US CPI could be the deciding factor for the Fed in its upcoming interest rate announcement on Wednesday.

Federal Reserve officials seeking to put their tightening campaign on pause this week may be set to receive support from consumer price index data due Tuesday.

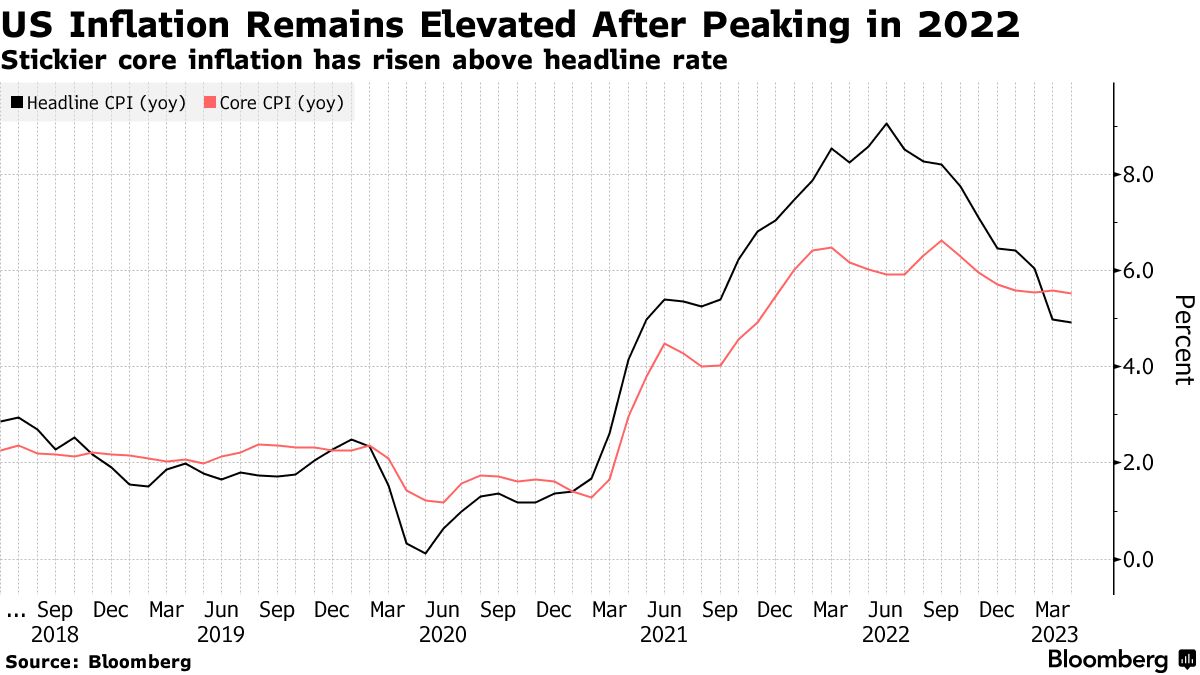

US CPI is more crucial than ever and may be the deciding factor for the Fed’s decision making. Leading up to this week, several US economic data has been on the decline heightening recessionary fears; however, tight labor market conditions remain alongside inflation levels that are far off the target rate. Estimates point to a rapid decline in headline inflation alongside a marginal drop in core inflation and has been the case of recent. Another release following this trend shouldn’t significantly disrupt Fed forecasts.

How does the CPI affect the stock market?

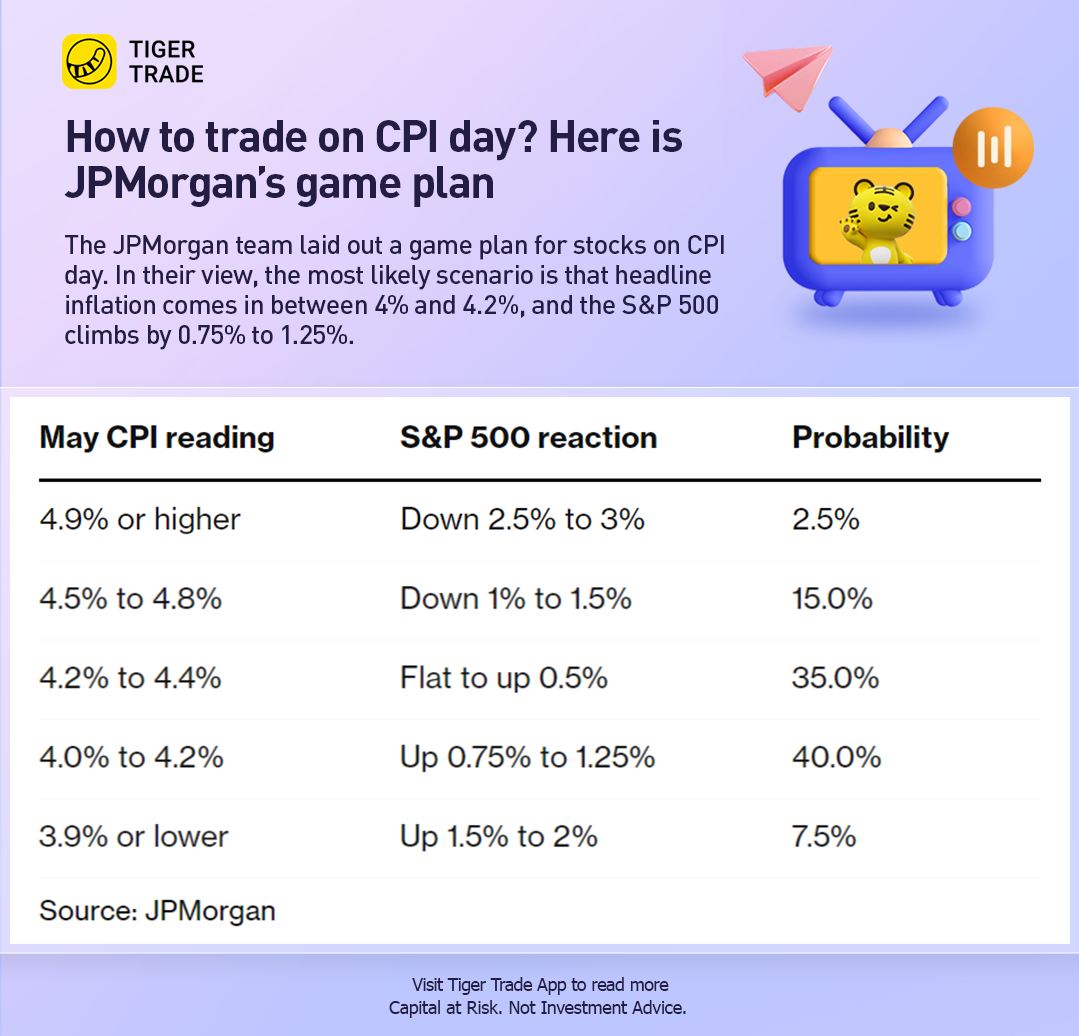

The JPMorgan team on Monday laid out a game plan for stocks on CPI day. In their view, the most likely scenario is that headline inflation comes in between 4% and 4.2%, and the S&P 500 climbs by 0.75% to 1.25%.

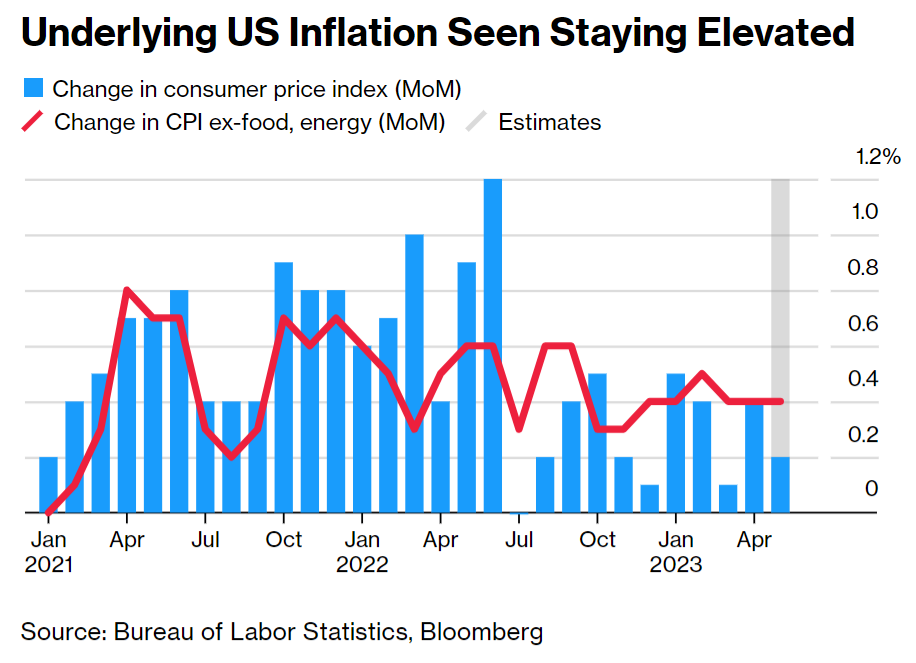

According to Bloomberg consensus estimates, May's Consumer Price Index (CPI) is expected to reveal headline inflation rose 0.2% over last month and 4.1% over the prior year, a slowdown from April's 0.4% month-over-month increase and 4.9% annual gain.

On a "core" basis, which strips out the more volatile costs of food and gas, prices in May are expected to have climbed 0.4% over the prior month and 5.2% over last year.

A 4.1% jump in headline inflation would be the slowest annual increase since April 2021, but would still be significantly above the Federal Reserve's 2% target.

While still uncomfortably high, gradually moderating inflation provides some space for the central bank to pause.

"It is hard to overstate the importance of the May CPI print for the June FOMC decision the following day, with markets highly sensitive to either upside or downside surprises," Citi Research wrote in a note to clients. "For the actual Fed decision, the month-on-month change in core CPI will be the key figure to watch."

Citi warned investors, "A 0.4% MoM increase in line with our forecast (0.37% unrounded) would be strong enough to tip the scales for Fed officials towards a hike (although market pricing would still be unlikely to fully price a hike)."

Bank of America said used car prices are a key driver behind its forecast for a strong core CPI print. The bank said it expects used car prices to rise 2.7% month-over-month, following a 4.4% increase in April.

Oxford Economics, with lead US economist Michael Pearce writing in a note that "there is little in the incoming data to suggest the Fed will not follow through on the clear guidance for a pause at this week's Federal Open Market Committee meeting."

"Even if the core [inflation] number comes in hot, Fed officials are paying more attention to the trend, which is likely to be downward over the second half as base effects work in their favor," Pearce added.

Comments