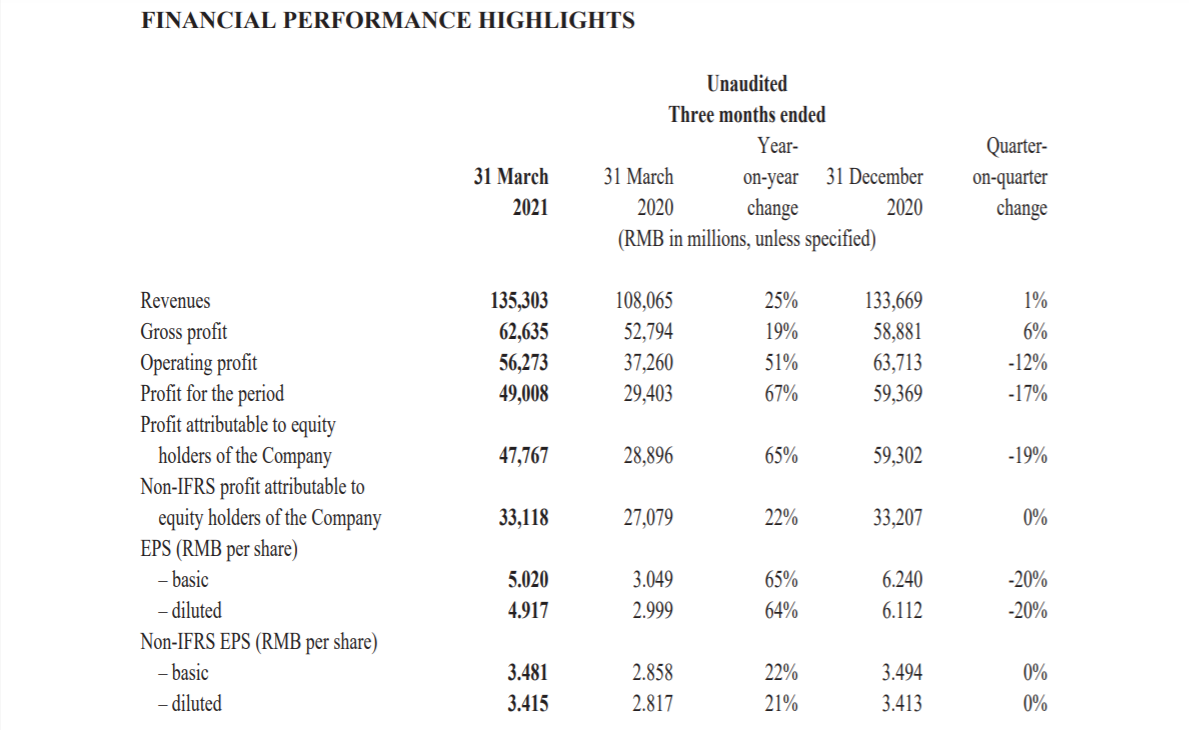

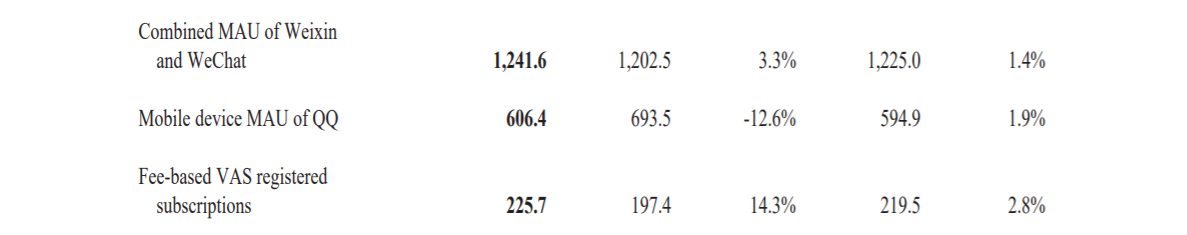

Tencent Holdings Ltd announce the unaudited consolidated results of the Group for the three months ended 31 March 2021.Qtrly revenues rmb135,303 million versus rmb108,065 million;Qtrly profit attributable rmb47,767 million versus rmb28,896 million;Qtrly revenues from online advertising increased by 23% to rmb21.8 billion;At march 31, combined mau of Weixin and Wechat 1,241.6 mln vs 1,202.5 mln

BUSINESS REVIEW AND OUTLOOK

During the quarter, we achieved notable growth for our business services as well as online advertising revenue streams, while stepping up our investment in areas including business services and enterprise software, high-production-value games, and short-form video. Our listed investment portfolio experienced meaningful value appreciation, while contributing mixed results to our associate income, with certain investees delivering wider associate losses due to their investments in new initiatives such as community group buying activities. Overall, we believe we sustained healthy operational and financial results during a period when the China Internet industry as a whole is undergoing a heavy investment phase. Here are some highlights of our key products and business lines for the quarter:

Weixin

Weixin Video Accounts continued to gain user and content creator traction as we build the content ecosystem. We have increased our efforts in attracting and incubating content creators by providing customised onboarding services and ongoing operational support. Mini Programs’ ecosystem is thriving with deeper penetration among small and medium-sized businesses. Our low-code development platform enables smaller businesses to develop Mini Programs more cost-effectively. We provided more tools to assist system integrators and the number of active Mini Programs they served more than tripled year-on-year.

QQ and Digital Content

We are leveraging technology to better integrate social and content consumption experiences at QQ, such as seamless experiences between instant messaging and games. Users can team up with QQ friends to start a multi-player game battle with one click. For in-game friends who are not on QQ, users can communicate with them synchronously via Game Center. They can also stay up-to-date with game events via QQ Mini Programs. Looking forward, QQ’s new leadership team will seek to upgrade the service’s technology, operations and content, and better serve the social and entertainment needs of young users.

Our fee-based VAS subscriptions grew 14% year-on-year to 226 million. Video subscriptions increased 12% year-on-year to 125 million, benefitting from adaptation of certain IPs, such as The Land of Warriors, into animated and live action drama series. Our self-commissioned variety shows such as Chuang 2021 and Roast Season 5 attained popularity. Music subscriptions increased 43% year-on-year to 61 million, primarily driven by better content, effective marketing campaigns and an improved retention rate.

We are merging the Tencent Video and WeiShi teams to upgrade their algorithmic recommendations, bring integrated viewing experiences to users, and enrich short video clips adapted from our long form video library. We have announced leadership changes in TME, aiming to enhance the co-operation and synergies between our digital content services, as well as with our social communities.

Games

Our aggregate user engagement and user spending increased year-on-year despite the high base due to stay-at-home impact in the first quarter of 2020. We released Honour of Kings’ biggest-ever update in January to improve its graphics and game experiences, and then launched appealing marketing campaigns with top-tier skins during the Chinese New Year, which drove the game’s DAU and paying users to record highs in February. We reduced the application file size of PUBG Mobile and enhanced our local market operational capabilities, boosting PUBG Mobile’s DAU in EMEA countries. League of Legends benefitted significantly from the release of bigger and better Lunar Revel content across PC and mobile devices, as well as across its core game mode and Teamfight Tactics.

We are also cultivating emerging genres beyond these large audience games. For example, our new titles Komori Life and The Walnut Diary ranked among China’s top ten life simulation mobile games by DAU in April 2021. Our games pipeline covers a wide spectrum of genres, including Action, MOBA and Survival. For China, many of the new games are adapted from popular existing game and literature IPs. Internationally, we expect our substantial prior investments in best-in-class PC, console and mobile studios to begin contributing a range of genre-innovating games in the quarters to come.

Online Advertising

We enhanced the transaction capabilities of our advertising properties via linkage with Weixin Mini Programs and upgraded marketing solutions for key industries including games, retail and automobile-related verticals, delivering higher sales conversion and ROIs for advertisers. Advertisers’ adoption of Mini Programs as landing pages increased substantially, demonstrating growing recognition of Weixin as a transaction-generating environment. Our mobile advertising network continued to benefit from increased video advertising inventories primarily within games, online reading and tool apps. For the rest of 2021, industry uncertainties include potential regulatory headwinds for K-12 education and potential delays to the release schedule of our video content.

FinTech

Our commercial payments volume benefitted from rising adoption of mobile payment in China due to consumption growth and an expanding digital economy. As people travelled less and consumed more during the Chinese New Year holiday, offline payment transactions increased sequentially, particularly in retail and dining services.

Weixin Pay has been assisting small and medium-sized merchants in China to grow and digitalise their businesses. We are committing significant subsidies, resources and services to small and medium-sized merchants, to further reduce their operating costs and enhance their operational efficiency.

Cloud and Other Business Services

Leveraging our strengths in security, communication and CRM solutions, we expanded our PaaS and SaaS businesses during the quarter. To better position ourselves for the opportunities in China’s nascent SaaS market, we have established our SaaS ecosystem program to nurture the growth of SaaS providers and facilitate digitalisation of enterprise clients. We launched our Enterprise App Connector with unified login accounts and data flow across different SaaS products, allowing SaaS providers to develop and deliver their products more efficiently, while facilitating better coordination of multiple SaaS solutions by enterprise clients

Investments for the Future

We believe that we are still in the early stage of the global digital transformation. The advance of technology will present ample opportunities for our Consumer Internet and Industrial Internet activities. Consequently, we are proactively increasing our rate of investment in new opportunities by investing a portion of our incremental profits for 2021, which we believe will deliver high returns in the long run. Incremental investments will include the following areas – business services, games and short-form video content.

- Business Services: We will make further investments in areas such as headcount and infrastructure to support the rapid growth of our business. We will strengthen our productivity SaaS products and security software as well as partnerships with and investments in SaaS providers and Independent Software Vendors, supporting our clients’ digital needs. Through enhancing our upsell and cross-sell capabilities in key verticals such as healthcare, retail, education and transportation, we will provide smart solutions for enterprises and consumer-facing products for users.

- Games: We are stepping up our investments in game development, and in particular focusing on large-scale and high-production-value games that can appeal to users globally. We are also investing further in new types of games serving more targeted audiences, building up IP franchises and developing them across media, and investing in advanced technologies for next generation game experiences such as cloud games.

- Short-Form Video Content: We are now incubating the content ecosystem for Video Accounts which connect users with real-life content and bridge high-quality content creators with their customers. We will provide production and monetisation tools to content creators, optimise social-driven recommendation, enrich knowledge-based content as well as add servers and bandwidth to support Video Accounts’ solid growth. We are strengthening the synergies between our long-form and short-form video services. Through the merger of Tencent Video and WeiShi, we will empower long-form video leveraging our short-form capabilities. We will escalate self-commissioned production to further expand our IP content library, and provide video clips that can be adapted by our creator network.

As a technology company serving a broad base of users and enterprises, we recognise our social responsibility and the opportunities for us to create significant social value through innovations. Consequently, we integrated our Corporate Social Responsibility and charitable activities into a new Sustainable Social Value Organisation. We will invest an initial capital of RMB50 billion, to be funded by our investment gains, in areas including basic science, education innovation, rural revitalisation, carbon neutrality, food/energy/water provision, assisting with public emergencies, technology for senior citizens and public welfare. This upgrade aims to implement our mission of “Tech for Good” and marks a new phase of development for the Company.

Comments