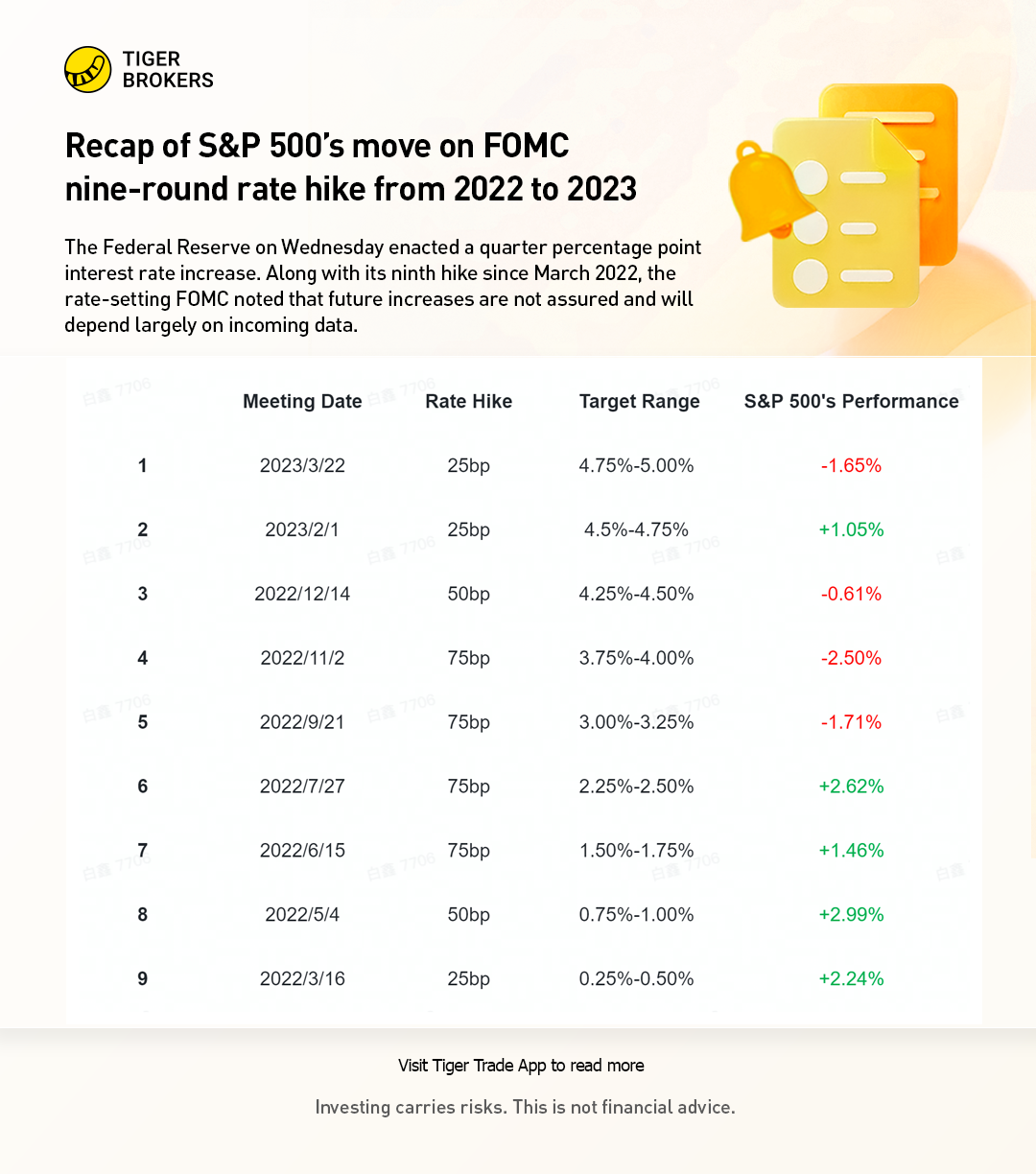

The Federal Reserve on Wednesday enacted a quarter percentage point interest rate increase. Along with its ninth hike since March 2022, the rate-setting FOMC noted that future increases are not assured and will depend largely on incoming data.

Nine straight rate hikes

Policymakers raised overnight lending rates to the highest level since September 2007. That sends a clear message that restoring price stability remains a top priority.

The decision to raise rates by a quarter point was unanimous. No policymaker has voted against a decision since June last year.

Policymakers also released their rate projections for the first time since December.

Projections fell largely in line with previous forecasts. The Federal Reserve still expects to bring the interest rates 5.1% by the end of 2023, which means that they expect one more quarter-point rate hike before they pause.

Officials did indicate, however, that interest rates will likely remain higher for longer as they brought their projected Federal funds rate up to 4.3% from 4.1% in 2024.

In March, Powell indicated that interest rates could move higher and stay there for longer than previously expected, but current financial conditions could indicate less need to hold rates higher in order to cool the economy and bring down inflation.

Fed officials are now projecting deeper cuts to the economy over the next two years.

Real GDP — a widely used measure of the economy — is forecast to grow by 0.4% this year, down from earlier projections of 0.5%. In 2024, officials project that the economy will grow by 1.2%, a cut from the 1.6% they projected in December.

Fed policymakers also forecast that unemployment would drop lower than previously expected by the end of the year, to 4.5%, from the projected 4.6% in December.

Inflation, meanwhile, could remain higher than expected, with Fed officials projecting that PCE inflation, its preferred gauge, could tick up this year to 3.3% from the previously forecast 3.1%.

Comments