Baidu, Inc. today announced its unaudited financial results for the first quarter ended March 31, 2021.

“We are delighted to bring innovation across many sectors, including marketing cloud, enterprise cloud, smart transportation, autonomous driving, smart assistant and AI chip, through our decadelong investment in AI,” said Robin Li, co-founder and CEO of Baidu. “With AI powering the next stage of technology growth, many Baidu alumni have rejoined us, and our employees are energized from working on intelligent computing that can improve daily life and make the complex world simpler.”

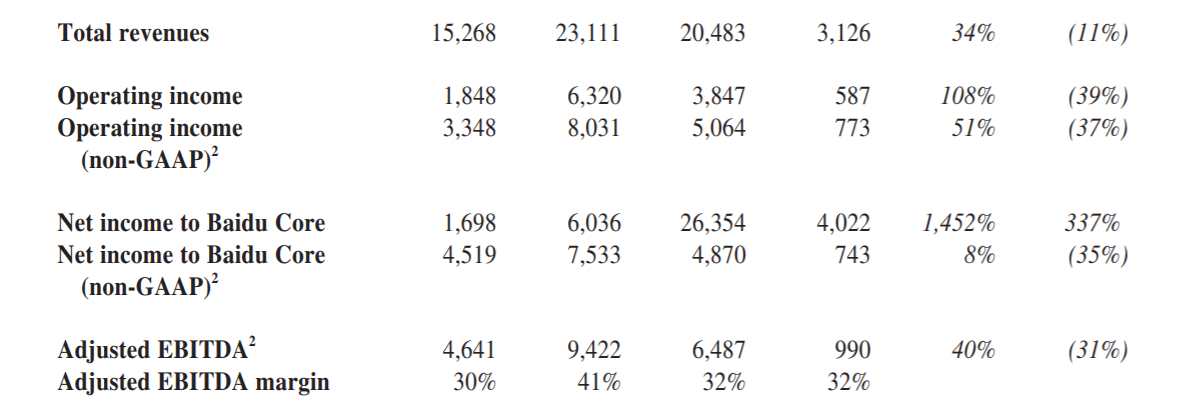

“Baidu Core delivered a strong first quarter with revenue growing 34% year over year, powered by non-advertising revenue growing 70% year over year,” said Herman Yu, CFO of Baidu. “We will continue to invest heavily in sales, R&D and operations to support the rapid growth of our AIpowered business.”

Baidu stock surged 3.6% in aftermarket trading.

Other Highlights

Corporate

- Baidu ranks Top 3 in cloud services and No.1 in the utilization of renewable energy for data centers, according to Greenpeace, a global environmental organization, based on itsApril 2021reportClean Cloud: Tracking Renewable Energy Use inChina'sTech Industry.

- Baidu released its annual ESG Report inFebruary 2021, which details Baidu's ESG policies and sustainability initiatives (http://esg.baidu.com/en/esg_download.html).

- OnMarch 23, 2021, Baidu listed on the HKEX (9888) through a global offering of 95,000,000 Class A ordinary shares, receiving$3.1 billionin net proceeds.

- Baidu returnedUS$300 millionto shareholders under the 2020 Share Repurchase Program this year, bringing the cumulative repurchase to$2.2 billionsince 2020.

AI Cloud

- Baidu EasyDL, a simple to use machine learning service, was rated No.1 in terms of usage inChina, per IDC inDecember 2020, topping the list for the second time.

- Baidu deep learning framework PaddlePaddle, upgraded to v2.0 inMarch 2021, was ranked among the Top 3 globally in terms of usage based on pull request, according to Github.

- A leading retail bank inChinaimplemented Baidu's AI PaaS, which has led to five follow-on purchases, including application to automate customer service and consumer loan approval, and the recent purchase of private cloud services.

- Baidu partnered with the online arm ofChina'slargest TV network CCTV to implement Baidu AI PaaS with capabilities to automate video clip creation and tagging from live broadcasting and use smart assistant to quickly locate desired video content. During an important annual event, Baidu enabledCCTV.comto simultaneously interview congressional meeting participants with AI reporters, powered by Baidu Brain, and timely share these interviews on the Internet.

- Chongqing, which implemented Apollo V2X last year, marking Baidu's entry into westernChina, signed with Apollo to make its smart transportation infrastructure 5G enabled, to support robotaxi ride hailing operation.

- Chengdu(Sichuan), a leader in science and technology development, signed with Apollo to implement V2X vehicle-to-road infrastructure.

Intelligent Driving

- Apollo has accumulated 6.2 million miles of L4 autonomous driving testing on the road and 600 million miles of simulated testing since its founding in 2013.

- Apollo received permit to test autonomous driving at night and under special weather conditions on public roads inBeijing. Apollo also received permits to pilot fully autonomous driving inBeijing, Cangzhou (Hebei), andChangsha(Hunan).

- Apollo Go,China'sfirst fully autonomous ride-hailing, is now available at theShougang Park, a Beijing 2022 Winter Olympics site.

- Apollo Gobegins to charge for robotaxi ride hailing in Cangzhou, based on the distance traveled starting with a minimum fare, similarly to regular ride hailing.

- The total addressable market for robotaxi ride hailing will reachUS$224 billioninChinaby 2025, according to China Insights Consultancy, a market research and consulting company.

- Jidu Auto, an intelligent EV company established in partnership withZhejiang Geely Holding Group, appointedYiping Xiaas its CEO.Mr. Xiapreviously served as CTO at Mobike and held positions atFiat Chryslerand Ford.

- Guangzhou Automobile Group joins Apollo's network of over 10 leading automakers to install Apollo Self Driving (ASD) services in its new vehicles.

- Guidehouse Insights (previouslyNavigant Research) has rated Baidu in the "leader" category for the second consecutive year, the only Chinese company honored among the four AI companies selected globally for this category. Apollo's open platform, to empower Jidu and other automakers as well asApollo Gorobotaxi, puts Apollo in a unique position to be well funded and widely adopted.

- DuerOS for Auto, powering infotainment, has been installed in over 1.5 million new vehicles, recorded Q1 2021 installation more than doubled from the prior year.

Other Growth Initiatives

- DuerOS monthly voice queries reached 6.6 billion with first-party voice queries reaching 3.9 billion inMarch 2021.

- Xiaodu ranked No.1 in smart display shipments globally and No.1 in smart speaker shipments inChinafor 2020, according to IDC, Strategy Analytics and Canalys.

- Xiaodu S12 smart pad for the education market was introduced in March with an MSRP of 1,699.

- Baidu Kunlun completed its first round of funding at a post-money valuation of$2 billioninApril 2021. Kunlun chips are designed to optimize AI workload and improve cloud cost structure.

Mobile Ecosystem

- Baidu has strengthened its strong Internet foundation with Baidu App monthly active users (MAUs) reaching 558 million and daily logged in users reaching over 75% inMarch 2021.

- Baidu's AI building blocks are helping creators, service providers and merchants better engage with users and perform user life-time management:

- BJH publisher accounts grew 40% year over year to reached 4.2 million.

- Smart Mini Program MAUs reached 416 million, and the number of SMPs grew 74% from a year ago; and

- Revenue from Managed Page accounted for 35% of Baidu Core's online marketing revenue, up from 21% a year ago.

iQIYI

iQIYI subscribers reached 105.3 million as ofMarch 31, 2021, serving as a strong foundation to support its over 50 in-house studios and produce entertainment blockbuster originals. iQIYI's net loss narrowed toRMB1.3 billionin Q1 21, compared toRMB 2.9 billionfrom a year ago.

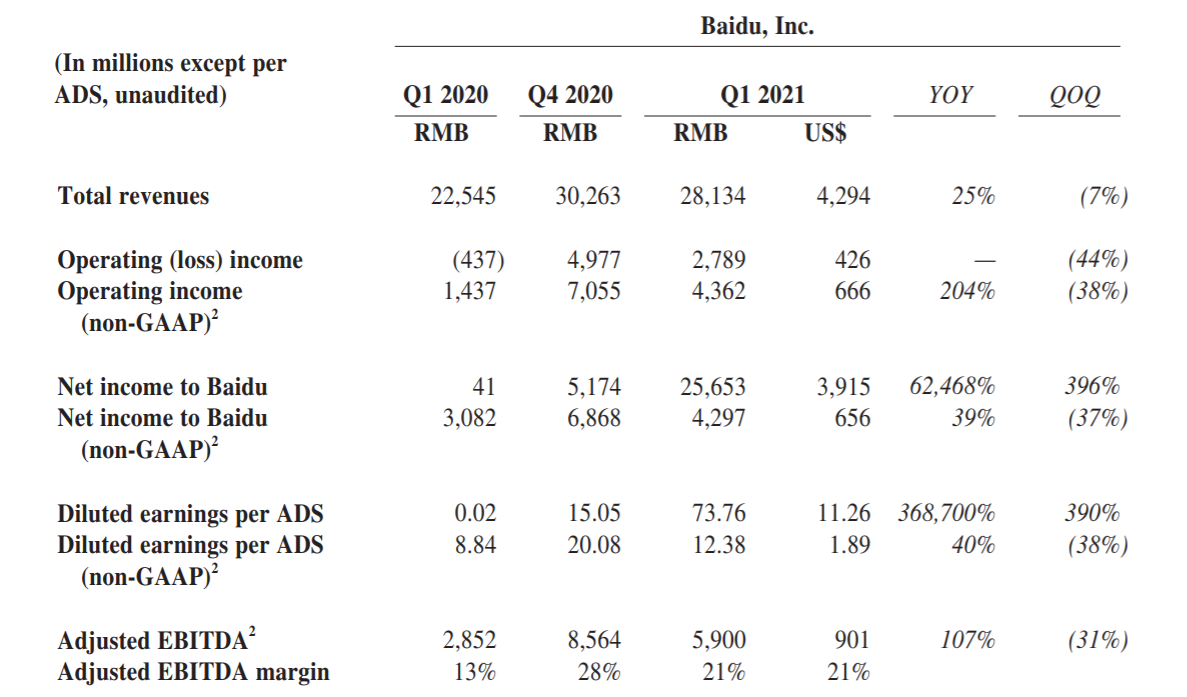

First Quarter 2021 Results

Total revenueswereRMB 28.1 billion($4.29 billion), increasing 25% year over year.

- Revenue from Baidu Core was RMB 20.5 billion($3.13 billion), increasing 34% year over year.Online marketing revenue was RMB 16.3 billion($2.48 billion), up 27% year over year.Non-marketing revenue was RMB 4.2 billion($646 million), up 70% year over year, driven by cloud and other services.

- Revenue from iQIYI was RMB 8.0 billion($1.22 billion), increasing 4% year over year.

Cost of revenues was RMB 15.0 billion($2.29 billion), increasing 2% year over year, primarily due to an increase in traffic acquisition costs and cost of goods sold, offset by a decrease in content costs and the amortization/impairment of intangible assets.

Selling, general and administrative expenses were RMB 5.2 billion($800 million), increasing 36% year over year, primarily due to an increase in channel spending and promotional expenses.

Research and development expensewasRMB 5.1 billion($778 million), increasing 15% year over year, primarily related to personnel-related expenses.

Operating income was RMB 2.8 billion($426 million).Baidu Core operating income was RMB 3.8 billion($587 million), and Baidu Core operating margin was 19%.Non-GAAP operating income was RMB 4.4 billion($666 million).Non-GAAP Baidu Core operating income was RMB 5.1 billion($773 million), and non-GAAP Baidu Core operating margin was 25%.

Total other income, net was RMB 23.8 billion($3.63 billion), which included a fair value gain ofRMB 23.7 billionfrom long-term investments, mainly including a gain from the investment in Kuaishou Technology.

Income tax expense was RMB 1.5 billion($234 million), compared toRMB 198 millionlast year, primarily due to the increase in profit.

Net income attributable to Baidu was RMB 25.7 billion($3.92 billion), and diluted earnings per ADS wasRMB 73.76($11.26).Net income attributable to Baidu Core was RMB 26.4 billion($4.02 billion).Non-GAAP net income attributable to Baidu was RMB 4.3 billion($656 million), and non-GAAP diluted earnings per ADS wasRMB 12.38($1.89).Non-GAAP net income attributable to Baidu Core was RMB 4.9 billion($743 million).

Adjusted EBITDA was RMB 5.9 billion ($901 million).Adjusted EBITDA for Baidu CorewasRMB 6.5 billion($990 million) and adjusted EBITDA margin for Baidu Core was 32%.

As ofMarch 31, 2021,cash, cash equivalents, restricted cash and short-term investments were RMB 172.9 billion($26.40 billion), and cash, cash equivalents, restricted cash and short-term investments excluding iQIYI were RMB 159.6 billion($24.37 billion).Free cash flow was RMB 2.6 billion($400 million), and free cash flow excluding iQIYI was RMB 4.0 billion($615 million).

Comments