Market Overview

U.S. stocks ended mixed on Friday (July 21), with the Dow Jones Industrial Average rising marginally to notch its 10th straight day of advances, its longest rally in almost six years. Analysts attributed Friday's volatile trading to the expiration of monthly options and the expected special rebalancing of the multi-trillion dollar Nasdaq 100 following the close of trading.

Regarding the options market, a total volume of 42,602,184 contracts was traded, down 5% from the previous trading day.

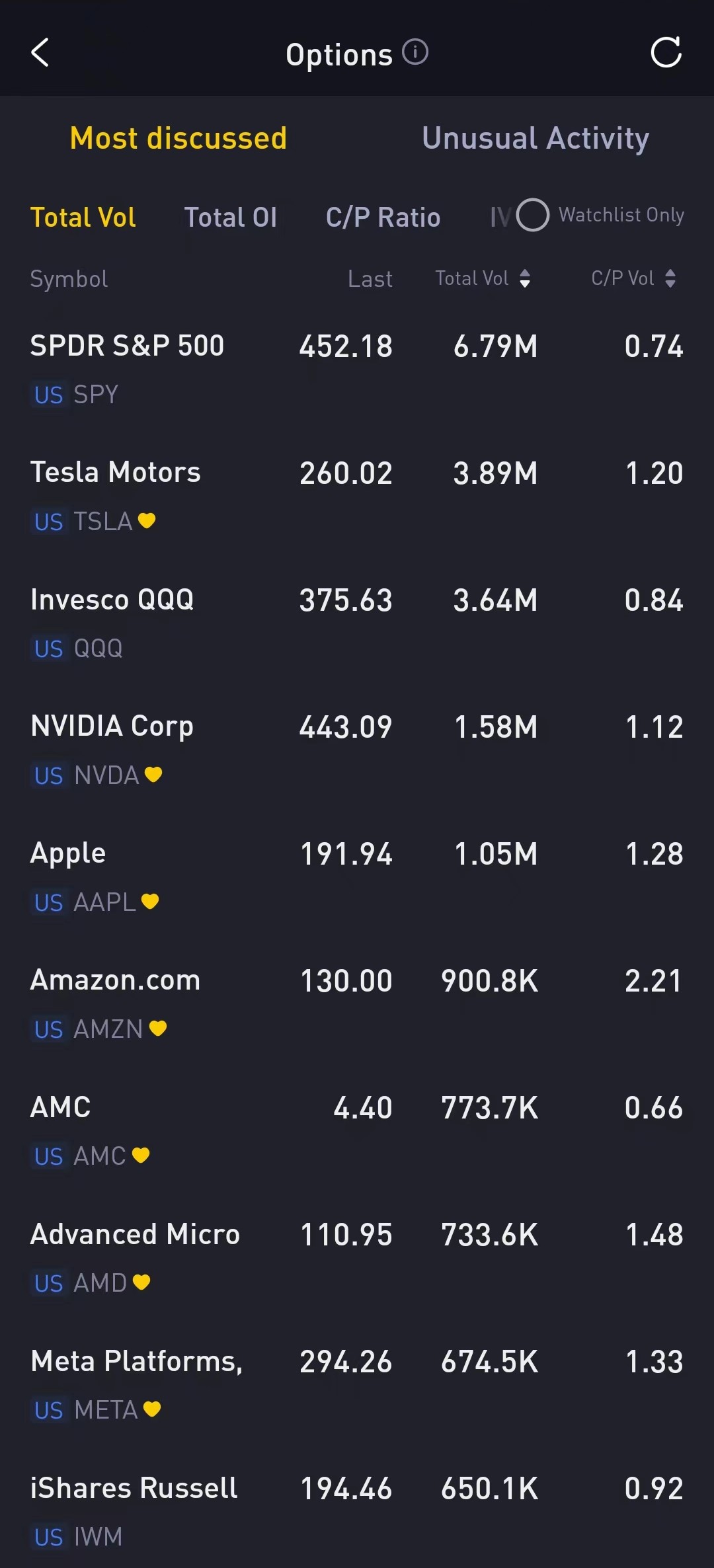

Top 10 Option Volumes

Top 10: SPY; TSLA; QQQ; NVDA; AAPL; AMZN; AMC; AMD; META; IWM

Options related to equity index ETFs are still popular with investors, with 6.79 million SPDR S&P500 ETF Trust (SPY) and 3.64 million Invest QQQ Trust ETF (QQQ) options contracts trading on Friday.

Nvidia and Meta Platforms lost more than 2% each in a choppy trading session Friday. Netflix dipped 2.3%, down for a second straight day after the video streaming company's quarterly results this week failed to impress. NVIDIA Corp stock fell for a third straight day as Taiwan Semi’s disappointing earnings report helps trigger a broad chip-sector selloff. Nvidia’s quarterly earnings report is expected on Aug. 23.

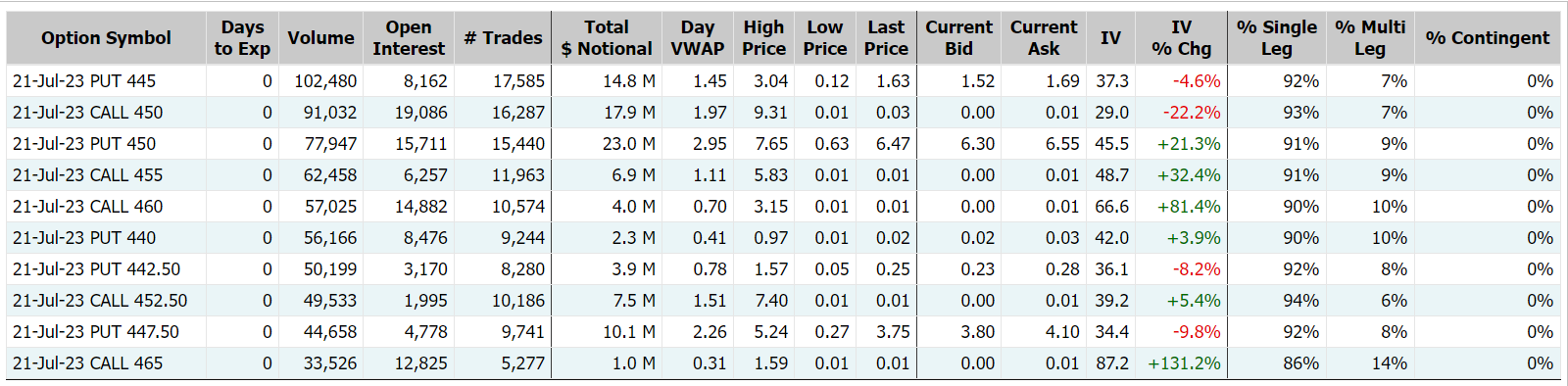

There are 1.58 million Nvidia option contracts traded on Friday, up 21% from the previous trading day. Call options account for 53% of overall option trades. Particularly high volume was seen for the $445 strike put option expiring July 21, with 102,480 contracts trading.

Most Active Equity Options

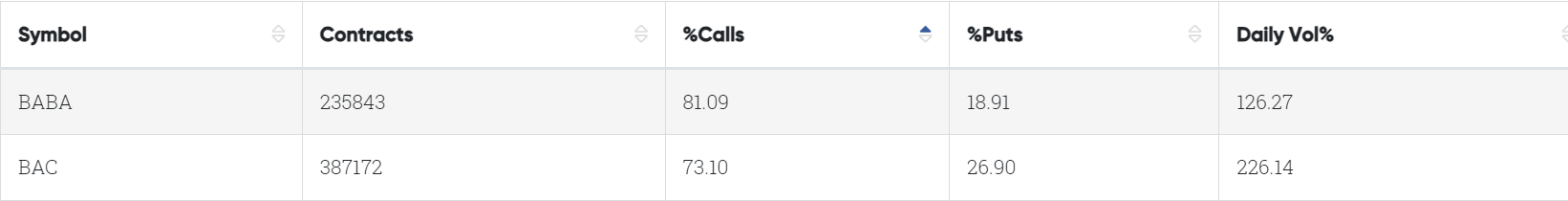

Special %Calls >70%: Alibaba, Bank of America

Unusual Options Activity

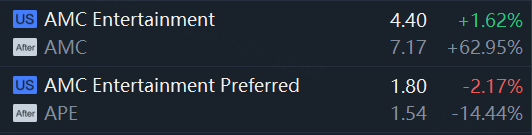

A judge on Friday blocked a proposed settlement on AMC Entertainment stock conversion plan that would allow the company to issue more shares, sending its common shares soaring almost 63% and preferred shares down more than 14% in after-hours trading.

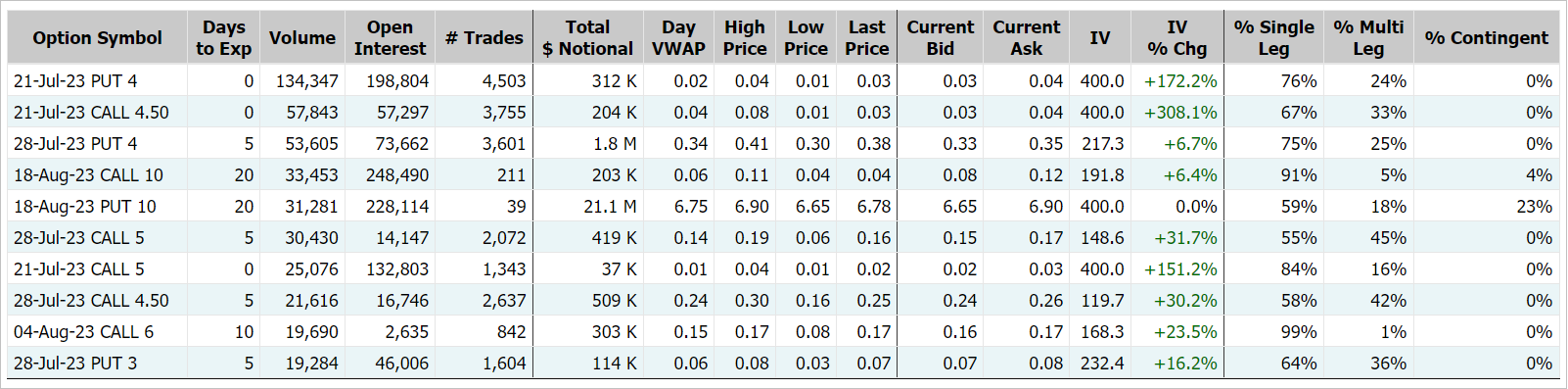

There are 773.7K AMC Entertainment option contracts traded on Friday, approximately 1.8 times the 90-day average trading volume. Put options account for 61% of overall option trades. Particularly high volume was seen for the $4 strike put option expiring July 21, with 134,347 contracts trading. The next is the $4.5 strike call option expiring July 21, with 57,843 contracts trading, and the $4 strike put option expiring July 28, with 53,605 contracts trading. AMC 20230728 4.0 PUT

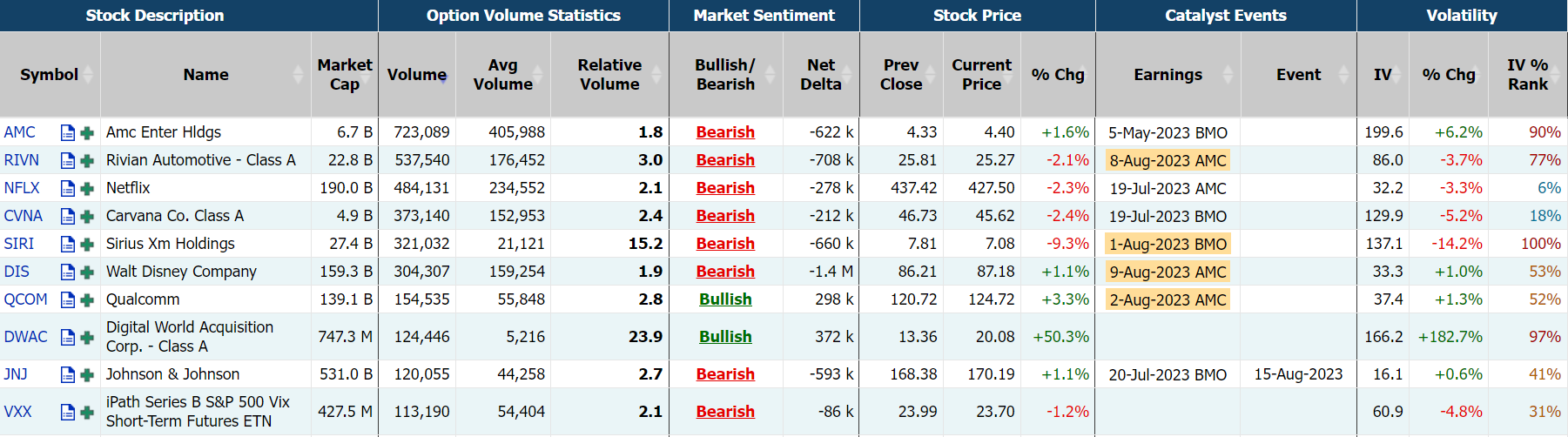

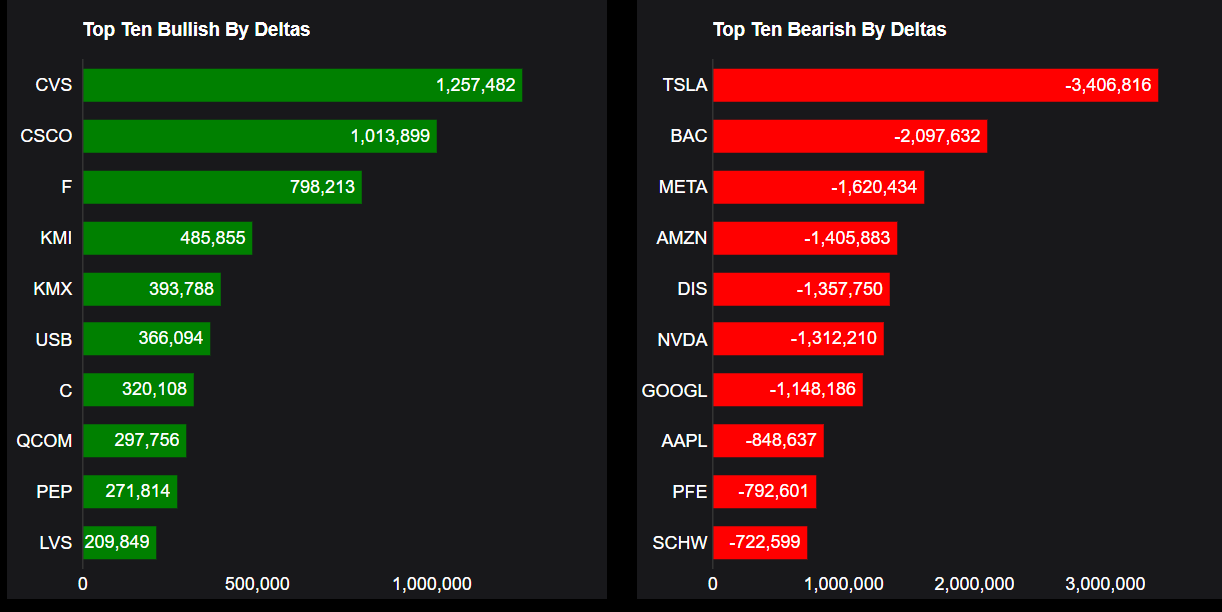

TOP 10 Bullish & Bearish S&P 500

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Based on option delta volume, traders sold a net equivalent of -3,406,816 shares of Tesla stock. The largest bearish delta came from selling calls. The largest delta volume came from the 21-Jul-23 260 Put, with traders getting long 5,751,463 deltas on the single option contract.

Top 10 bullish stocks: CVS, CSCO, F, KMI, KMX, UBS, C, QCOM, PEP, LVS

Top 10 bearish stocks: TSLA, BAC, META, DIS, NVDA, GOOGL, AAPL, PFE, SCHW

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments