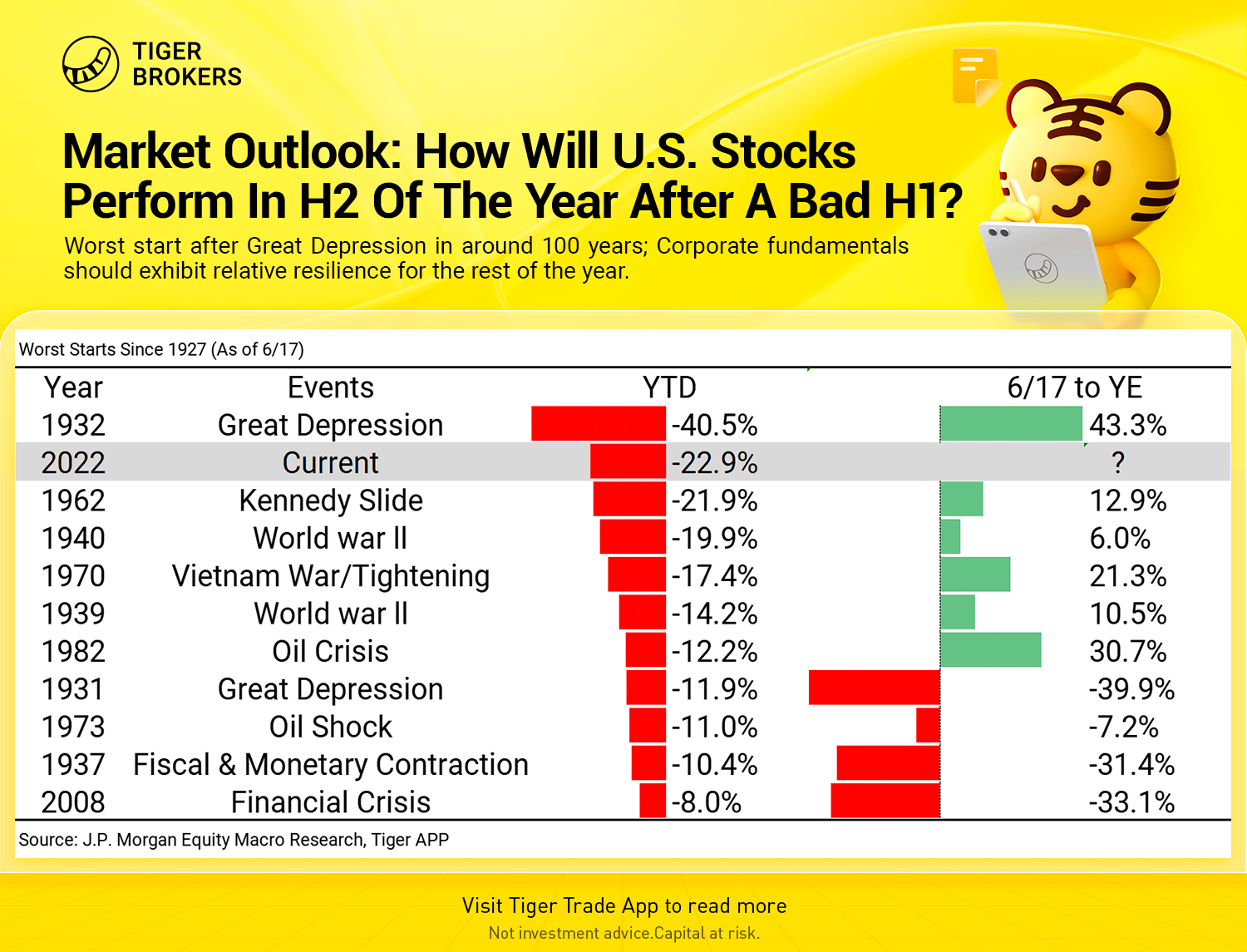

Worst start after Great Depression in around 100 years; Corporate fundamentals should exhibit relative resilience for the rest of the year.

Equity sentiment, investor positioning and market internals have been bearish, resulting in the worst annual start for equities in around 100 years, with the exception of the Great Depression. Portfolios are defensively positioned for a recessionary outcome and corporate fundamentals should exhibit relative resilience for the rest of the year, despite some softness in corporate guidance.

“We believe the fundamental risk-reward for equities will be improving as we enter the second half of the year, with growth-policy tradeoff likely to turn, from both sides,”said Dubravko Lakos-Bujas, Global Head of Equity Macro Research at J.P. Morgan.

Mid-to-high single digit growth rate is expected for S&P 500 earnings per share (EPS) in 2022, with J.P. Morgan estimates at $225 (vs. consensus $229.58). Growth should moderate in 2023 with negative revisions to EPS driven by slight margin compression and U.S. dollar headwinds.

Equity markets typically have large drawdowns during a hiking cycle, with an average sell-off of -16% in the 13 cycles since 1954. The -25% drawdown so far in this cycle is comparable to 1986-89 cycle (-32.6%, Black Monday, recession came after three and a half years from the start of the cycle). Anything short of a recession will likely catch most investors completely wrong-footed, especially after broad correction that resulted in the average stock drawdown around 80% of the way to prior recession bottoms.

“At the current juncture defensive stocks possess valuation risk while flushed out cyclicals / growth / small-caps are presenting an increasingly attractive risk/reward. Our highest conviction sector call remains energy (strong fundamentals, still attractive valuation, rising shareholder return and geopolitical/inflation hedge),”added Lakos-Bujas.

Comments