It is expected Apple to report fiscal Q2 results in line with Street estimates. The strength in iPhone may offset incremental weakness in other areas. Fiscal Q3 guidance could impact Apple stock in case of an upbeat outlook.

Apple’s fiscal Q2 earnings day is scheduled for May 4, 2023. We gear up for the big day. Can the company beat these forecasts, pushing Apple stock higher?

Apple's second quarter revenue is expected to be $92.596 billion, with an adjusted net profit of $22.636 billion and an adjusted EPS of $1.428, according to Bloomberg's consensus expectations.

Previous quarter review

Apple missed expectations for revenue, profit, and sales for many of its lines of business on Q1. Apple’s overall sales for the holiday quarter were about 5% lower than last year’s, the first year-over-year sales decline since 2019.

Apple CEO Tim Cook said three factors hurt the results: a strong dollar, production issues in China affecting the iPhone 14 Pro and iPhone 14 Pro Max, and the overall macroeconomic environment.

Here's how Apple did versus Refinitiv consensus expectations:

EPS: $1.88 vs. $1.94 estimated, down 10.9% year over year

Revenue: $117.15 billion vs. $121.10 billion estimated, down 5.49% year over year

iPhone revenue: $65.78 billion vs. $68.29 billion estimated, down 8.17% year over year

Mac revenue: $7.74 billion vs. $9.63 billion estimated, down 28.66% year over year

iPad revenue: $9.4 billion vs. $7.76 billion estimated, up 29.66% year over year

Other Products revenue: $13.48 billion vs. $15.23 billion estimated, down 8.3% year over year

Services revenue: $20.77 billion vs. $20.67 billion estimated, up 6.4% year over year

Gross margin: 42.96% vs. 42.95% estimated

Apple did not provide guidance for the current quarter ending in March. However, Apple did offer some data points on performance expectations. Chief Financial Officer Luca Maestri said March quarter revenue would have a similar declining trend as the December quarter. Services are expected to grow, Maestri said, but Mac and iPad sales are both expected to decline double digits from the year-earlier period. IPhone sales will decline less in the March quarter versus the December quarter, Apple added.

What to expect on Q2

Apple's fiscal 2Q results could indicate a much more pronounced slowdown in Mac sales than experienced in 1Q, on weakening global consumer spending on higher-priced computing devices. This segment only accounts for about 10% of Apple's revenue, yet recent data from IDC indicates a 40% drop in unit shipments in the March quarter, much higher than what consensus is modeling. Services is another segment which could see sales decelerate at a faster pace than 1Q on weak advertising and gaming spending.

On the positive side, it is expected higher-end iPhone sales to help gross margin and management to indicate further tightening of operating expenses throughout the year, including much lower hiring. Meanwhile, buybacks could be flat compared with last year at roughly $23 billion, despite weaker economic conditions.

iPhone: Slowly Recovering

Apple's iPhone segment is showing signs of recovery, with revenues expected to shrink by only 1-2% in fiscal Q2, potentially outperforming Wall Street expectations.

Global smartphone shipments declined 12% in Q1 2023, but Apple's market share increased to 21%, suggesting a 3% rise in iPhone shipments.

Investors should pay attention to fiscal Q3 guidance, as resolving supply chain and FX issues and providing an upbeat outlook could positively impact Apple stock. Fiscal Q3 guidance could impact Apple stock in case of an upbeat outlook.

The Mac Might Be In Trouble

According to research firm IDC, shipments of Apple’s personal computers dropped YOY by a whopping 40% in the first calendar quarter of 2023.

Relative to the competition, and assuming that IDC’s report is accurate, the Mac performed substantially worse. To be fair, global shipments across all vendors ex-Apple still looked pretty weak at -28% YOY against tough pandemic comps.

Apple’s underperformance in fiscal Q2 of 2023, if confirmed, will be an outlier. For the past several quarters, the company has been gaining market share in the PC space.

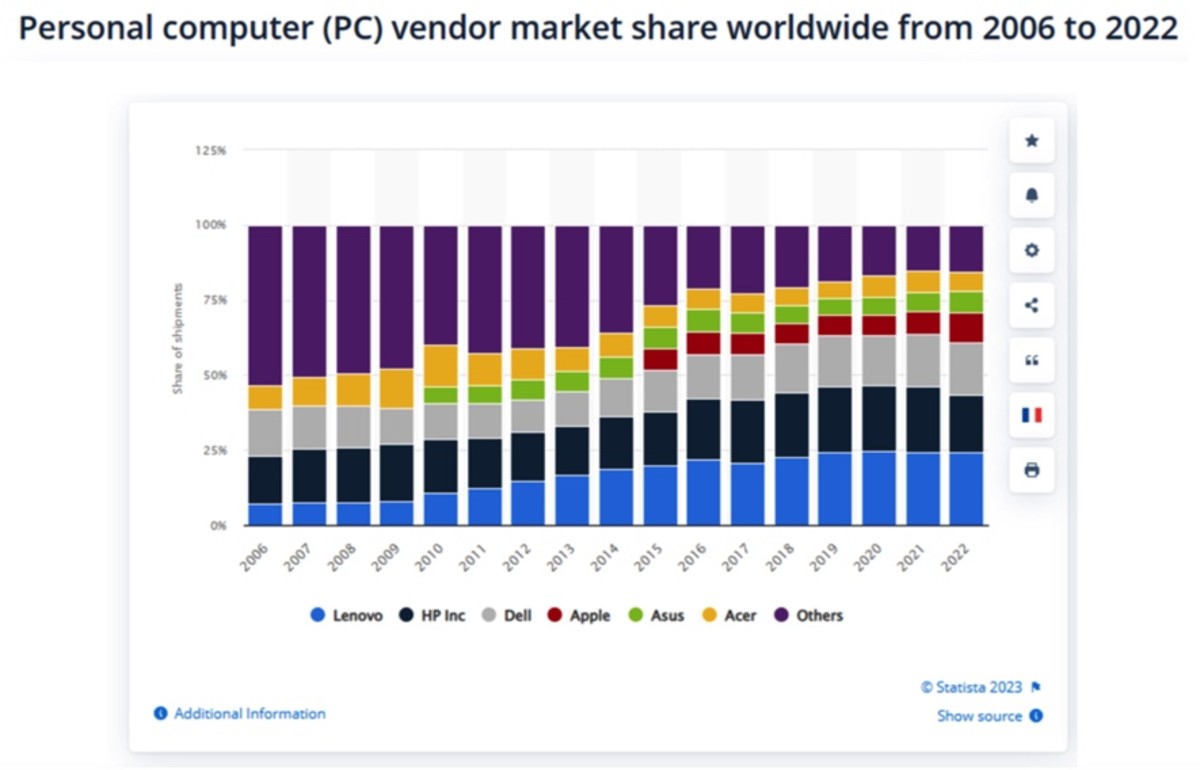

The chart below shows how the Mac climbed from less than 8% market share in 2014 (Apple is lumped under the “others” category) to roughly 10% in 2022.

iPad: Unlikely To Shine

Apple's iPad segment struggled with supply chain issues last year. That page has been turned, but fiscal 2023 is unlikely to be a walk in the park.

Fiscal Q2 expectations are low due to difficult market conditions and a lack of new model releases. At best, pent-up demand could support sales as supply chain issues ease.

Having said the above, the iPad's impact on Apple's overall stock performance remains limited. The segment represents only 7% of total revenues and has less of an influence on market value than the iPhone or services businesses.

Will Services Push Apple Higher?

Apple's services segment, accounting for one-third of op profits, has experienced underwhelming growth in 2023, with a low of 5% in fiscal Q4 last year.

Ad sales softness and gaming struggles contribute to the weak performance. Investments in newer initiatives like Apple TV+ could offer potential upside, but most likely only in the long term.

A rebound in services growth could push Apple shares higher, as the segment is likely Apple's most valuable due to its high margins and recurring revenue model.

China Could Be Crucial

Apple's earnings are greatly influenced by the volatile Greater China market, which represents one-fifth of the company's total revenues.

China's recent economic struggles caused in great part by COVID-related factory closures have led to near-zero revenue growth over the past year for Apple. However, there's potential for a rebound in fiscal Q2 as COVID-19 restrictions ease and workers return to offices and factories.

A potential resurgence in China sales could positively impact Apple stock, especially if such recovery is not fully anticipated by analysts and investors.

Analyst opinions

Apple price target raised to $170 from $160 at Deutsche Bank

Deutsche Bank raised the firm's price target on Apple to $170 from $160 and keeps a Buy rating on the shares. The analyst expects Apple to report fiscal Q2 results in line with Street estimates, with strength in iPhone offsetting incremental weakness in other areas. For Q3, the firm sees potential for Products revenue to be lower than estimates, but also expects lower component costs to drive upside to margins, leading to earnings in line with estimates. Deutsche believes investors are attracted by the company's "quality of earnings and its strong balance sheet in an uncertain macro environment."

Apple price target raised to $149 from $145 at Barclays

Barclays analyst Tim Long raised the firm's price target on Apple to $149 from $145 and keeps an Equal Weight rating on the shares. The analyst sees in-line March quarter results for Apple as better iPhone revenue offset weaker Macs and Services. However, June quarter estimates look to be at risk due to deteriorating demand trends, says the firm. It expects a guide-down with revenue declining by low single digit year-over-year, but says it is "not clear that it matters for the stock."

Wells says Google's declining TAC 'potential negative datapoint' for Apple

Wells Fargo analyst Aaron Rakers notes that Google (GOOGL) reported total Traffic Acquisition Costs, or TAC, of $11.72B in Q1, which was down 2% year-over-year. While the firm is leaving its Services estimate for Apple (AAPL) unchanged ahead of the company's upcoming fiscal Q2 report, it calls Google's declining TAC "a potential negative datapoint." Wells has an Overweight rating and $185 price target on Apple shares.

Apple price target raised to $190 from $175 at JPMorgan

JPMorgan raised the firm's price target on Apple to $190 from $175 and keeps an Overweight rating on the shares ahead of the fiscal Q3 results. The analyst says fundamental weakness in Apple's hardware categories, driven by a pullback in consumer spending, will drive consensus estimates lower. However, the magnitude of the downward revision will be limited to a couple of percentage points and "reinforce positioning of the shares for resilience," the analyst tells investors in a research note. The combination of downside to revenue earnings being limited despite being in a tough macro environment, dividend and buyback support to total return as well as earnings growth, and Apple shares trading below the peak multiple of 30-tiimes, reinforces that the shares "still have room" to run, contends the firm. It sees Apple's earnings multiple expanding "in response to the resilient positioning."

Apple price target raised to $188 from $184 at Credit Suisse

Credit Suisse analyst Shannon Cross raised the firm's price target on Apple to $188 from $184 and keeps an Outperform rating on the shares ahead of the Q2 earnings report on May 4. The firm believes iPhone demand was resilient during the quarter and thinks Apple will guide Q3 revenue up year over year and gross margin around 44%, the analyst tells investors in a research note.

Comments