Market Overview

U.S. stock indexes rallied to kick off the trading week on Monday, as investors girded for inflation data on Tuesday and a policy announcement from the Federal Reserve later in the week.

The Dow Jones Industrial Average rose 1.58%, the S&P 500 gained 1.43%, and the Nasdaq Composite added 1.26%.

Regarding the options market, a total volume of 33,459,697 contracts was traded on Monday, down 5.49% from the previous trading day.

Top 10 Option Volumes

Top 10: SPY, QQQ, FXI, TSLA, EEM, IWM, AAPL, VIX, AMZN, EFA

There are 7.12 million SPY and 2.24 million QQQ options contracts trading on Monday.

SPY’s total trading volume rose 0.85% while QQQ’s volume slid 8.94% from the previous day. 57% of SPY trades bet on bearish options.

FXI slid 1.17% on Monday after China announced a dramatic loosening in COVID-19 testing, quarantine and management rules.

There were 1,580,000 FXI options trading on Monday, and its volumes surged over 350% from the previous day. Call options account for 94% of overall option trades. Particularly high volume was seen for the $27 strike call option expiring December 16th, with 249,289 contracts trading on Monday.

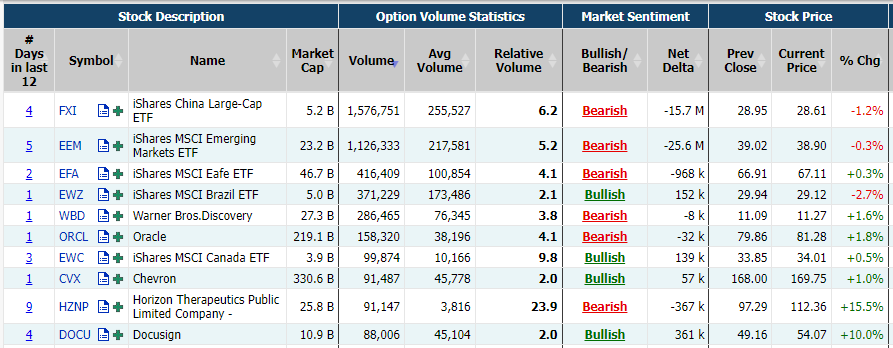

Unusual Options Activity

Horizon Pharma PLC surged 15.49% on Monday as Amgen Inc. has agreed to acquire it in an all-cash deal valued at $27.8 billion, marking the largest healthcare merger of the year.

There were 91,730 Horizon Pharma PLC options trading on Monday. Put options account for 61% of overall option trades. Particularly high volume was seen for the $115 strike call option expiring December 16th, with 8,868 contracts trading on Monday.

Docusign continued to gain 9.99% after showing its financial results. The company reported adjusted earnings of 57 cents per share on $645 million in revenue where Wall Street expected adjusted earnings of 42 cents and revenue of $627 million.

There were 88,100 Docusign options trading on Monday, and its volumes shrank over 50% from the previous day. Call options account for 52% of overall option trades. Particularly high volume was seen for the $54 strike call option expiring December 16th, with 4,028 contracts trading on Monday.

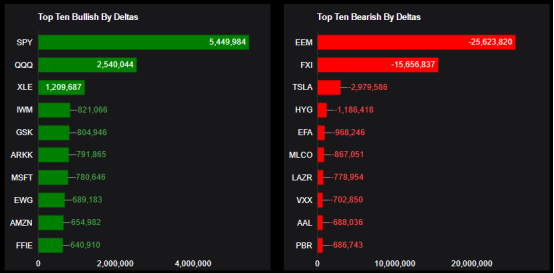

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: SPY, QQQ, XLE, IWM, GSK, ARKK, MSFT, EWG, AMZN, FFIE

Top 10 bearish stocks: EEM, FXI, TSLA, HYG, EFA, MLCO, LAZR, VXX, AAL, PBR

If you are interested in options and you want to:

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments