- Quarterly total revenues reached RMB8.73 billion (US$1.30 billion)

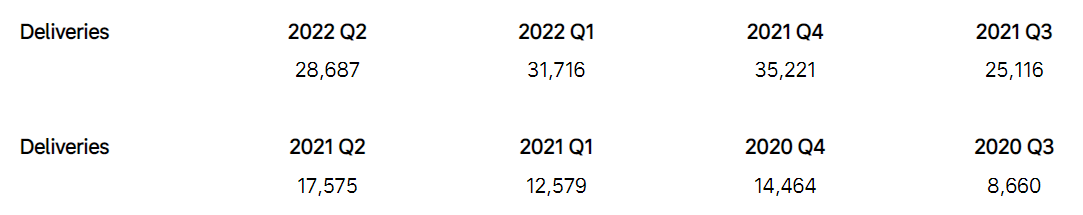

- Quarterly deliveries reached 28,687 vehicles

- Quarterly gross margin reached 21.5%

Li Auto Inc. (Nasdaq: LI; HKEX: 2015) today announced its unaudited financial results for the quarter ended June 30, 2022.

Operating Highlights for the Second Quarter of 2022

- Deliveries of Li ONE were 28,687 vehicles in the second quarter of 2022, representing a 63.2% year-over-year increase.

- As of June 30, 2022, the Company had 247 retail stores covering 113 cities, as well as 308 servicing centers and Li Auto-authorized body and paint shops operating in 226 cities.

Financial Highlights for the Second Quarter of 2022

- Vehicle sales were RMB8.48 billion (US$1.27 billion) in the second quarter of 2022, representing an increase of 73.0% from RMB4.90 billion in the second quarter of 2021 and a decrease of 8.9% from RMB9.31 billion in the first quarter of 2022.

- Vehicle margin was 21.2% in the second quarter of 2022, compared with 18.7% in the second quarter of 2021 and 22.4% in the first quarter of 2022.

- Total revenues were RMB8.73 billion (US$1.30 billion) in the second quarter of 2022, representing an increase of 73.3% from RMB5.04 billion in the second quarter of 2021 and a decrease of 8.7% from RMB9.56 billion in the first quarter of 2022.

- Gross profit was RMB1.88 billion (US$280.4 million) in the second quarter of 2022, representing an increase of 97.1% from RMB952.8 million in the second quarter of 2021 and a decrease of 13.2% from RMB2.16 billion in the first quarter of 2022.

- Gross margin was 21.5% in the second quarter of 2022, compared with 18.9% in the second quarter of 2021 and 22.6% in the first quarter of 2022.

- Loss from operations was RMB978.5 million (US$146.1 million) in the second quarter of 2022, representing an increase of 82.6% from RMB535.9 million in the second quarter of 2021 and an increase of 136.9% from RMB413.1 million in the first quarter of 2022. Non-GAAP loss from operations was RMB520.8 million (US$77.8 million) in the second quarter of 2022, representing an increase of 42.5% from RMB365.5 million in the second quarter of 2021, and compared with RMB74.9 million non-GAAP income from operations3in the first quarter of 2022.

- Net losswas RMB641.0 million (US$95.7 million) in the second quarter of 2022, representing an increase of 172.2% from RMB235.5 million in the second quarter of 2021, and compared with RMB10.9 million net loss in the first quarter of 2022. Non-GAAP net loss was RMB183.4 million (US$27.4 million) in the second quarter of 2022, representing an increase of 181.7% from RMB65.1 million in the second quarter of 2021, and compared with RMB477.1 million non-GAAP net income3in the first quarter of 2022.

- Operating cash flow was RMB1.13 billion (US$168.6 million) in the second quarter of 2022, representing a decrease of 19.8% from RMB1.41 billion in the second quarter of 2021 and a decrease of 38.4% from RMB1.83 billion in the first quarter of 2022.

- Free cash flow was RMB451.7 million (US$67.4 million) in the second quarter of 2022, representing a decrease of 54.0% from RMB982.1 million in the second quarter of 2021 and a decrease of 10.0% from RMB502.0 million in the first quarter of 2022.

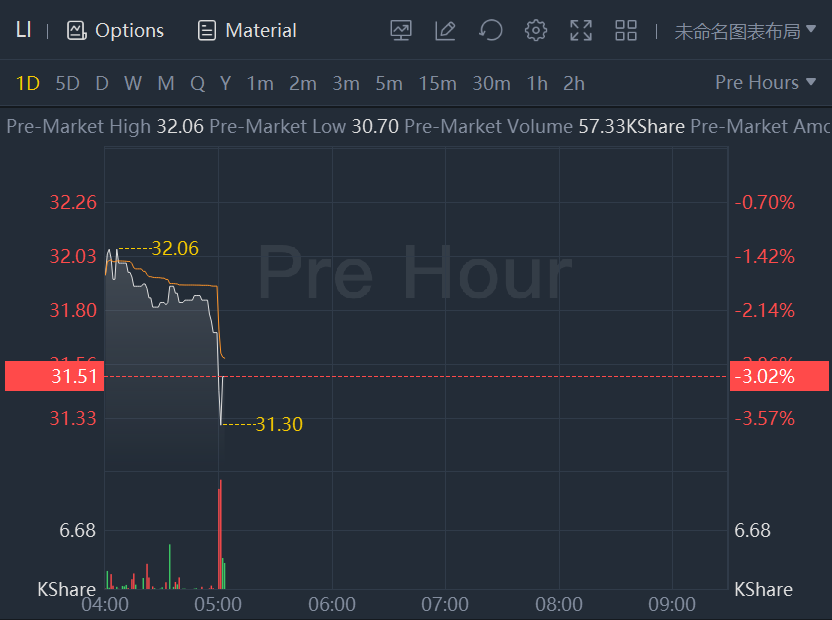

Li Auto shares dropped more than 3% after reporting quarterly results.

Recent Developments

Delivery Update

- In July 2022, the Company delivered 10,422 Li ONEs, representing a 21.3% increase from July 2021. As of July 31, 2022, the Company had 259 retail stores covering 118 cities, in addition to 311 servicing centers and Li Auto-authorized body and paint shops operating in 226 cities.

Li L9

- On June 21, 2022, the Company officially unveiled Li L9, the flagship smart SUV for families. Li L9 is a six-seat, full-size flagship SUV, offering superior space and comfort for family users. Its self-developed flagship range extension and chassis systems provide excellent drivability with a CLTC range of 1,315 kilometers and a WLTC range of 1,100 kilometers. With a 44.5 kilowatt-hour new-generation NCM lithium battery, it can support a CLTC range of 215 kilometers and a WLTC range of 180 kilometers under the EV mode. Li L9 also features top-notch vehicle safety measures and the Company’s self-developed autonomous driving system, Li AD Max, powered by dual Orin-X chips with 508 TOPS of computing power to protect every family passenger. Li L9’s innovative five-screen, three-dimensional interactive intelligent cockpit brings a new level of driving and entertainment experience. Li L9 comes standard with over 100 flagship features at a retail price of RMB459,800.

At-The-Market Offering

- On June 28, 2022, the Company announced an at-the-market offering program (the “ATM Offering”) to sell up to US$2,000,000,000 of American depositary shares (“ADSs”), each representing two Class A ordinary shares of the Company.

- As of the date of this press release, the Company has sold 9,431,282 ADSs representing 18,862,564 Class A ordinary shares of the Company under the ATM Offering raising gross proceeds of US$366.5 million before deducting fees and commissions payable to the distribution agents of up to US$4.8 million and certain other offering expenses.

Business Outlook

For the third quarter of 2022, the Company expects:

- Deliveries of vehiclesto be between 27,000 and 29,000 vehicles, representing an increase of 7.5% to 15.5% from the third quarter of 2021.

- Total revenuesto be between RMB8.96 billion (US$1.34 billion) and RMB9.56 billion (US$1.43 billion), representing an increase of 15.3% to 22.9% from the third quarter of 2021.

Comments