- Dow is set to extend sell-off with futures falling again.

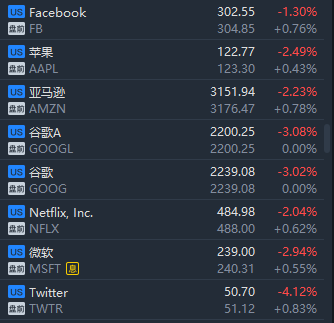

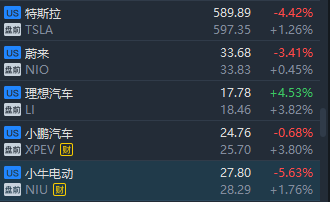

- FAANGs, EV stocks rally.

- In FX,the Bloomberg Dollar index held steady around Wednesday’s best levels.

- Bitcoin slumped as much as 15%

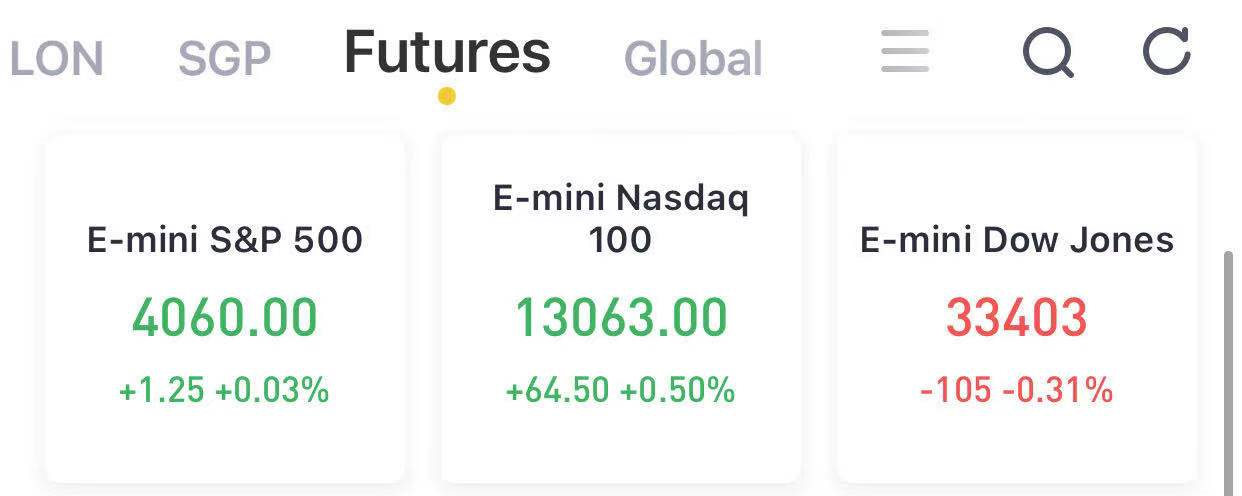

(May 13) Futures contracts tied to the major U.S. stock indexes were set to add to Wednesday's steep losses, but have started to rebound.

At 8:03 a.m. ET, Nasdaq futures jumped by 0.5%, turning higher as investors stepped into buy some tech stocks under fire all week. S&P 500 futures gained 0.03%. Futures on the Dow Jones Industrial average were still off by 105 points following its worst day since January.

Key tech stocks rebounded in premarket trading. Facebook, Apple, Amazon, Netflix and Alphabet turned higher in premarket trading, making back previous losses. Even Tesla reversed course, trading higher by 1.26%.

Stocks making the biggest moves in the premarket: Vroom, Shift, Sonos, Poshmark & more

1) Vroom(VRM) – Vroom stock jumped 11% in the premarket after it reported a smaller-than-expected loss for its latest quarter. The online used-car retailer's revenue beat estimates as demand surged. Consumers are turning to used cars as the global chip shortage crimps production of new vehicles. Vroom rivalShift(SFT) reported similarly upbeat results, and its shares rallied 8.1%.

2) Sonos(SONO) – Sonos earned 12 cents per share for its latest quarter, compared to forecasts of a 22 cents per share loss. The maker of speakers and other audio products also raised full-year sales guidance, saying it believes it can meet demand despite the global chip shortage. Shares jumped 11.9% in premarket trading.

3) Alibaba(BABA) – The China-based e-commerce giantfell short of analysts' forecastson the bottom line, but reported better-than-expected fiscal fourth-quarter revenue. The company also gave an upbeat revenue forecast for the current fiscal year.

4) Casper Sleep(CSPR) – Casper Sleep shares soared 6.3% in premarket trading after the maker of mattresses and other bedding products reported a smaller-than-expected quarterly loss and saw revenue exceed estimates as well. It also raised its full-year outlook due to what it calls "favorable business trends."

5) Canada Goose(GOOS) – Shares of the outdoor apparel maker surged 5.3% in premarket action after Canada Goose reported an unexpected quarterly profit. The company earned 1 cent per share, compared to forecasts of a 12 cents per share loss (all figures in Canadian currency). Revenue also beat forecasts amid a surge in online sales and strong demand from China.

6) Utz Brands(UTZ) – The snacks maker fell a penny a share shy of estimates, with quarterly earnings of 13 cents per share. Revenue was also short of forecasts, however Utz noted that its sales were impacted by February snowstorms and it issued an upbeat full-year outlook.

7) Boeing(BA) – Boeingreceived Federal Aviation Administration approvalfor its proposed fix to the electrical systems of some 737 Max jets. Boeing has issued service bulletins detailing the fix and said it should only take a day or two for airlines to implement.

8) Bumble(BMBL) – Bumble surprised analysts with a first quarter profit, compared to expectations of a quarterly loss. The dating service operator also reported better-than-expected revenue. Bumble issued upbeat current-quarter revenue guidance, with more people returning to dating as the pandemic recedes. Despite the upbeat numbers, Bumble shares fell 1.2% in premarket trading.

9) BJ’s Wholesale(BJ) – The warehouse retailer was upgraded to “overweight” from “neutral” at J.P. Morgan Securities, which said it is more optimistic about BJ’s upcoming earnings report than most on the Street. The firm also said it sees stimulus checks giving a boost to membership renewal rates. BJ’s shares rose 1.8% in premarket trading.

10) Poshmark(POSH) – Poshmark stock tanked 12.5% in the premarket, despite upbeat first-quarter results. The company reported a loss of 33 cents per share, smaller than the 42 cents a share loss expected by Wall Street analysts. The online retailer of used luxury goods also saw revenue come in above analyst forecasts.

11) Lowe’s(LOW) – Lowe’s was upgraded to “outperform” from “perform” at Oppenheimer, which pointed to the home improvement retailer’s discounted valuation compared to that of rivalHome Depot(HD).

In rates, treasuries were calmer and little changed trading near the low end of Wednesday’s range, with curve slightly flatter, after erasing gains. Treasury 10-year yields around 1.697% are less than 1bp higher on the day; bunds lag by 3bp, gilts by 4bp on Ascension Day holiday in some euro-area countries including Germany and France. Dip-buying emerged during an active Asia session in which cash and futures volumes were almost double recent average. The Treasury auction cycle concludes with $27b 30-year bond sale at 1pm ET; Wednesday’s 10-year stopped through by more than 1bp; the WI 30-year yield is around 2.395% is above auction stops since November 2019 and 7.5bp cheaper than last month’s, which stopped through by 1.6bp. Yield curves in Europe bear steepen. BTPs widen across the curve to bunds, trading around session lows after a soft reception at today’s auctions.

In FX, the Bloomberg Dollar index held steady around Wednesday’s best levels. A gauge of the dollar’s implied volatility climbed to a one- month high after a surprisingly strong U.S. inflation print prompted traders to recalibrate bets for an interest-rate hike. Still, options traders haven’t determined whether that makes for a stronger greenback. The Australian dollar fell to its lowest in over a week as iron ore futures dropped after Chinese Premier Li Keqiang urged the country to deal with the surge in commodity prices and its impact. The yen and Swiss franc led advances as global stocks fell to a six-week low and U.S. equity futures retreated. NOK and AUD are the worst performers in G-10, CHF outperforms. EUR/USD briefly tests 1.21 before paring gains. TRY lags in EMFX. Bitcoin remains ~8% lower after its overnight slump.

In commodities, front-month crude futures drop over 2%: WTI trades back on a $64-handle, Brent back below $68. Spot gold trades near $1,814/oz, holding a narrow range close to Wednesday’s worst levels. Base metals are in the red with LME nickel slumping close to 3

Meanwhile, Bitcoin slumped as much as 15% after Elon Musk tweeted that Tesla was no longer accepting the digital currency for vehicle purchases due to environmental concerns.It has since recovered much of its losses.

After yesterday's CPI shocker, the Labor Department's data is likely to show U.S. producer prices rose 0.3% last month after a gain of 1% in March. A separate report is expected to indicate claims for U.S. unemployment benefits was below 500,000 in the latest week, for the third time in a row.

Looking at the day ahead, the data highlights will include the April PPI reading from the US, as well as the weekly initial jobless claims. Central bank speakers include BoE Governor Bailey and Deputy Governor Cunliffe, the Fed’s Barkin, Waller and Bullard, the ECB’s Centeno and BoC Governor Macklem. Finally, earnings releases include Disney, Airbnb and Alibaba.

Comments