Major market averages opened to the downside but have since pared back some losses.

Early on and the Nasdaq Composite gained 0.02% as it gave back some of the previous session's big gains after Apple (AAPL), Amazon (AMZN) and Alphabet (GOOG) (GOOGL) saw post-earnings declines.

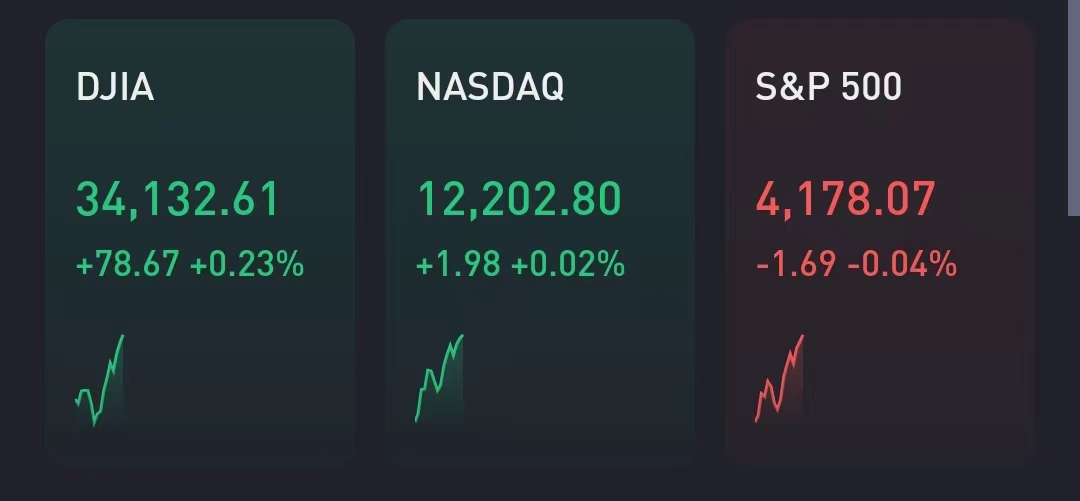

At the same time the S&P 500 dropped 0.04% and the Dow rose by 0.23%.

Nonfarm payrolls rose by to 517K well above the 185K consensus figure and 260K previous reading. At the same time the unemployment rate declined to 3.4% from 3.5% and the 3.6% forecasted figure.

"So rightfully, people are clearly feeling suspicious about this payroll #. Otherwise bonds would be down (yields up) way more," Tom Graff, head of research at Facet, tweeted. "Bear in mind that January is usually a HUGE seasonal adjustment month, so that could be part of what's going on here."

"Regardless, ain't no recession."

Unemployment rate is at its lowest level since 1969.

"A stunning US jobs highlighting the strength of the labor market and its complexities," Allianz adviser Mohamed El-Erian tweeted. "The puzzle: Wage growth came in as expected (0.3%)."

Yields are up. The 10-year Treasury yield (US10Y) was higher by 15 basis points to 3.54% and the 2-year yield (US2Y) was higher by 20 basis points to 4.29%. Additionally, the U.S. dollar index (DXY) gained 0.6%.

Yesterday, Bloomberg’s financial conditions index for the U.S. eased intraday "to its most accommodative level since last February before tightening into the close as rates sold off," Deutsche Bank's Jim Reid said. "Regardless financial conditions remain nearly as loose as we have seen in nearly a year."

Additionally, the ISM service index for January arose more than anticipated after a contraction in the prior month. January ISM Services PMI Index data came in at 55.2 compared to the 50.4 consensus point and 49.6 previous reading.

Among other active stocks, Nordstrom (JWN) soared on a report that Ryan Cohen had taken a stake.

Apple stock jumps over 4% in morning trading.

Comments