News out of the retail sector could be the latest data to drive markets higher in the week ahead.

After a series of better-than-expected economic prints helped stoke renewed optimism on Wall Street, investors will get key earnings reports from retailers and the July retail sales report from the Commerce Department this week.

Walmart , Target, and the Home Depot are all set to release quarterly results, and July's retail sales report is set for release Wednesday morning.

Also on Wednesday, investors will comb through the minutes from the Federal Reserve’s policy-setting meeting last month.

On Friday, U.S. stocks capped their longest winning weekly streak since November 2021. The S&P 500 closed higher for a fourth straight week, officially retracing 50% of losses since plunging from its all-time January high.

The Nasdaq gained 3.8% from Monday to Friday to close above 13,000 for the first time since April 25, and the Dow Jones Industrial Average advanced 2.9% for the week.

Nearly 90% of stocks in the S&P 500 are now above their 50-day moving average, Carson Group’s Ryan Detrick pointed out in an interview with Yahoo Finance Live.

“It’s extremely rare to go right back down to make new lows when you have that much breadth,” Detrick said. “The messaging of the market has been very strong, and to see that much breadth is a really good thing, probably for a continuation of this summer rally.”

The Commerce Department is set to release its monthly retail sales report for July on Wednesday, with economists expecting headline sales rose 0.1%, a modest increase after climbing 1.0% in June. Sales excluding auto and gas likely rose 0.3%, according to Bloomberg estimates.

Bank of America projects core control sales, which net out autos, gas, building materials and restaurants, climbed by a “hefty” 0.9%.

“Combined with softer-than-expected inflation, this should imply solid gains in real consumer spending in July,” BofA economists said in a note. “If our forecast for July retail sales proves accurate, it would suggest that household spending is off to a fast start in Q3 and pose upside risk to our forecast for another modest decline in real GDP in the quarter.”

On the earnings front,retail heavyweights are set to report second-quarter results, beginning with Walmart on Tuesday. The megastore’s latest financials will come just weeks after the company slashed its forecast and announced plans for corporate layoffs and restructuring. Target, Home Depot, and a bevy of other retailers will follow suit later in the week.

Target also ignited worries about the retail sector in June with aafter announcing plansto liquidate massive amounts of slow-moving inventory and take a more cautious view on near-term profits,preparing Wall Street for a worrisome earnings season for retailers.

Investors expect results may reflect continued pressure from inflation, rising interest rates, and supply chain disruptions. Warnings from Walmart and Target last quarter about a pullback in consumer spending sent shares tumbling and rattled the retail sector and markets at large.

"There is this pivot happening from discretionary and general merchandise into necessities," Jefferies AnalystStephanie Wissink told Yahoo Finance Livelast month. "The household is having to make discriminate decisions every single week about funding that inflation."

Walmart CEO Doug McMillon said in late Julyincreasing levels of food and fuel inflation were pressuring consumer spending and apparel required more markdown dollars, but the company was “encouraged” by the start on spending for school supplies in its U.S. stores.

Back-to-school spending will be a closely watched metric as retails report, with internal data from Bank of America suggesting consumers started back-to-school shopping earlier this year, which could help boost retail earnings.

“Despite weakening demand for goods and worries around the resilience of consumer spending, back-to-school season kicked off on a strong footing,” economists at Bank of America said in a report last week. “An earlier back-to-school season could be positive for consumer spending in July though it put downward pressure to spending in August as spending may have been pulled forward.”

Elsewhere in the week ahead, minutes from the Fed’s July meeting out Wednesday may give investors a better picture of where policymakers see interest rates this fall and whether the U.S. central bank reached peak hawkishness when it hiked rates by 75 basis points for a second consecutive time last month.

Key data on the housing market is also due out Tuesday and Thursday, with the release of housing starts and existing home sales data.

Economic Calendar

Monday: Empire Manufacturing, August (5.0 expected, 11.1 during prior month), NAHB Housing Market Index, August (55 expected, 55 during prior month), Net Long-Term TIC Outflows, June ($155.3 billion during prior month), Total Net TIC Outflows, June (182.5 billion during prior month)

Tuesday: Building permits, July (1.645 million expected, 1.685 million during prior month, upwardly revised to 1.696 million), Building permits, month-over-month, July (-3.0% expected, 0.6% during prior month, downwardly revised to 0.1%), Housing Starts, July (1.532 million expected, 1.559 during prior month), Housing Starts, month-over-month, July (-1.7% expected, -2.0% during prior month), Industrial Production, month-over-month, July (0.3% expected, -0.2% during prior month), Capacity Utilization, July (80.2% expected, 80% during prior month), Manufacturing (SIC) Production, July (0.2% expected, -0.5% during prior month)

Wednesday: MBA Mortgage Applications, week ended August 12 (0.2% during prior week), Retail Sales Advance, month-over-month, July (0.1% expected, 1.0% during prior month), Retail Sales excluding autos, month-over-month, July (-0.1% expected, 1.0% during prior month), Retail Sales excluding autos and gas, month-over-month, July (0.3% expected, 0.7% during prior month), Retail Sales Control Group, July (0.6% expected, 0.8% during prior month), Business Inventories, June (1.4% expected, 1.4% during prior month), FOMC Meeting Minutes

Thursday: Initial jobless claims, week ended August 13 (265,000 expected, 262,000 during prior week), Continuing claims, week ended August 6 (1.428 during prior week), Philadelphia Fed Business Outlook Index, August (-4.5 expected, -12.3 during prior month), Existing Home Sales, July (4.85 million expected, 5.12 million during prior month), Existing Home Sales, month-over-month, July (-5.3% expected, -5.4% during prior month), Leading Index, July (-0.5% expected, -0.8% in during prior month)

Friday: No notable reports scheduled for release.

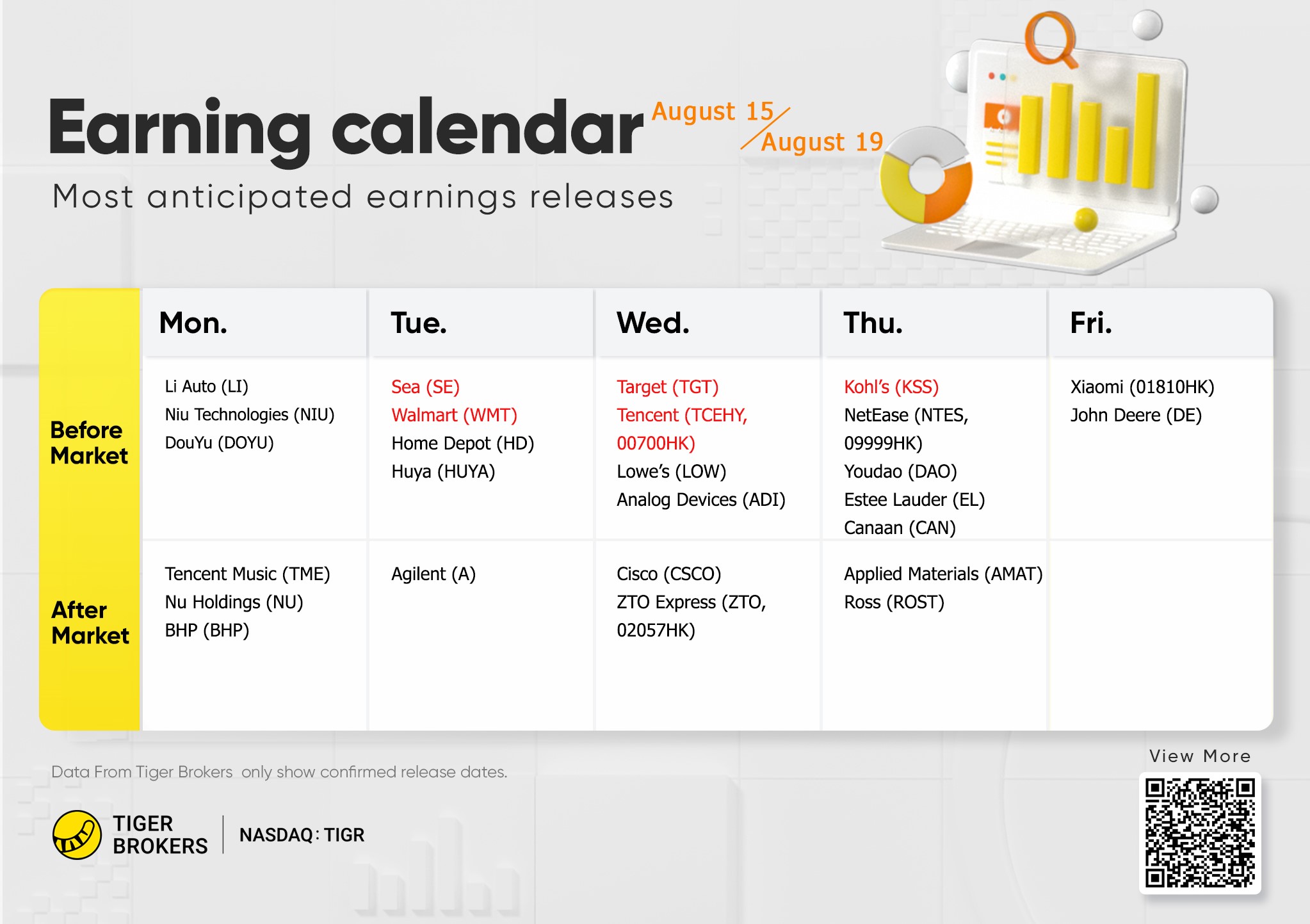

Earnings Calendar

Monday: Blend Labs (BLND), Compass (COMP), Fabrinet (FN), Tencent Music (TME), Weber (WEBR), World Wrestling (WWE), ZipRecruiter (ZIP)

Tuesday: Walmart (WMT), Home Depot (HD), Lumentum (LITE), Sea Limited (SE)

Wednesday: Lowe’s (LOW), Amcor (AMCR), Analog Devices (ADI), Bath & Body Works (BBWI), Cisco Systems (CSCO), Krispy Kreme (DNUT), Performance Food Group (PFGC), Synopsys (SNPS), Target (TGT), The Children's Place (PLCE), TJX Companies (TJX), Wolfspeed (WOLF)

Thursday: BJ's Wholesale Club Holdings (BJ), Applied Materials (AMAT), Bilibili (BILI), Estee Lauder (EL), Kohl's (KSS), Melco Resorts & Entertainment (MLCO), Nio (NIO), Ross Stores (ROST), Tapestry (TPR)

Friday: Buckle (BKE), Deere (DE), Foot Locker (FL)

Comments