NEW YORK (Reuters) - Options traders are expecting comparatively subdued moves in GameStop Inc shares around its earnings report, as the company that helped spark the so-called meme stock phenomenon prepares to report quarterly results on Wednesday.

Traders are pricing a 14% swing for GameStop's shares by Friday, according to pricing in options expiring at the end of the week. By comparison, the video game retailer’s shares have moved about 30% on the day after each of its last two earnings reports.

The expectations for smaller stock swings comes as the daily moves in GameStop’s shares have also grown tighter. The company’s shares have logged average daily moves of around 3.6% in either direction over the last month, compared with average daily moves of 12% for the first half of the year.

One reason for the toned-down moves may be that the company’s shares - which stand at around $200 compared with around $16 in early January - may be growing less attractive to investors looking to get in on cheaper stocks in the hopes of catching a big rally, said Henry Schwartz, head of product intelligence at Cboe.

A recent batch of meme stocks that rallied last month included names like Support.com, which went from trading at around $8 in mid-August to as high as $59.69 in late August, and Vinco Ventures, which went from around $2.50 in late August to as high as $7.89 earlier this month.

"GameStop has been eclipsed by a lot of other names," Schwartz said.

GameStop is up about 950% for the year and down 8% so far this quarter. The stock's 1-month average daily options trading volume is at about 111,000 contracts, down from about 820,000 contracts in early February, according to Trade Alert data. Similarly, the stock's 1-month average daily volume is at 3.3 million shares, down from about 77 million shares in early February.

The Grapevine, Texas-based company is expected to post a rise in second-quarter revenue on Wednesday as its brick-and mortar business is slowly recovering.

With the company pushing for e-commerce growth, investors will also look for comments regarding its future plans. Hardcore proponents of the stock on forums such as Reddit's WallStreetBets have famously pledged to hold its shares until they go "to the moon."

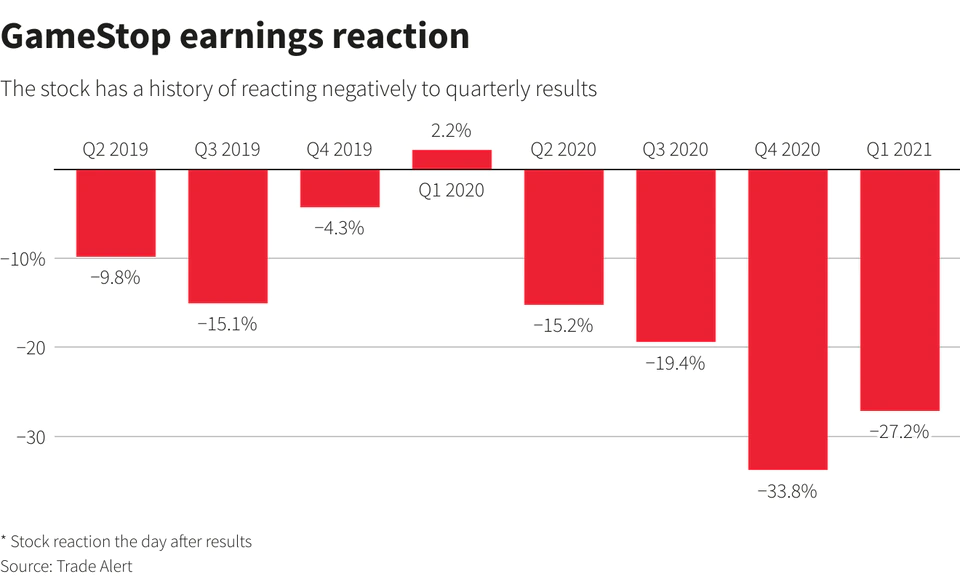

Indeed, a look at implied volatility - an options-based measure of how much traders expect a stock to move - suggests that some are betting on the shares to snap a four-quarter streak of post-earnings declines.

Implied volatility on Friday-expiration calls that would come into play if the stock rises 15% stood at 230% on Tuesday afternoon, compared with 210% for puts that come into play if the stock falls 15%, according to Refinitiv data.

Calls convey the right to buy shares at a fixed price in the future and are typically bought by bullish investors, while puts provide the right to sell shares at a set price in the future.

"The marketplace is willing to pay up for the calls in the near-term cycle," said Brian Overby, senior options analyst at Ally Invest.

Comments