A wild day on crypto exchanges is being blamed on a raft of glitches and reports of a big sale that at least one analyst credited for contributing to the downward pressure on digital-asset prices.

Temporary technical trading issues were reported by users of exchanges from Coinbase Global, the largest U.S. crypto-trading platform, to Hong Kong-based Bitfinex and FTX, as well as rival platforms Gemini and Kraken.

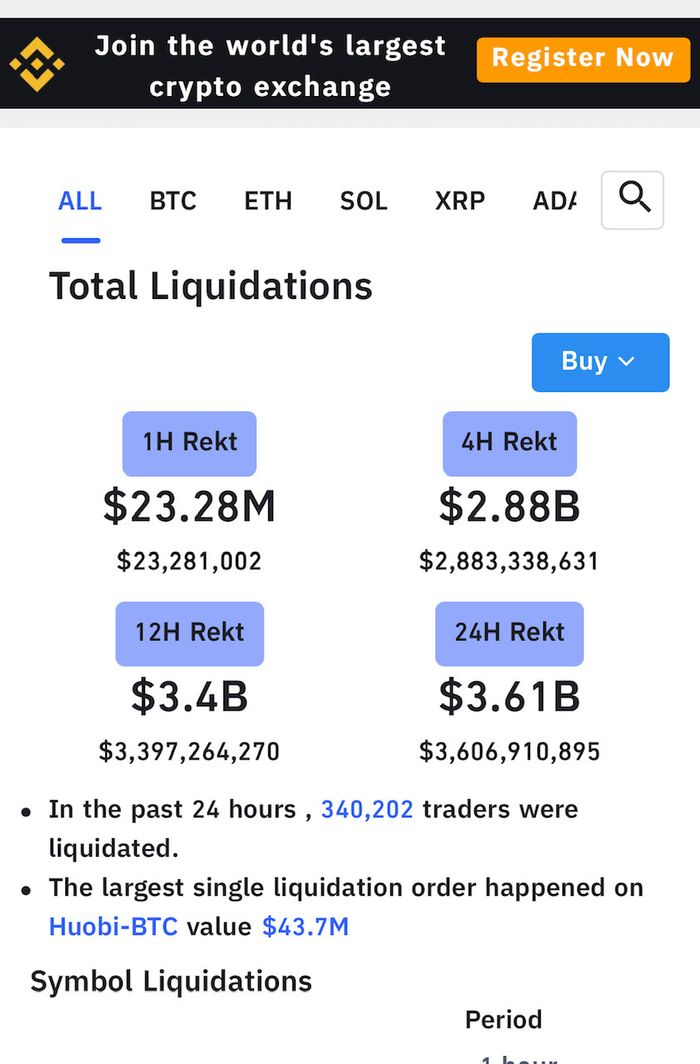

On top of that, an analyst pointed to the big sale of some $44 million in bitcoin on Seychelles-based cryptocurrency exchange Huobi as amplifying the slump on Tuesday, as many traditional investors in the U.S. returned from a three-day holiday.

Traditional stock indexes, such as the Dow Jones Industrial Average and the S&P 500 index , and bond markets were closed Monday in observance of Labor Day, but the crypto market never sleeps.

Against that backdrop, bitcoin , Ether on the Ethereum blockchain and meme asset dogecoin declined sharply, but recovered somewhat as brave investors bought into the slump.

Even by crypto's whipsawing standards, Tuesday's action was a bit unsettling for digital-asset bulls.

"Bitcoin price [was] being hammered...but if you look at the price action more closely you can see that traders have actually bought the dip as the price has bounced near its 50-day [simple moving average]," wrote Naeem Aslam, chief analyst at AvaTrade, in a daily note.

"At the same time, it is important to note that crypto exchanges like Bitfinex have turned off their platforms, possibly crashed, and this is certainly a concern for investors," the analyst wrote.

At last check, bitcoin was changing hands at $46,920.19, down nearly 10%, while Ether was trading at $3,414.49, off by nearly 14% on CoinDesk.

Comments