U.S. stocks rallied on Tuesday (November 22) with all three major indexes rising over 1%.

A sales forecast by Best Buy dampened concerns high inflation would lead to a dismal holiday shopping season while a bounce in oil prices helped lift energy shares.

Regarding the options market, a total volume of 36,688,714 contracts was traded, up 5.6% from the previous trading day.

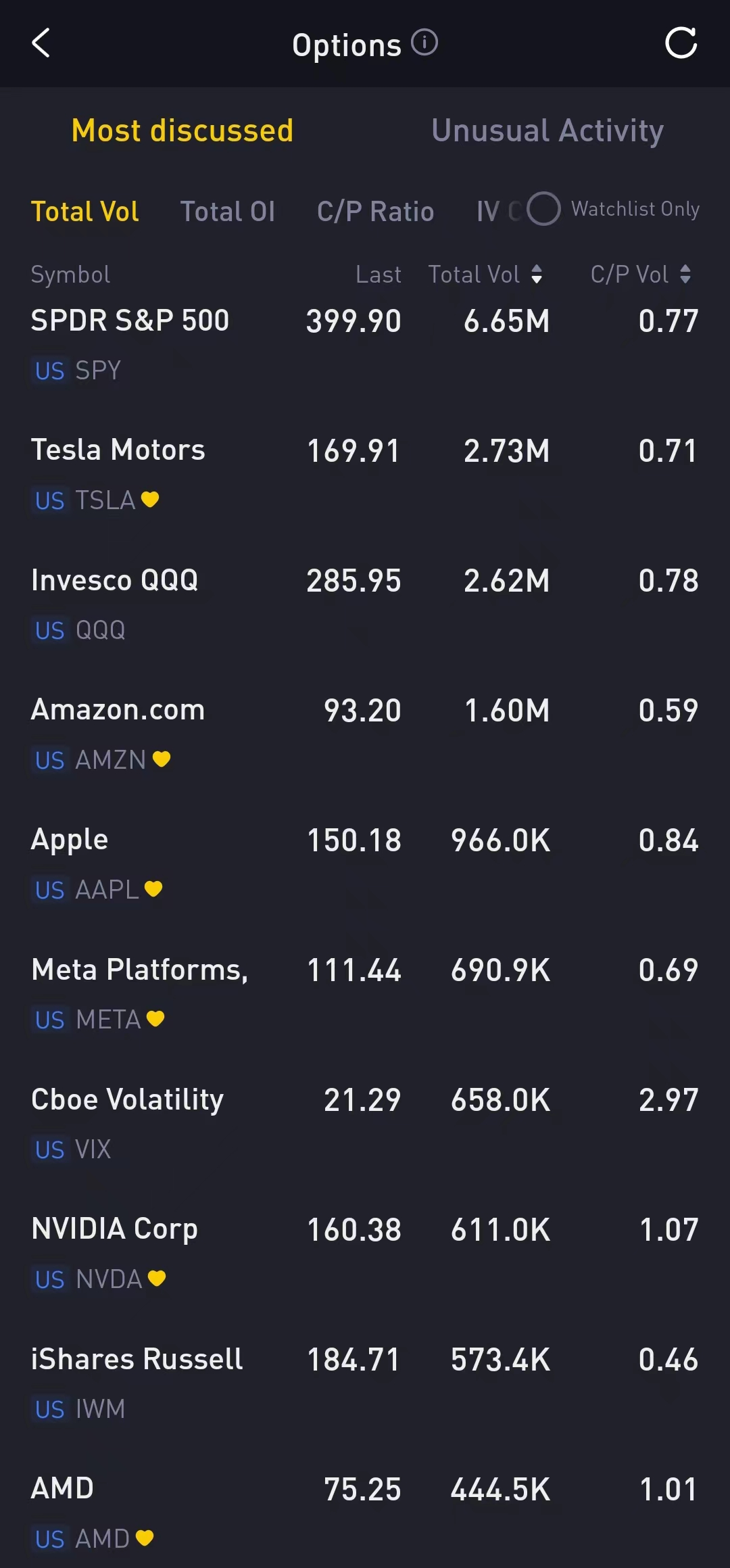

Top 10 Option Volumes

Top 10: SPY, TSLA, QQQ, AMZN, AAPL, META, VIX, NVDA, IWM, AMD

Options related to equity index ETFs are popular with investors, with 6.34 million SPDR S&P500 ETF Trust and 2.06 million Invest QQQ Trust ETF options contracts trading on Monday. 55% of SPY trades bet on bearish options.

There were 658K options related to Cboe Volatility Index traded on Tuesday. The massive news event will come on Wednesday at 2 PM with the release of the November Fed minutes. These minutes will likely reverse the equity market's celebration following a lower-than-expected October CPI report, as the Fed has a different view and is already pushing back hard.

Currently, the VIX is trading towards the lower end of its trading range, around 21.3.

According to Bloomberg's forecast, the VIX should rise sharply heading into the FOMC meeting on December 14. Not on worries over a 50 or 75 bps rate hike but due to concerns over the Fed's Summary of Economic Projections and the committee's dot plot for terminal rate for the end of 2023.

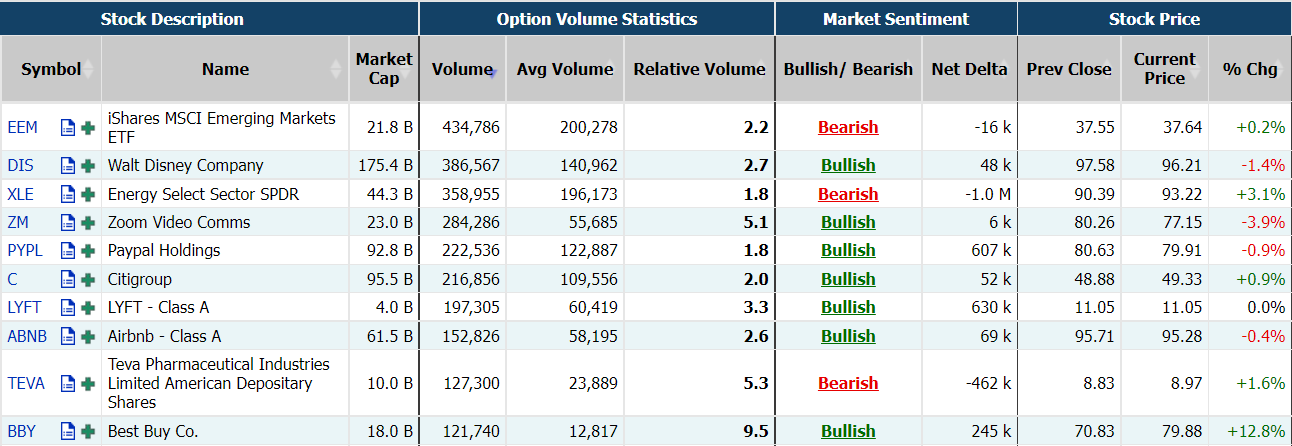

Unusual Options Activity

There were 121,740 Best Buy options trading on Tuesday. Call options account for 50% of overall option trades. Particularly high volume was seen for the $80 strike call option expiring November 25, with 8,941 contracts trading on Tuesday.

Best Buy reported third-quarter adjusted earnings of $1.38 a share, higher than forecasts. The stock jumped 12.8% to $79.88 on Tuesday.

Source: Tiger Trade App

Investors were also encouraged by Best Buy's guidance. Management now expects comp sales to decrease by roughly 10%, compared to a prior projection of an 11% decline. Additionally, the company lifted its adjusted operating margin target to above 4%.

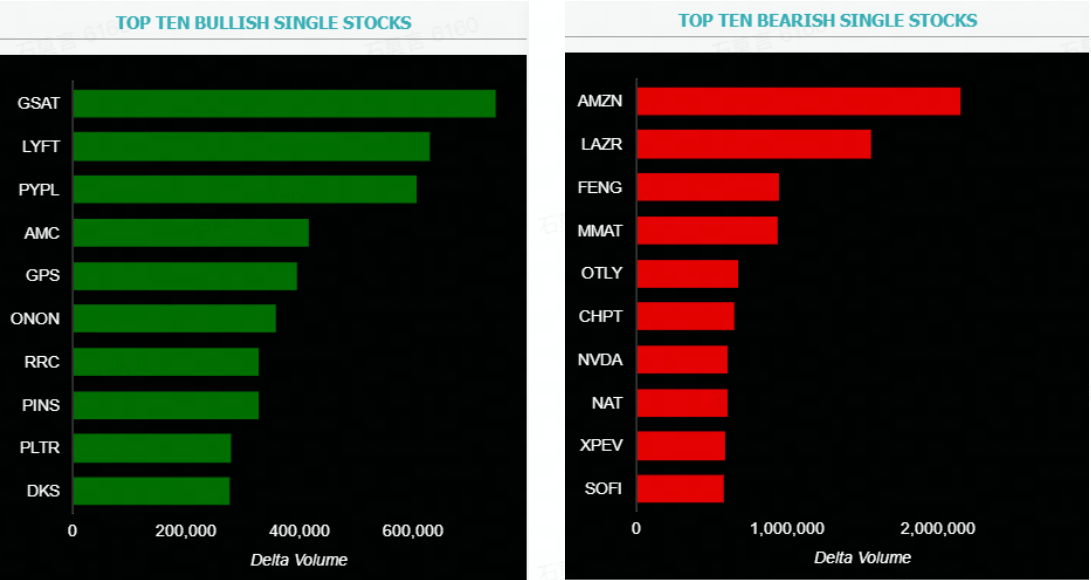

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: GSAT, LYFT, PYPL, AMC, GPS, ONON, RRC, PINS, PLTR, DKS

Top 10 bearish stocks: AMZN, LAZR, FENG, MMAT, OTLY, CHPT, NVDA, NAT, XPEV, SOFI

If you are interested in options and you want to:

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments