U.S. stock index futures extended gains on Monday on better-than-expected results from Bank of America, with investors scanning the latest batch of earnings for impact of decades-high inflation and rising interest rates on corporate profit.

Market Snapshot

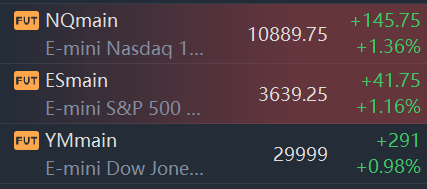

At 7:53 a.m. ET, Dow e-minis were up 291 points, or 0.98%, S&P 500 e-minis were up 41.75 points, or 1.16%, and Nasdaq 100 e-minis were up 145.75 points, or 1.36%.

Pre-Market Movers

Continental Resources(CLR) –Chairman and founder Harold Hamm and his family will acquire the shares of the energy producer that they don’t already own for $74.28 per share. The deal is not contingent on any financing and is expected to close before the end of the year. Continental surged 8.6% in the premarket.

Bank of America(BAC) – Bank of America jumped 3.1% in premarket trading after beating top and bottom line estimates in its third-quarter earnings report. Results were boosted by an increase in net interest income.

Bank of NY Mellon(BK) – The bank’s stock rallied 4.4% in premarket action following better-than-expected third-quarter results. Net interest revenue surged 44% from a year ago during the quarter.

News Corp.(NWSA),Fox Corp.(FOXA) – News Corp. gained 3.5% in the premarket while Fox Corp. slid 4.1%. Rupert Murdoch’s media companies have both formed special committees to consider recombining the two media companies, which separated in 2013.

Apple(AAPL) – Apple added 1.4% in the premarket after Morgan Stanley named it a “top pick” for its ability to withstand an economic downturn.

Meta Platforms(META) – Meta is falling short of its goals for its flagship metaverse product “Horizon Worlds”, according to internal documents seen by the Wall Street Journal. The product has less than 200,000 monthly active users, compared with an initial goal of 500,000 by the end of this year and a revised year-end goal of 280,000. Meta rose 1.6% in the premarket.

Goldman Sachs(GS) – Goldman plans to combine its various businesses into three divisions in a significant reorganization, according to people familiar with the matter who spoke to the Wall Street Journal. One unit will house investment banking and trading, with asset and wealth management in another and transaction banking in a third division. Goldman added 1% in premarket trading.

Splunk(SPLK) – Splunk surged 9.1% in the premarket following a Wall Street Journal report that activist investor Starboard Value has just under a 5% stake in the software company.

Archaea Energy(LFG) – The natural gas producer’s shares soared 51.1% in premarket trading after agreeing to be acquired byBP(BP) for $26 per share. BP rose 2.2%.

Credit Suisse(CS) – Credit Suisse rallied 3.2% in premarket action after the Financial Times reported that the company is prepared to sell parts of its Swiss domestic bank to raise capital.

Market News

Archaea Energy Stock Soars 53% Premarket on News of Takeover By BP in $4.1 Billion All-Cash Deal

Archaea Energy Inc. said Monday it has entered an agreement to be acquired by BP PLC for about $4.1 billion in cash including about $800 million of debt.

The cash consideration of about $26 per Archaea share is equal to a 38% premium over the stock's volume weighted average share price for the 30 days through Oct. 14.

Bank of America Tops Estimates on Better-Than-Expected Bond Trading, Higher Interest Rates

Bank of Americasaid Monday that profit and revenue topped expectations on better-than-expected fixed-income trading and gains in interest income, thanks to choppy markets and rising rates.

Bank of America said third-quarter profit fell 8% to $7.1 billion, or 81 cents a share, as the company booked a $738 million provision for credit losses in the quarter. Revenue net of interest expense jumped to $24.61 billion.

Goldman Shakes Up Leadership Ranks in Yet Another Overhaul

Goldman Sachs Group Inc’s David Solomon is embarking on his third major reorganization in just four years as chief executive officer, undoing some of the signature moves he made as recently as 2020.

The Wall Street giant plans to once again combine its expanded asset management and private wealth businesses into one unit run by Marc Nachmann, according to people familiar with the matter. Goldman will also fuse its investment-banking and trading operations under one group run by Dan Dees, Jim Esposito and Ashok Varadhan. The money-losing consumer unit will be broken up.

Berkshire’s Market Value Nears Tesla’s After Topping Meta, Nvidia This Year

With the sharp drop in shares of Tesla this year, the market value of Berkshire Hathaway (ticker BRK/A, BRK/B) is approaching that of the leader in electric vehicles.

Berkshire, led by longtime CEO Warren Buffett, is demonstrating its defensive attributes in a bear market with its class A share down about 8% this year to $415,000—against a nearly 25% decline in the S&P 500 index.

Comments