Dec 22 (Reuters) - AMC Entertainment Holdings said on Thursday it would raise $110 million in new equity capital through the sale of its preferred stock, sending the cinema chain's shares down about 24% before the bell.

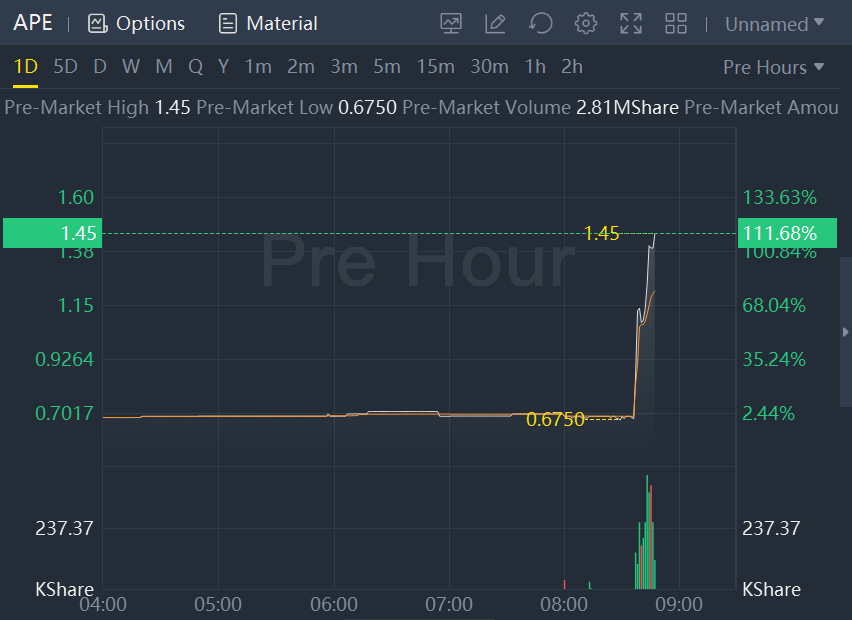

Antara Capital will buy APE at an average price of 66 cents per share. APE shares surged about 112% to $1.45.

Antara, a current AMC debt holder, will also exchange $100 million in debt for about 91 million APE units, which would reduce AMC's annual interest expense by about $10 million.

AMC in August announced APE as a special dividend for shareholders and a means to raise capital in the future. The company in the same month listed the stock in New York under the ticker 'APE'.

The following is the original announcement of AMC Entertainment:

AMC Entertainment Holdings, Inc. Announces $110 Million Equity Capital Raise, a $100 Million Debt for Equity Exchange, and a Proposed Vote to Convert AMC Preferred Equity (“APE”) Units Into AMC Common Shares and Implement a Reverse Stock Split

- Raises $110 million of new equity capital through the sale of APE units to Antara Capital, LP (“Antara”) at a weighted average price of $0.660 per share. The APE closing price on the NYSE on December 21, 2022 was $0.685.

- Reduces debt by $100 million principal amount of 2nd Lien Notes due 2026 currently held by Antara in exchange for approximately 91.0 million APE units. This $100 million principal debt reduction reduces annual interest expense by approximately $10 million.

- Seeks a special shareholder meeting to vote on the following AMC Board of Directors proposals:

AMC Entertainment Holdings, Inc. (NYSE: AMC and APE) (“AMC” or “the Company”), today announced it will raise $110 million of new equity capital through the sale of APE units to Antara Capital, LP (“Antara”) in two tranches at a weighted average price of $0.660 per share. The APE unit closing price on the New York Stock Exchange on December 21, 2022 was $0.685.

Under the terms of the agreement, Antara, a current AMC debt holder, will also exchange $100 million principal amount of 2nd Lien Notes due 2026 for approximately 91.0 million APE units thereby reducing AMC’s outstanding debt by $100 million. As a result of the $100 million principal debt reduction, future annual interest expense will be reduced by approximately $10 million.

The sale of APE units to Antara will be split into two tranches. The first tranche involves the immediate purchase by Antara of 60 million APE units under the Company’s at-the-market program (“ATM program”). The second tranche, for the purchase of approximately 106.6 million APE units, as well as the $100 million debt exchange, are subject to the completion of the waiting period under Hart-Scott-Rodino (“HSR”).

In addition, AMC’s Board of Directors is seeking to hold a special meeting for holders of both AMC common shares and APE units (voting together) to vote on the following proposals:

- To increase the authorized number of AMC common shares to permit the conversion of APE units into AMC common shares.

- To affect a reverse-split of AMC common shares at a 1:10 ratio.

- To adjust authorized ordinary share capital such that, after giving effect to the above proposals if adopted, AMC would have the same ability to issue additional common equity as it currently has to issue additional APE units.

As part of the agreement, Antara has agreed to hold their APE units for up to 90 days and vote them at the special meeting in favor of the proposals. In addition, AMC will limit the amount of additional equity capital it can raise prior to the special meeting.

Adam Aron, Chairman and CEO of AMC Entertainment commented, “AMC’s ongoing capital raising efforts and balance sheet strengthening continues in earnest. We have agreed with Antara to raise $110 million dollars of fresh equity capital, taking our total equity capital raised through the sale of APE units to $272 million of additional cash over the last 90 days. In addition, with this Antara transaction, we also are improving our balance sheet by reducing the principal balance of our debt by yet another $100 million through a debt for APE unit exchange. This is in addition to the approximate $180 million of debt reduction already accomplished by AMC in 2022.”

Aron added, “Clearly, the existence of APEs has been achieving exactly their intended purposes. They have let AMC raise much welcomed cash, reduce debt and in so doing deleverage our balance sheet and allow us to explore possible M&A activity. However, given the consistent trading discount that we are routinely seeing in the price of APE units compared to AMC common shares, we believe it is in the best interests of our shareholders for us to simplify our capital structure, thereby eliminating the discount that has been applied to the APE units in the market.”

Aron concluded, “All should know that our liquidity position is now significantly enhanced, and our balance sheet is strengthened. We look forward to a growing industry box office in 2023 and beyond and also look forward to AMC continuing to benefit from our unique leadership position in the movie theatre industry.”

The capital raise and debt exchange are subject to customary closing conditions.

Comments