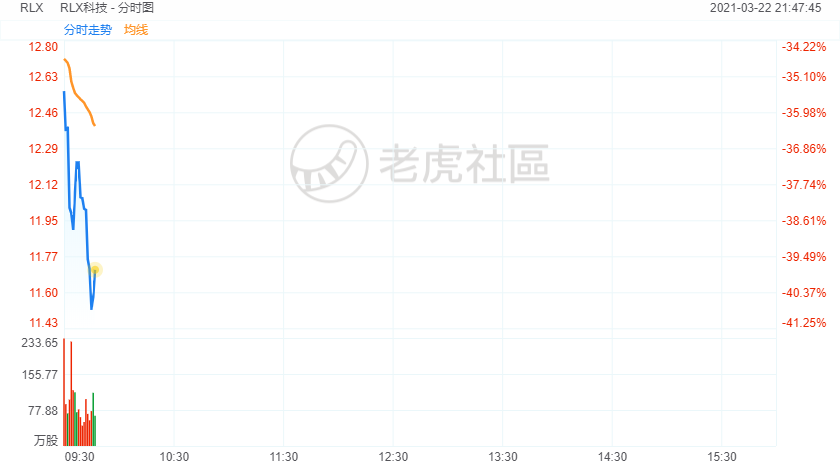

RLX Technology stock plunged 41% in Monday morning trading as China mulls bringing e-cigarette regulation in line with traditional tobacco products.

Two of China's regulators plan to bring the rules governing the sale of e-cigarettes and other new tobacco products in line with those for ordinary cigarettes.

The Ministry of Industry and Information Technology (MIIT) and China's State Tobacco Monopoly Administration, posted online the draft regulations that could potentially curb a fast-growing industry.

In 2019, a string of Chinese e-cigarette companies emerged targeting the domestic market, following the overseas success of the Juul.

The most successful among them, RLX Technology Inc, raised $1.4 billion in an IPO in January that valued the company at $35 billion.

RLX Technology did not immediately respond to a request for comment.

A huge market of smokers and its large electronics manufacturing industry makes China a promising market for the e-cigarette industry.

Yet the sector exists in precarious regulatory area.

China's tobacco industry is controlled entirely via a government monopoly, and strict controls determine what companies and retailers can produce and sell cigarettes.

Cigarette sales generated 5.45% of China's overall tax revenue in 2018. For this reason, industry experts have long expected the state to intervene in the business operations of China's private e-cigarette companies.

In November 2019, Chinese regulators forbid e-commerce platforms from selling e-cigarette products online. The ban swiftly curbed the growth of the sector, and many brands focused their business toward offline sales.

Comments