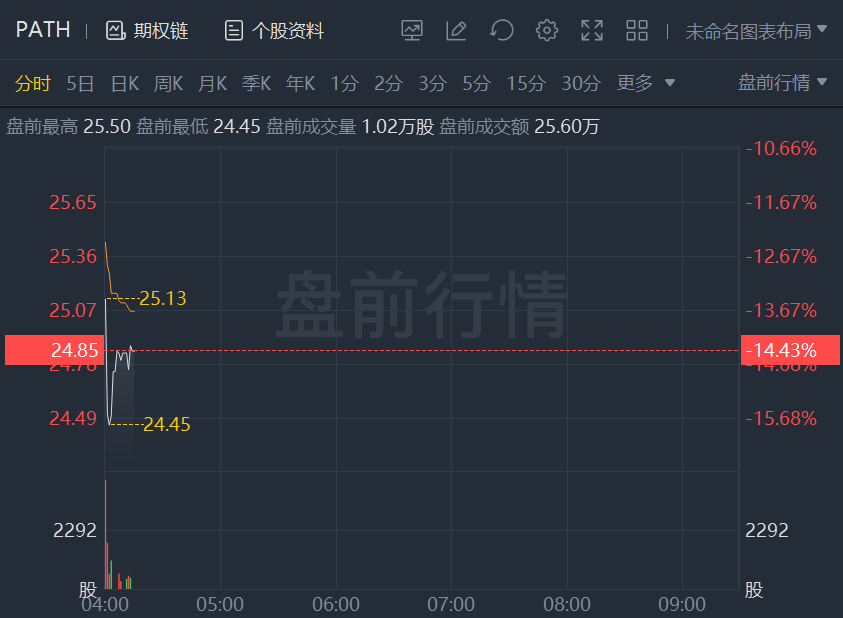

UiPath stock tumbled 14% in premarket trading after the "software robot" provider's weaker-than-expected outlook overshadowed a beat of Wall Street's quarterly results estimates.

The company forecast revenue of $223 million to $225 million and an annualized renewal run rate of $960 million to $965 million for the first quarter, while analysts surveyed by FactSet expect revenue of $247 million and ARR of $968.2 million. ARR is a metric often used by software-as-a-service companies to show how much revenue the company can expect based on subscriptions.

For the year, UiPath expects revenue of $1.08 billion to $1.09 billion and ARR of $1.2 billion to $1.21 billion, while analysts forecast revenue of $1.26 billion and ARR of $968.2 million.

Additionally, UiPath said that Chief Revenue Officer Thomas Hansen was leaving the company but would stay on until the end of the first quarter. The company also appointed Chris Weber, a former Microsoft Corp. executive, to the position of Chief Business Officer.

The company reported a fourth-quarter loss of $63.1 million, or 12 cents a share, versus net income of $26.3 million in the year-ago period. Adjusted earnings, which exclude stock-based compensation expenses and other items, were 5 cents a share, compared with 9 cents a share in the year-ago period.

Revenue rose to $289.7 million from $207.9 million in the year-ago quarter. The company's ARR rose 59% to $925.3 million from a year ago.

Analysts had estimated earnings of 3 cents a share on revenue of $283 million and an ARR of $902.5 million, based on UiPath's forecast revenue of $281 million to $283 million and ARR of $901 million to $903 million for the fourth quarter.

Comments