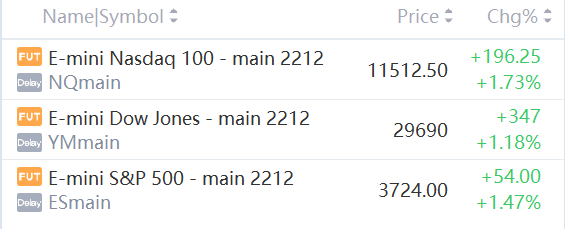

At 8:00 a.m. ET, Dow e-minis were up 347 points, or 1.18%, S&P 500 e-minis were up 54 points, or 1.47%, and Nasdaq 100 e-minis were up 196.25 points, or 1.73%.

Pre-Market Movers

Keurig Dr Pepper — The consumer stock fell 1.5% premarket after Goldman Sachs downgraded the stock to neutral from a buy rating. The Wall Street firm said it sees increased risk to Keurig’s margins as commodity inflation, especially related to coffee, remains elevated.

Lucid Group — Shares of the electric vehicle player jumped 2.99% in premarket trading after Cantor Fitzgerald initiated coverage with an overweight rating. The firm said Lucid’s luxury and premium vehicles provide greater efficiency, longer range, faster charging and more space relative to its peers.

Norfolk Southern, CSX — Shares of the railroad companies declined more than 1% each after UBS downgraded the duo, citing a deteriorating macro backdrop. The Wall Street firm said it will be hard for Norfolk and CSX to achieve the consensus 25% volume growth going forward.

Li Auto — Shares of the Chinese EV maker edged up 0.5% premarket, even after the company cut its third-quarter delivery guidance by 2,500 vehicles or 9%. The company said the downward revision was due to supply chain constraints.

Amazon, Apple, Microsoft — Big Tech names Amazon, Apple, Alphabet and Microsoft all traded at least 1% higher premarket, a possible rebound from Monday’s sell-off. Treasury yields retreated Tuesday morning after the multi-year highs hit in the previous session put pressure on tech names.

Market News

Tesla Expects "Very High Volume" Deliveries at End of Quarter

Tesla is expecting a “very high volume” of vehicle deliveries during the end of the quarter, and it is asking all employees to help – even those outside of the sale and delivery organization.

Netflix Sets Up First Internal Studio to Develop Video Games

Netflix Inc. is creating its first in-house video games studio in a push to be less reliable on third-party creators and expand its gaming offerings.

The new studio will be based in Helsinki and headed by Marko Lastikka. Lastikka previously spent more than five years at Zynga Inc., where he worked on FarmVille 3, and before that was the co-founder and executive producer at Electronic Arts Inc.’s Tracktwenty studio in Helsinki, according to his LinkedIn page.

Grab Expects 2026 Breakeven for Digital Bank Operations, Losses to Peak in 2023

Tech group Grab is targeting for its digital bank operations to turn profitable in 2026, chief operating officer Alex Hungate said in an investor presentation on Tuesday (Sep 27).

“In 2023, we will spend more than we spent this year on digital bank build. But that will be the peak of the losses (for) investment of the digital bank. And thereafter this strategy will allow us, after the peak losses in 2023, to move to a breakeven position by 2026,” Hungate said.

Hertz and BP Plan to Partner on National EV Charging Network

Hertz Global Holdings inked a deal with BP plc for the development of a national network of electric vehicle charging stations.

The memorandum of understanding between the two companies is said to set the foundation for Hertz and BP to drive the future of mobility and accelerate EV consumer adoption.

Comments