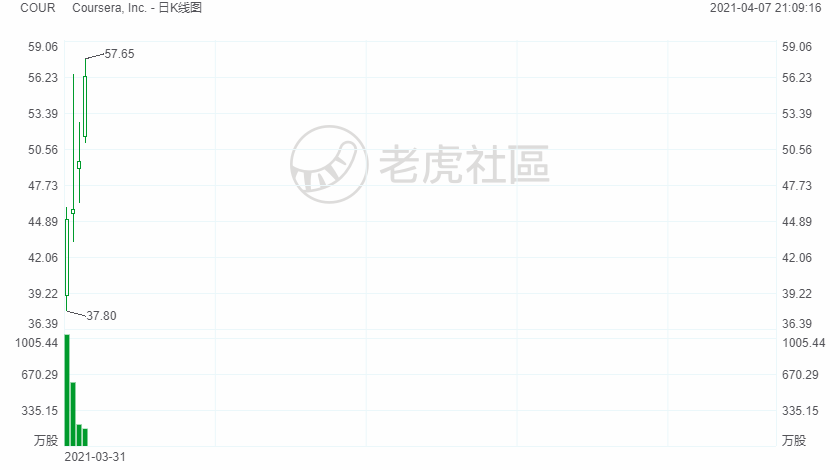

Online education platform Coursera has risen more than 70% since it went public.The shares rose another 1.9% in Wednesday premarket action.

The company priced its deal – for 15.7 million shares – at $33, which was at the high end of the $30 to $33 range. The stock jumped by 36%, bringing the market capitalization to $5.9 billion. Additionally, the lead underwriters on the IPO includedMorgan Stanley, Goldman Sachs, Citi and UBS Investment Bank.

The founders of Coursera are former Stanford professors Andrew Ng and Daphne Koller. In 2011, they posted some videos of their courses online, and the reception was strong, as more than 100,000 learners viewed them within a few weeks.

This would becomeoneof the pioneering examples of MOOCs (Massive Open Online Courses), but at the time, it was not clear if there was a viable business model. Would this be a good alternative to traditional instruction? What would the business model be?

Well, Ng and Koller kept at it – and Coursera continued to grow at a rapid pace. The cofounders also brought on savvy business managers to help scale the operations. In June 2017, they recruited Jeff Maggioncalda to take on the CEO spot. Before this, he was the CEO atFinancial Engines, which he took public.

Background On Coursera

The online educational model has a variety of advantages. For example, a student can get access to some of the world’s top instructors and there is also a diverse set of course offerings.

But Coursera has gone above and beyond, with the company focusing on providing curriculum to help its learners get high-paid jobs. To this end, it has forged partnerships with companies like Amazon (AMZN), C3ai (AI),IBM(IBM) and Alphabet (GOOGL).

It should also be noted that Coursera offers affordable courses, with the pricing starting at $39 per month. In addition, there are certificate programs that range from $2,000 to $6,000 as well as bachelor’s or master’s Degrees, which cost between $9,000 to $45,000.

In terms of the growth, Coursera has been experiencing an acceleration. Last year, revenues jumped by 59%, boosted by the COVID-19 pandemic. Educational institutions had little choice but to provide their courses online – and Coursera was a big help for this.

Now it’s true that net losses did increase from $46.7 million to $66.8 million, but this was mainly to build up the infrastructure to handle the influx of new learners, which came in at over 30 million last year.

As for the market opportunity, it is definitely large. According to analysis from HolonIQ, the global spending on online degrees was $36 billion in 2019, and is expected to hit $74 billion by 2025.

Comments