The S&P 500 hit a record high on Tuesday morning as bank stocks and other cyclical plays climbed.

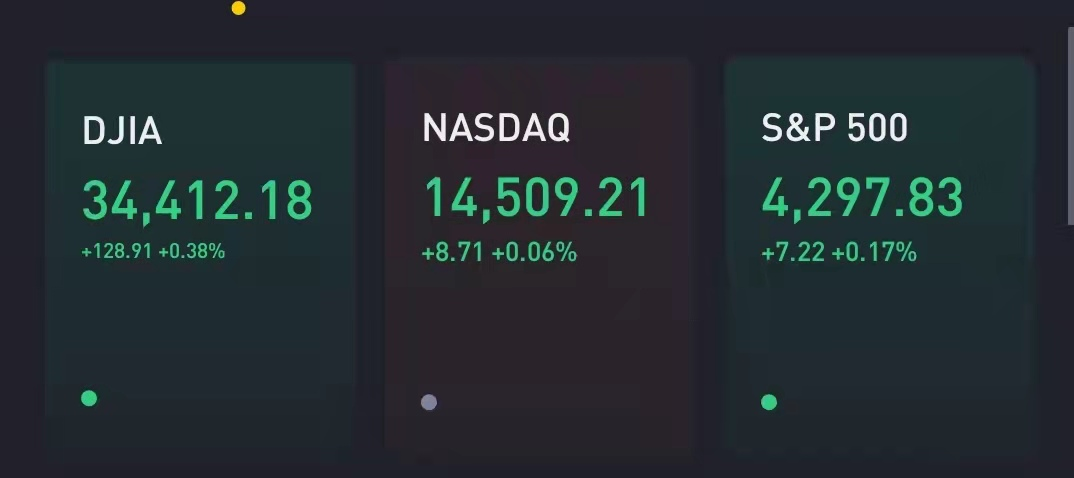

The broad market index ticked up about 0.2%, building on a record close from the previous session. The Dow Jones Industrial Average rose 130 points, and the tech-heavy Nasdaq Composite climbed 0.1%.

Shares of Morgan Stanley jumped more than 3% in morning trading after the bank said it will double its quarterly dividend. The bank also announced a $12 billion stock buy back program. The announcement follows last week's stress tests by the Federal Reserve, which all 23 major banks passed.

Wells Fargo said it plans on doubling its dividend to 20 cents a share, subject to board approval and announced an $18 billion buyback plan. Bank of America, Goldman Sachs and JPMorgan also announced dividend increases.

Boeing shares rose more than 1% in early trading trading after United Airlinessaid it was buying 200 Max planes. General Electric also boosted the industrials sector, rising more than 1% afterGoldman Sachs named the stock a top idea. Homebuilder stocks rose after S&P Cash Shiller saidhome prices rose more than 14% in Aprilcompared to the prior year.

Stocks rose to new highs during regular trading on Monday amid strength in Big Tech. The S&P 500 advanced 0.23%, registering its third straight record close. The Nasdaq gained nearly 1%, posting its fifth positive session in the last six, and also closed at a new high. The Dow, however, dipped 151 points amid a pullback in Boeing and Chevron, among other names.

The early strength for cyclical and value stocks on Tuesday pushed back against some of the recent rebound in growth and tech stocks. Andrew Smith, chief investment strategist at Delos Capital Advisors in Dallas, said he expects those groups to continue to jockey back and forth in the months ahead.

“It’s not really going to be one of those easy rotations that we’ve had in the past, where all the gains come out of value or the ETF asset flows are going to go out of value and into growth. I think it’s going to be a choppy market back and forth,” Smith said, adding that he recommends investors add defensive stocks and not just shift fully back to growth.

With the market entering the final trading days of June and the second quarter, the S&P 500 is on track to register its fifth straight month of gains. The Nasdaq is pacing for its seventh positive month in the last eight. The Dow, however, is in the red for the month, and on track to snap a four-month winning streak.

Through Monday’s close, the S&P 500 is up 14% and the Dow and Nasdaq are up 12% so far for 2021.

“Markets are off to a strong start this year,” LPL Financial chief market strategist Ryan Detrick said. “However, most of those gains came early in the year, and many stocks have stagnated over recent months,” he added. Detrick believes investors should stay overweight stocks relative to bonds, but pointed to some concerns in the market, including elevated valuations.

JPMorgan quantitative strategist Dubravkos Lakos-Bujas on CNBC’s “Squawk Box” that the market appeared to have near-term upside.

“The growth policy backdrop in our opinion still remains supportive for risk assets in general, certainly including equities. At the same time, the positioning is not really stretched to where we are in a problematic territory. So we do think there is still a runway. ... The summer period, the next two months, is where I think the market continues to break out,” the strategist said.

On the data front, an updated reading on consumer confidence is due out later Tuesday morning.

Comments