U.S. stocks tumbled last Friday to cap a brutal week for financial markets, as surging interest rates and foreign currency turmoil heightened fears of a global recession.

The Dow Jones Industrial Average tumbled 486.27 points, or 1.62%, to 29,590.41. The S&P 500 slid 1.72% to 3,693.23, while the Nasdaq Composite dropped 1.8% to 10,867.93.

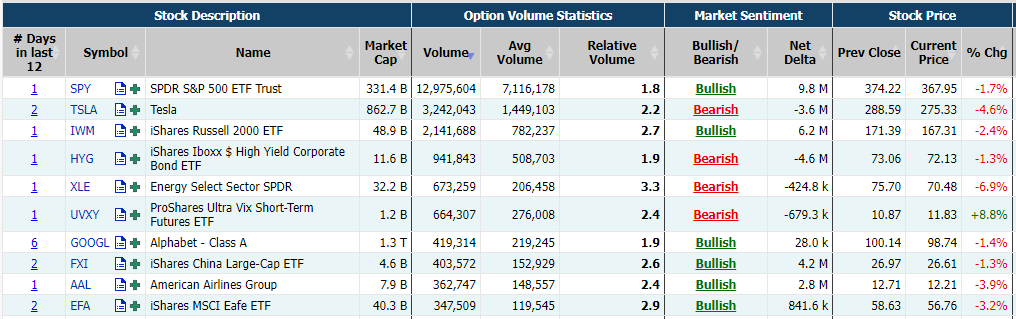

Options Broad View

A total volume of 54,312,173 contracts were traded last Friday, up 32.85% from the previous day. Call options account for 45% of total options trades.

There are 13.24 million SPDR S&P500 ETF Trust options traded last Friday. Call options account for 38% in overall option trades.

Top 10 Option Volumes

Top 10:SPY, QQQ,TSLA,IWM,AAPL,AMZN, VIX, HYG, NVDA, XLE

Options related to equity index ETFs are still top choices for investors, with 3.68 million Invesco QQQ Trust options contracts trading last Friday. Call options account for 41% in overall option trades. Total trading volume for SPDR S&P 500 ETF Trust and Invesco QQQ Trust surged 59.52% and 30.96%, respectively, from the previous day.

Netflix slid 4.49% last Friday, its principal accounting officer Ken Barker has submitted his resignation effective Oct. 7, and it named Chief Financial Officer Spencer Neumann as principal accounting officer while it conducts a search for a replacement for Barker. Moreover, it is changing up the compensation for comedy specials on its streaming platform, moving to a licensing model as it seeks to cut costs and put more of the onus on the comedians themselves.

There are 341,200 option contracts traded last Friday. Call options account for50% of overall option trades. Particularly high volume was seen for the $235 strike call option expiring September 23, with 21,730 contracts trading last Friday.

Other Mega-cap stocks like Tesla and Amazon tumbled 4.59% and 3.01% respectively.

Energy Select Sector SPDR Fund crashed 6.9% last Friday, funds dropped their long and short positions in energy stocks, bonds and futures in the week ending Sept. 16 "more than any other time in recent months", and more than any other sector of the economy in the last 20 days, according to notes by Morgan Stanley and JP Morgan respectively.

There are 675,600 option contracts traded last Friday. Call options account for23% of overall option trades. Particularly high volume was seen for the $70 strike put option expiring September 30, with 47,786 contracts trading last Friday.

Docusign slid 2.98% last Friday, it named Allan Thygesen as its new CEO effective October 10. Thygesen had been president of Google's Americas & Global Partners, where he led the company's $100B advertising business across North and South America.

Thygesen replaces Mary Wilderotter, who has been serving as DocuSign's interim CEO since Dan Springer resigned from the job in June following a weaker-than-expected quarterly report and outlook. Wilderotter will remain as chairman of DocuSign's board of directors.

There are 41,360 option contracts traded last Friday. Call options account for 38% of overall option trades. Particularly high volume was seen for the $53 strike put option expiring September 23, with 930 contracts trading last Friday.

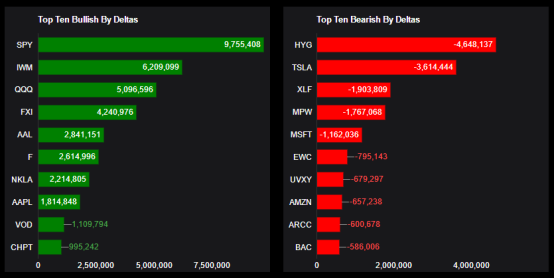

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: SPY, IWM, QQQ, FXI, AAL, F, NKLA, AAPL, VOD, CHPT

Top 10 bearish stocks: HYG, TSLA, XLF, MPW, MPW, MSFT, EWC, UVXY, AMZN, ARCC, BAC

Comments