(March 15) U.S. futures and European stocks climbed, with investors focused on the strength of the global economic recovery and progress in delivering vaccines.

Investors remain preoccupied with rising long-term borrowing costs and their implications for reflation trades and the rotation in the stock market from growth to value shares. The benchmark Treasury yield hovered around 1.62% on Monday.

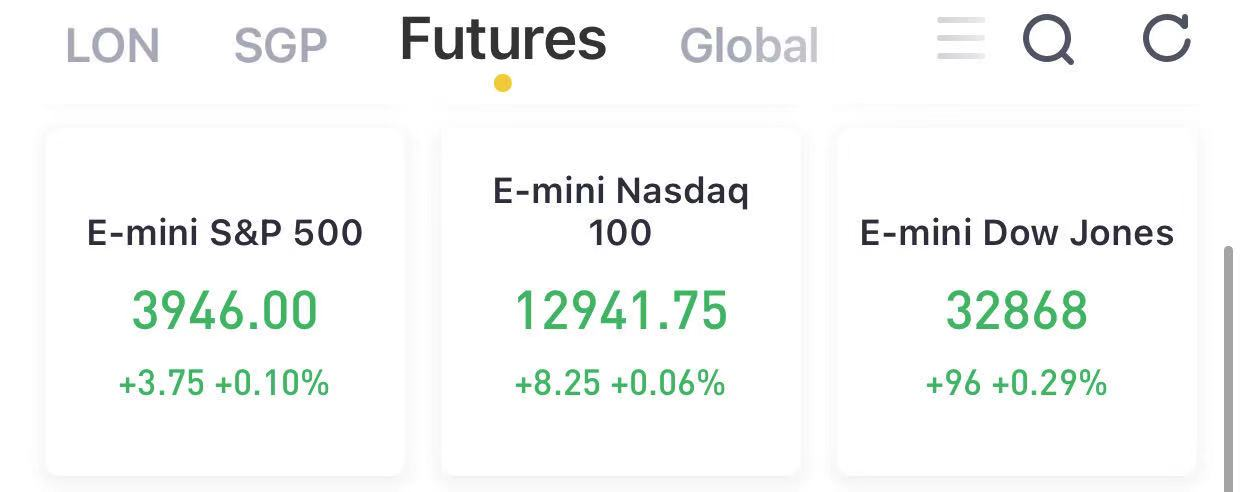

At 8:10 a.m. ET, Nasdaq 100 e-minis were up 8.25points, or 0.06%, S&P 500 e-minis were rose 3.75 points, or 0.10%, and Dow e-minis were up 96 points, or 0.29%.

*Source FromTiger Trade, EST 08:10

Markets are preoccupied with rising long-term borrowing costs and their implications for reflation trades and the rotation in the stock market from growth to value shares. The Federal Reserve decision later in the week is one of a slew due from central banks globally.

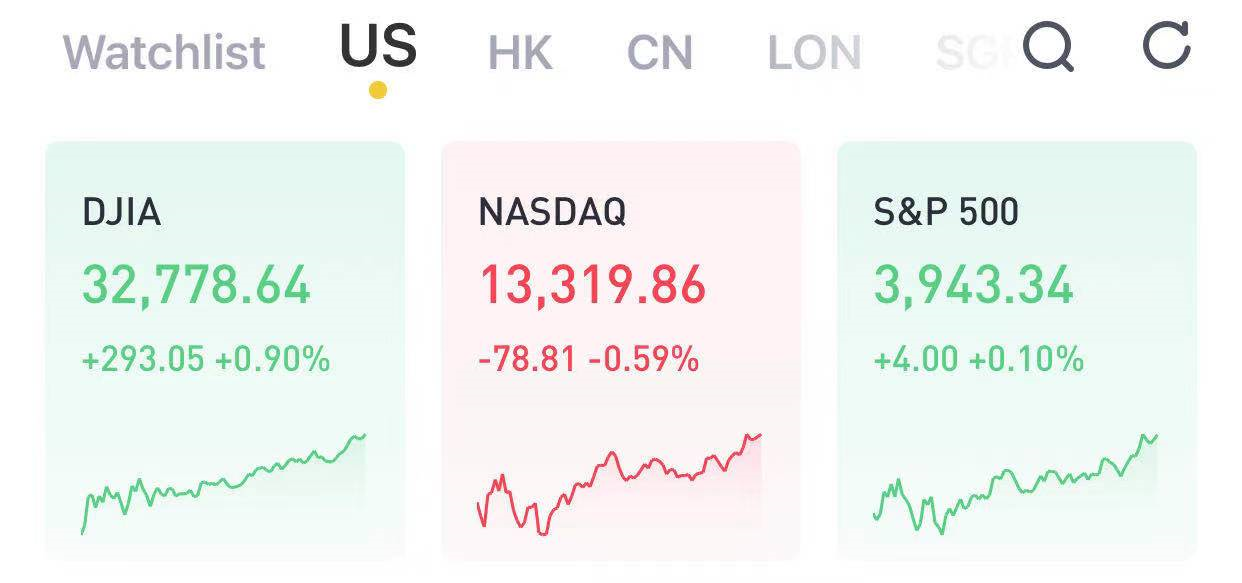

U.S. Market Last Week

Stocks rose last week with the Dow Jones Industrial Average rising 4% and the S&P 500 gaining 2.6%. The S&P 500 and the Dow both closed at record highs Friday.

The Nasdaq Composite advanced 3% last week, despite a sell-off on Friday spurred by rising interest rates. The jump in bond yields has challenged growth stocks in recent weeks and sent investors into cyclical pockets of the market. The Nasdaq is up less than 1% this month, while the Dow and S&P are up 6% and 3.5%, respectively.

The U.S. 10-year Treasury hit its highest level in more than a year on Friday. The benchmark Treasury note reached 1.642%, its highest level since February 2020.

Stocks making the biggest moves in the premarket trading

1) XPeng (XPEV) – XPeng got a $76.8 million investment from the provincial government in Guangdong, where the Chinese electric vehicle maker is based and has two manufacturing plants. XPeng added 4.2% in premarket action.

2) AMC Entertainment (AMC) – AMC will begin reopening movie theaters in Los Angeles, starting with two locations today. It plans to open the remaining 23 theaters in Los Angeles on Friday, and hopes to have all 56 California locations open by then depending on local approvals. AMC jumped 8.7% in premarket trade.

3) NXP Semiconductors (NXPI), Penn National Gaming (PENN), Generac (GNRC), Caesars Entertainment (CZR) – The stocks will join the S&P 500 as part of the index’s quarterly rebalancing. NXP jumped 8.1% in premarket trading, with Penn up 5.8%, Generac gaining 3.6% and Caesars climbing 4.8%.

4) Carnival (CCL) – Carnival CEO Arnold Donald told the Financial Times he sees at least two more tough years for the cruise industry. Donald said the cruise line operator’s full fleet might be sailing by the end of the year but that it will take at least until 2023 for revenue to return to pre-Covid levels. Carnival rose 1.2% in the premarket.

5) Ford Motor (F) – Ford will recall 2.9 million vehicles to check for potentially faulty driver-side Takata airbags. The National Highway Traffic Safety Administration had called on Ford to do so in January, and the automaker plans to begin notifying owners on April 1.

6) Gilead Sciences (GILD), Merck (MRK) – The drugmakers will study a combination of their experimental drugs to treat HIV. Gilead and Merck will look at the effectiveness of the drug cocktail even when taken only every few months.

7) Eli Lilly (LLY) – Eli Lilly said its experimental treatment for Alzheimer’s modestly slowed decline in patients over an 18-month period in a mid-stage study. Lilly has already begun a second study of the treatment. Lilly fell 5.3% in the premarket.

8) Lordstown Motors (RIDE) – Lordstown said it will issue a “full and thorough” statement in the coming days that the electric truck maker said would refute a critical report by short-seller Hindenburg Research. Lordstown has said the report contains “half-truths and lies.” Its shares rose 5.9% in premarket trading.

9) GenMark Diagnostics (GNMK) – GenMark will be bought by Swiss drugmaker Roche for $1.8 billion in cash, or $24.05 per share. Shares of the U.S.-based molecular diagnostic test maker had closed at $18.50 per share on Friday. GenMark surged 29.2% in premarket action.

10) Shaw Communications (SJR) – The Canadian communications company agreed to be bought by rival Rogers Communications for C$26B including debt ($20.9B in US Dollars). Shaw’s U.S. shares surged 53% in the premarket.

11) Dollar General (DG) – The discount retailer was upgraded to “overweight” from “neutral” at Atlantic Equities, which cited valuation as well as a positive impact from stimulus check spending and continued market share gain.

12) AstraZeneca (AZN) – Ireland became the latest country to suspend the use of AstraZeneca’s Covid-19 vaccine, following reports out of Norway regarding blood clots in some patients. Officials said they took the action “out of an abundance of caution,” although AstraZeneca said its review of more than 17 million people showed no increased risk of blood clots.

13) United Airlines (UAL), American Airlines (AAL), Delta Air Lines (DAL), Southwest Airlines (LUV) – Airline stocks are gaining ground after the Transportation Safety Administration said airport screening levels are now at one-year highs. Separately, Southwest said passenger demand is continuing to improve this month. United was up 3% in the premarket, American gained 4.3%, Delta rose 2% and Southwest edged up 1.3%.

14) DraftKings (DKNG) – The sports betting company announced a proposed offering of $1 billion in convertible notes due in 2028. DraftKings fell 3.5% in premarket trade.

15) AstraZeneca Plc said that a review of safety data of more than 17 million people vaccinated with its COVID-19 vaccine in the European Union and the United Kingdom showed no evidence of an increased risk of blood clots.

16) United States Steel Corporation issued profit forecast for the first quarter. The company said it expects Q1 adjusted earnings of $0.61 per share, versus analysts’ estimates of $0.73 per share.

17) Roche Holding AG said it has entered into a definitive agreement to acquire GenMark Diagnostics (NASDAQ:GNMK) for $24.05 per share in cash, or about $1.8 billion, on a fully diluted basis.

Economic calendar:

Monday: Empire Manufacturing, March(14.5 expected, 12.1 in February); Total Net TIC Flows, January (-$0.6 billion in December); Net Long-Term TIC Flows, January ($121.0 billion in December)

Tuesday: Import price index, month-over-month, February (1.0% expected, 1.4% in January); Import price index excluding petroleum, February (0.4% expected, 0.9% in January); Import price index year-over-year, February (2.6% expected, 0.9% in January); Export price index, month-over-month, February (0.9% expected, 2.5% in January); Export price index, year-over-year, February (2.3% in January); Retail sales advance month-over-month, February (-0.7% expected, 5.3% in January); Retail sales excluding autos and gas, month-over-month, February (-1.3% expected, 6.1% in January); Retail sales control group, February (-1.1% expected, 6.0% in January); Industrial production month-over-month, February (0.4% expected, 0.9% in January); Capacity utilization, February (75.6% in February, 75.6% in January); Manufacturing production, February (0.2% expected, 1.0% in January); Business inventories, January (0.3% expected, 0.6% in December); NAHB Housing Market index, March (84 expected, 84 in February)

Wednesday: MBA Mortgage Applications, week ended March 12 (-1.3% during prior week); Building permits, month-over-month, February (-7.2% expected, 10.4% in January); Housing starts, February (-1.0% expected, -6.0% in January); FOMC Rate Decision

Thursday: Initial jobless claims, week ended March 13 (703,000 expected, 712,000 during prior week); Continuing claims, week ended March 6 (4.144 million during prior week); Philadelphia Fed Business Outlook Index, March (24.0 expected, 23.1 in February); Leading Index, February (0.3% expected, 0.5% in January)

Friday: N/A

Earnings calendar:

Monday: N/A

Tuesday: Coupa Software (COUP), CrowdStrike (CRWD), Lennar (LEN) after market close

Wednesday: Green Thumb Industries (GTII.CN) after market close

Thursday: Dollar General (DG) before market open; Nike (NKE), FedEx (FDX), Hims & Hers Health (HIMS) after market close

Friday: N/A

These are some key events this week:

Fed Chair Jerome Powell will likely reaffirm his no-tightening policy stance at the Fed policy meeting Wednesday.Bank of England rate decision Thursday. BOE is expected to leave monetary policy unchanged.Bank of Japan monetary policy decision and Governor Haruhiko Kuroda briefing Friday.

These are the main moves in markets:

Currencies

The Bloomberg Dollar Spot Index increased 0.1%.The euro sank 0.2% to $1.1929.The British pound was little changed at $1.392.The onshore yuan strengthened 0.1% to 6.504 per dollar.The Japanese yen weakened 0.1% to 109.13 per dollar.

Bonds

The yield on 10-year Treasuries increased one basis point to 1.63%.The yield on two-year Treasuries gained one basis point to 0.16%.Germany’s 10-year yield was unchanged at -0.31%.Britain’s 10-year yield jumped two basis points to 0.839%.Japan’s 10-year yield fell one basis point to 0.111%.

Commodities

West Texas Intermediate crude declined 0.2% to $65.50 a barrel.Brent crude decreased 0.1% to $69.12 a barrel.Gold strengthened 0.1% to $1,729.67 an ounce.

Elsewhere, oil climbed and Bitcoin slid below $60,000 after a weekend rally to a record. On the virus front, the U.S. is reporting fewer infections but countries from India to Italy are seeing a resurgence.

Comments