Bitcoin sold off sharply Wednesday. The slump represented an acceleration of a downtrend in the world's No. 1 crypto that had begun over the past 10 days or so, investors and industry specialists told MarketWatch.

At last check, bitcoin prices were changing hands at $38,732,56 on CoinDesk, which is actually a remarkable feat since it touched a session low of $30,201.96 before bouncing back.

Prices of Ether on the ethereum blockchain were off 22% at $2,608.84 after touching an intraday nadir at 1,902.08, and dogecoin was off 25%, changing hands at 35.8 cents.

When bitcoin sneezes the rest of the crypto complex catches a cold because the dominant digital asset has increasingly become a gauge of sentiment not just in nonconventional markets but as a measure of risk appetite more broadly.

Crypto markets have shaved more than $850 billion from their combined market value, according to CoinMarketCap.com .

The stock market also saw substantial selling on the day, which abated somewhat by the closing bell. The Dow Jones Industrial Average , the S&P 500 index and the Nasdaq Composite Index suffered a third straight day of losses.

Why is bitcoin crashing?

Don't call it a crash. Bitcoin is falling, but its an asset known for volatile periods.

Its current slump isn't pegged to one single event or piece of news but was instead being blamed on fear, uncertainty and doubt, or FUD, in the parlance of crypto traders. Fear, at least partly, centered on China's digital-asset policy. The People's Republic was reportedly cracking down in the use of digital assets. For veteran crypto investors, such reports aren't new.

Meanwhile, bearish tweets from crypto enthusiast Elon Musk were also credited with tanking the crypto complex. Musk said earlier this month that he would no longer allow bitcoin to be used for payment at electric-vehicle maker Tesla $(TSLA)$ until the crypto becomes more environmentally friendly.

Musk had been one of the key reasons that crypto broadly had been on an uptrend, with his tweets on meme coin dogecoin and bitcoin supporting an uptrend in those assets.

Separately, analysts at JPMorgan Chase & Co. $(JPM)$, including Nikolaos Panigirtzoglou, make the case that investors in bitcoin were shifting to gold futures , which coincidentally has been seeing steady climbs in recent trade.

"Institutional investors appear to be shifting away from bitcoin and back into traditional gold," they wrote.

Market participants told MarketWatch that Wednesday's losses also were being amplified by the use of leverage which was forcing margin calls at some crypto trading platforms.

Complicating matters, some crypto trading platforms, including Coinbase Global $(COIN)$, experienced outages that appeared to help put further pressure on prices.

A spokeswoman for Coinbase said that the company's trading problems have since been resolved.

Will bitcoin prices recover?

Bitcoin and crypto are inherently volatile.

That said, bullish investors are advocating that long-term investors stay the course or review their original investment thesis before dumping crypto holdings.

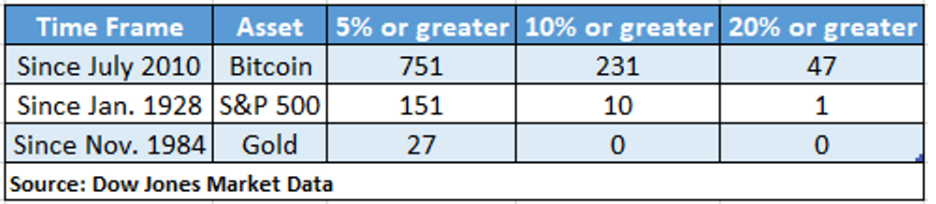

Over the course of the past 11 years, bitcoin has seen more than 750 instances where prices saw a daily change of 5% or greater, more than 230 instances in which it swung by at least 10% and nearly 50 times that it has moved by at least 20%, according to Dow Jones Market Data.

"Correction in the cryptocurrency market is a common phenomenon. It doesn't mean, however, that a bear market is under way," wrote Konstantin Boyko-Romanovsky, CEO and founder of Allnodes, in emailed comments.

To be sure, past performance is no guarantee of future results but that is what bullish investors tend to hang their hats on when they advocate for long-term ownership of bitcoin and its ilk.

Comments