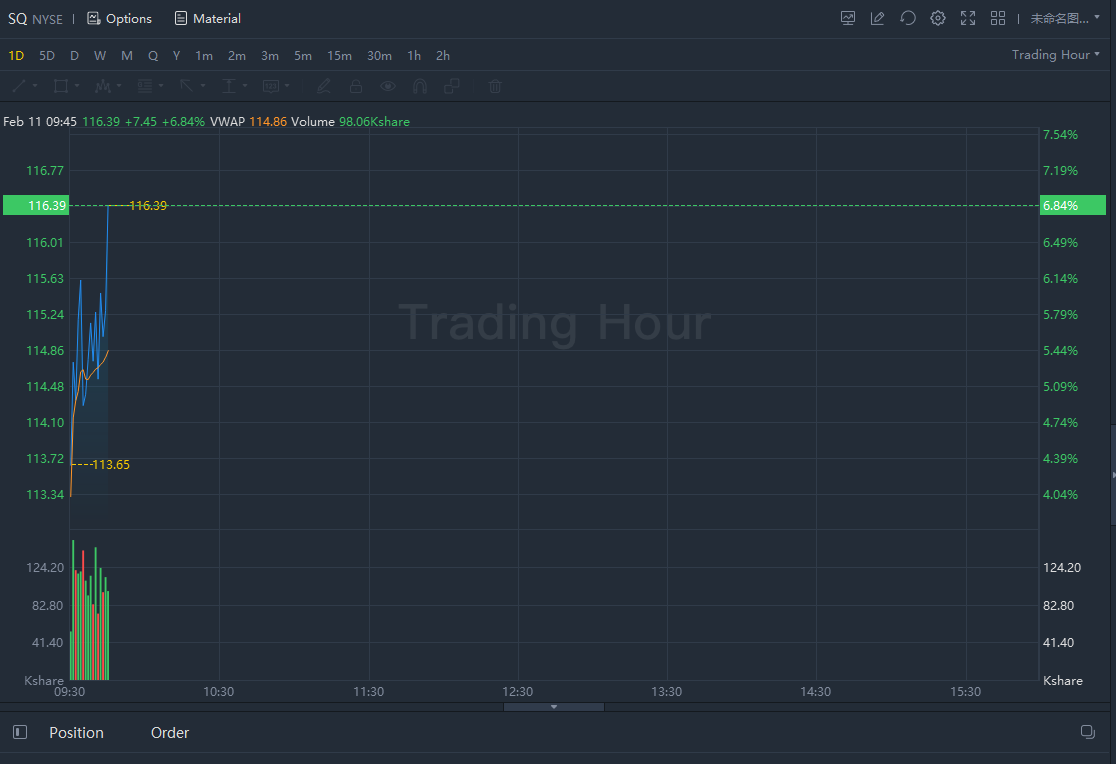

Block stock jumped 6% in morning trading after BofA and Citi Buy rating

“Following big underperformance in shares of SQ, we conducted a sum-of-the-parts (SOTP) analysis, which suggests the market is currently ascribing only ~$6.5B of value to Cash App, or ~$93 per annual active user vs. PYPL at $326 and AFRM at $1,472. Shares have lagged due to a combination of the general growth sell-off and continued limited visibility on the near-term and medium-term trajectory of Cash App gross profit (GP) growth, where concerns became further heightened following PYPL’s commentary on 2/1/22 regarding weakness in post-stimulus spending among lower-income cohorts. Headlines regarding Apple’s introduction of iPhone-based card acceptance have also weighed on SQ,” Kupferberg said in a client note.

Citi analyst Peter Christiansen resumed research coverage on Block with a Buy, $220.00 price target.

“We see the SQ+APT value creation opportunity to be more than just (i) ecosystem integration or (ii) a globalization accelerant – two very powerful rationales nonetheless. For us, we see the combination expanding both the new product development canvas (TAM vectors), as well as Block’s product development capabilities (asset extensions, time-to-market, differentiation),” Christiansen wrote in the report.

Comments