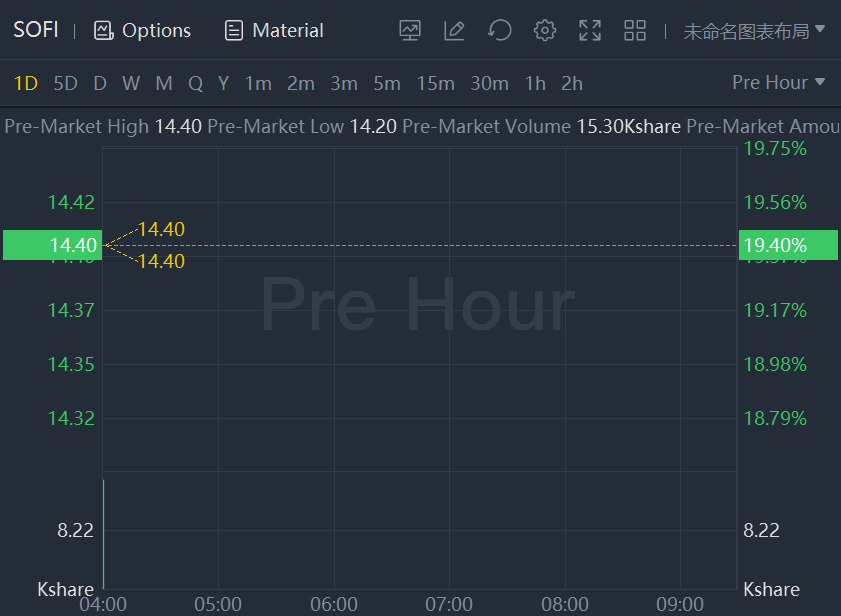

SoFi Technologies Inc., the financial firm led by former Twitter Inc. executive Anthony Noto, surged 19% after the Office of the Comptroller of the Currency granted it a U.S. banking charter.

The online lending platform acquired Golden Pacific Bank as a path to getting the full-fledged banking license, the regulator said in a statement on Tuesday. While the entity will have a national reach and SoFi’s well-established digital lending platform, the OCC said that the new license didn’t cover crypto transactions.

“This incredible milestone elevates our ability to help even more people get their money right and realize their ambitions,” Noto, SoFi’s chief executive officer, said in a statement posted on the company’s website.

SoFi was originally founded to set up affordable alternatives for student lending, and the rapidly growing company has since become one of the major financial technology firms, with millions of users through its online and mobile applications. A banking charter further cements its status in the U.S. financial system, and this long-expected development has been predicted by analysts to boost its earnings this year.

“Today’s decision brings SoFi, a large fintech, inside the federal bank regulatory perimeter, where it will be subject to comprehensive supervision and the full panoply of bank regulations,” Michael Hsu, the acting chief of the OCC, said in a statement.

The OCC said that in order to move past conditional status and become a full-service national bank, SoFi still needed to meet a number of the regulator’s requirements. The OCC said that the new license didn’t cover crypto transactions, unless specifically granted later by the agency.

The firm has also applied for approval as a bank holding company under Federal Reserve oversight.

Comments