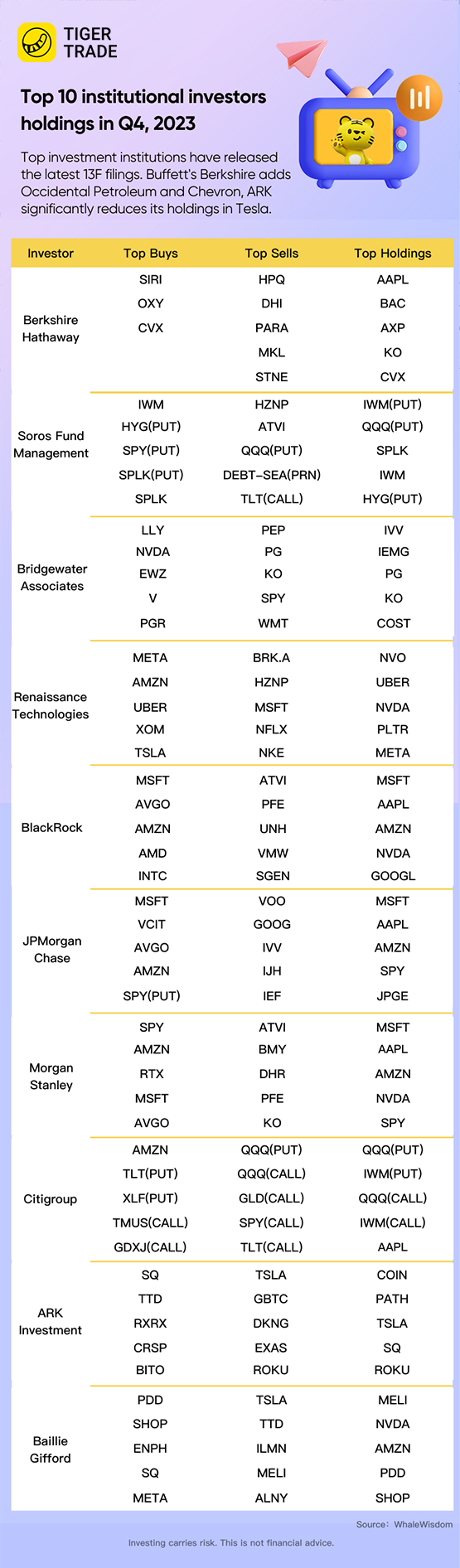

Top investment institutions have released the latest 13F filings for the fourth quarter of 2023. Buffett's Berkshire adds Occidental Petroleum and Chevron, ARK significantly reduces its holdings in Tesla.

Buffett's Berkshire Cuts Apple Stake, Adds Chevron and Occidental Petroleum

Berkshire Hathaway said it has trimmed its huge stake in Apple , and shed four common stock holdings, and kept investors guessing on what could be a major new investment by Warren Buffett.

In a regulatory filing describing its U.S.-listed stock holdings at the end of 2023, Berkshire said it sold 10 million Apple shares in the fourth quarter, but still owned more than 905 million shares worth about $174 billion.

The Omaha, Nebraska-based conglomerate also boosted its stake in oil company Chevron , one of its biggest holdings, and reduced its stakes in computer and printer maker HP , and media company Paramount Global .

Bridgewater Increased Nvidia Stake More Than 450% in Q4

Bridgewater Associates increased its stake in chipmaker Nvidia by 458% at the end of last year while also adding exposure to other members of the so-called Magnificent Seven group of growth and technology stocks that have driven markets higher, filings showed on Wednesday.

Bridgewater also bought roughly 500,000 new shares in Alphabet, bringing its total to 2 million shares at the end of the fourth quarter, valued at $286 million. The hedge fund also added a few more shares in Meta, bringing its position to 666,059 shares, while it acquired a comparatively small new position in Apple, of 1,109 shares, and roughly maintained its exposure to Microsoft at 197,732 shares.

George Soros' Fund Sells off Arm, Broadcom

Billionaire investor George Soros' investment fund has placed new bets on low-cost and ultra-low-cost U.S. airlines, going for fresh stakes in JetBlue Airways Corp., Spirit Airlines Inc. and Sun Country Airlines Holdings Inc., according to a filing late Wednesday.

The fund sold off its stakes in chip makers Arm Holdings Plc., whose stock had been on a tear until recently, and Broadcom Inc. , to name a few exits.

Comments