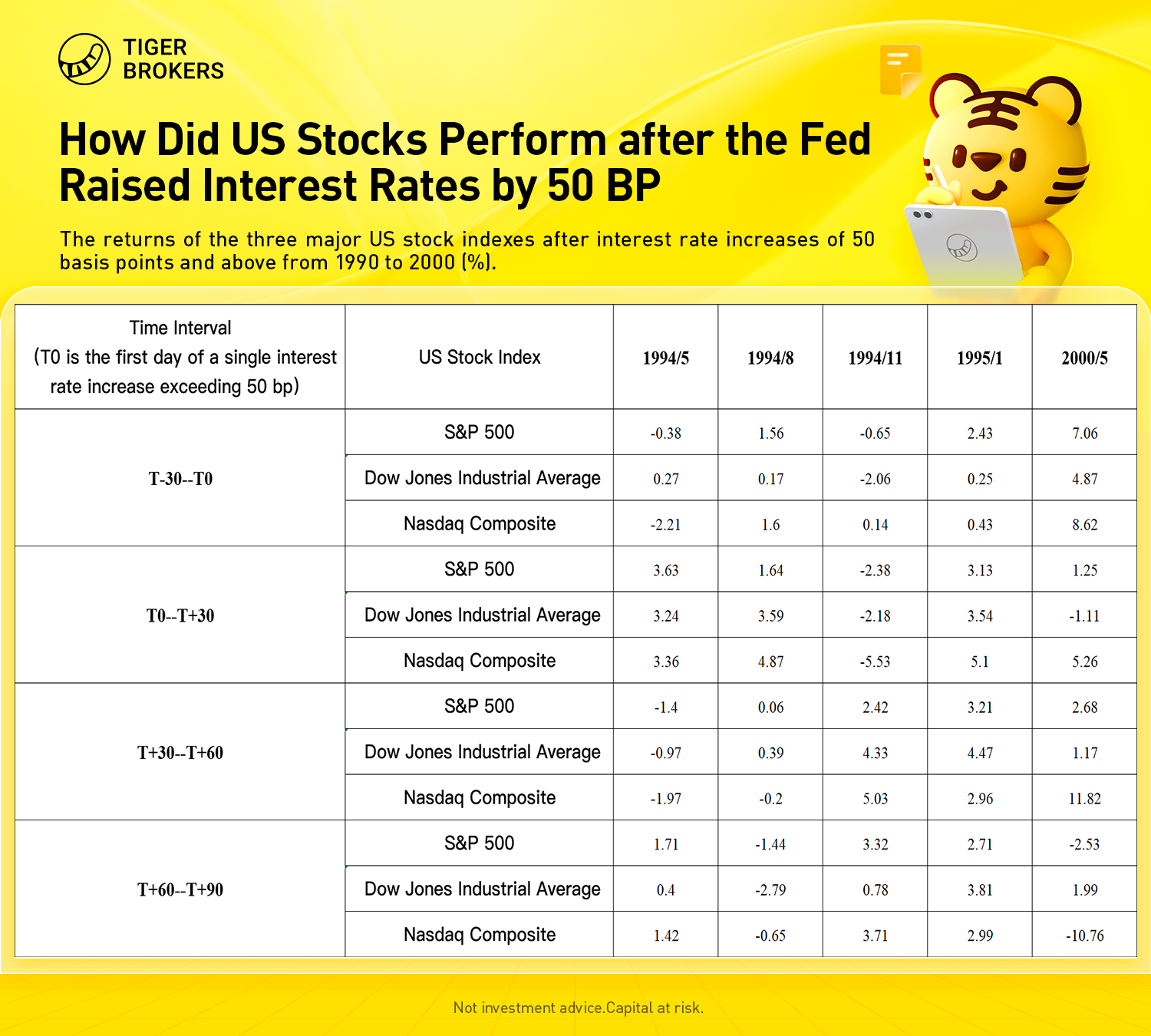

The Fed raised interest rates by 50 basis points for the first time in more than 20 years. We combed the return performance of the three major US stock indexes after interest rate increases of 50 basis points and above from 1990 to 2000. For the market, the range of interest rate increase may not be the key. The key lies in risk accumulation and whether the economy can "soft landing". From the historical experience, on the premise of healthy financial market, if the Fed raises interest rate by 50bp or more, it will not necessarily cause heavy damage to the financial market. On the contrary, when the market expects full price in, the asset price may rise after the implementation of interest rate hike boots.

Comments