Market Overview

U.S. stock indexes ended lower on Thursday(Feb. 9), erasing earlier gains as Treasury yields rose after an auction of 30-year bonds went poorly and overshadowed strong earnings from corporate giants like Disney and PepsiCo. Dow down 0.73%, S&P 500 down 0.88%, and Nasdaq down 1.02%.

Regarding the options market, a total volume of 44,814,274 contracts was traded, up 12% from the previous trading day.

Top 10 Option Volumes

Top 10: SPY, TSLA, QQQ, GOOGL, IWM, GOOG, NVDA, AAPL, AMZN, DIS

Options related to equity index ETFs are still popular with investors, with 9.43 million SPDR S&P500 ETF Trust and 2.87 million Invest QQQ Trust ETF options contracts trading on Thursday.

Total trading volumes for SPY and QQQ were up about 8% and 1%, respectively, from the previous day. 54% of SPY trades bet on bearish options.

Tesla rose 3% on Thursday. Elon Musk said the electric vehicle maker’s Master Plan 3 would be unveiled at the company’s annual meeting on March 1.

There were 4.10M Tesla options trading on Thursday, up 50% from the previous day, of which call options accounted for 58%. A particularly high volume was seen for the $210 strike call option expiring February 10, with 231,695 contracts trading on Thursday.

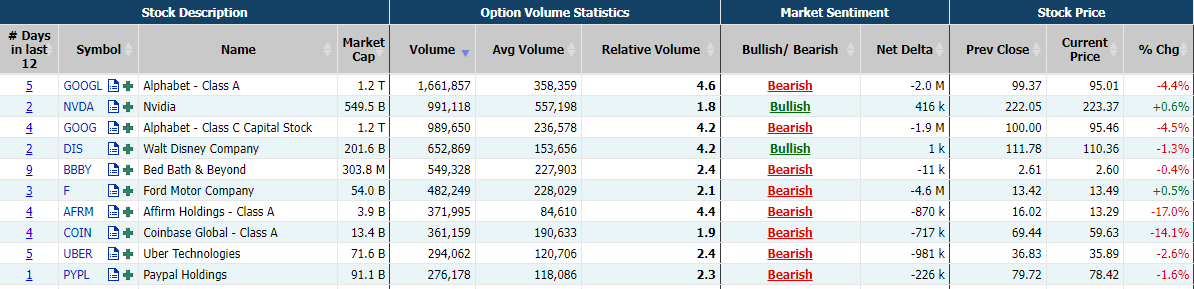

Unusual Options Activity

Disney Co beat earnings estimates and announced job cuts, encouraging activist investor Nelson Peltz to terminate his quest for a board seat. Still, it ended down 1.27%.

There were 654.1K Disney options trading on Thursday, of which call options accounted for 63%. A particularly high volume was seen for the $120 strike call option expiring February 10, with 29,557 contracts trading on Thursday.

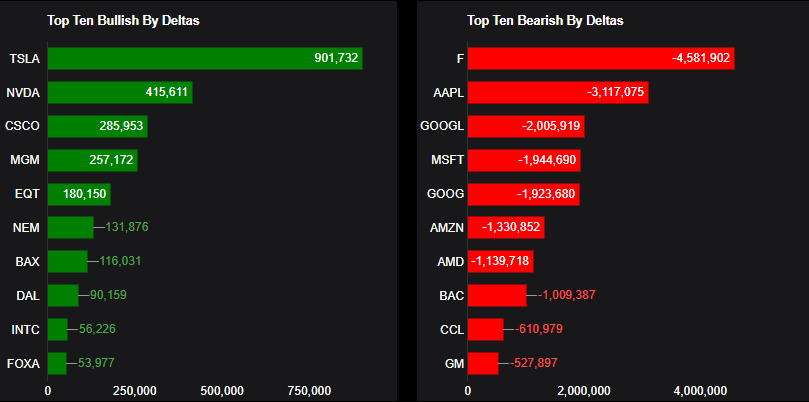

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: TSLA, NVDA, CSCO, MGM, EQT, NEM, BAX, DAL, INTC, FOXA

Top 10 bearish stocks: F, AAPL, GOOGL, MSFT, GOOG, AMZN, AMD, BAC, CCL, GM

If you are interested in options and you want to:

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments