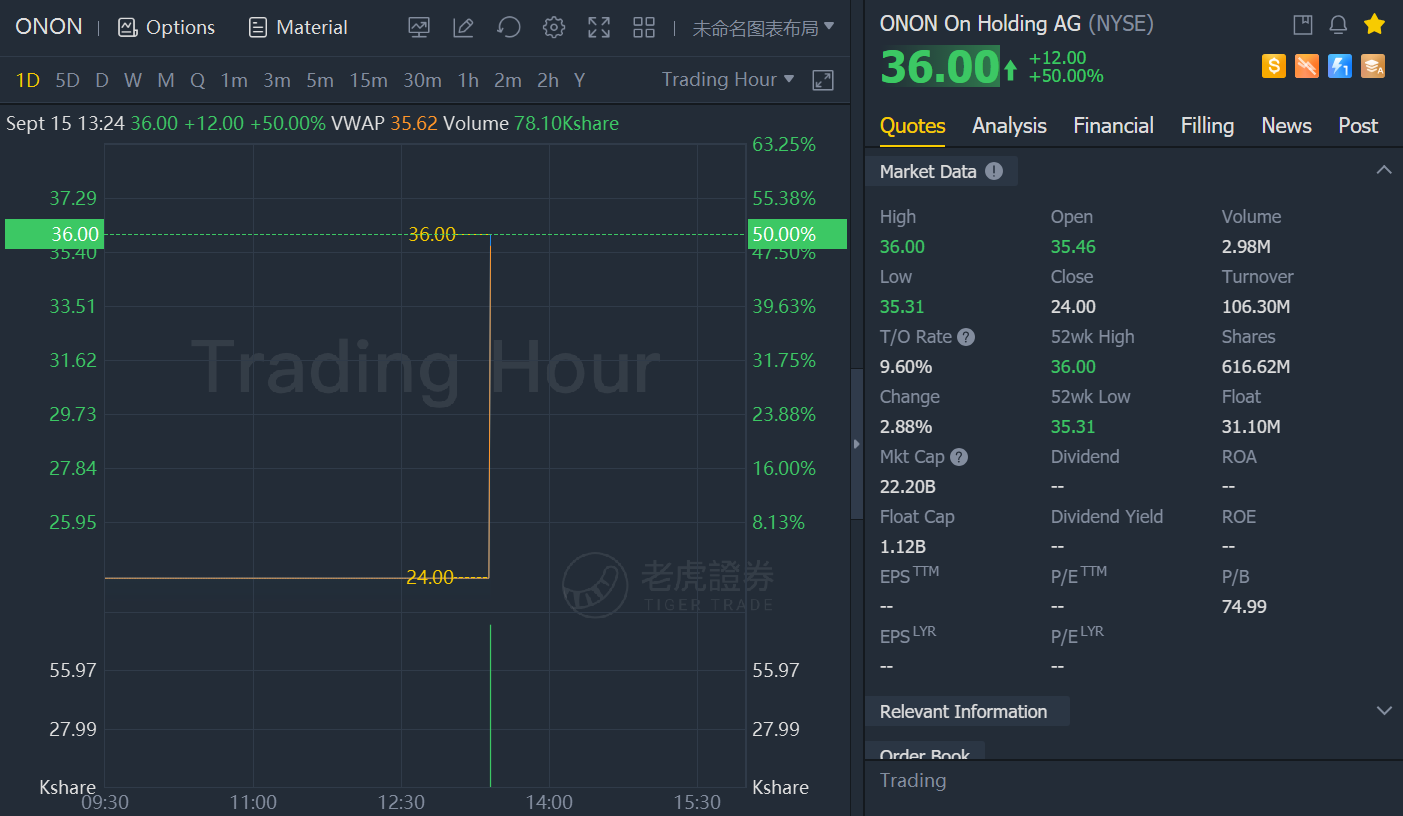

Federer-backed shoemaker ON spikes 50% on its first day of trading.

On Holding AG, a shoe firm backed by Swiss tennis legend Roger Federer, on Tuesday priced its initial public offering (IPO) well above the target range, valuing the company at over $6 billion.

On priced 31.1 million shares offered at $24 each, compared with a target range of $18 to $20 per share, raising $746.4 million, it said in a statement.

The shoemaker was founded in 2010 by running enthusiasts Olivier Bernhard, David Allemann and Caspar Coppetti, with Federer investing an undisclosed sum in the company in 2019.

The 20-time Grand Slam winner teamed up with the company earlier this year to develop the Roger Pro tennis shoe.

The IPO comes at a time when athletic gear, especially shoes, has been flying off the shelves at most retailers as COVID-induced gym closures push more people to take up running to keep themselves fit.

The company's largest market is North America, which accounts for nearly 49% of total sales, followed closely by Europe.

On is due to begin trading on the New York Stock Exchange on Wednesday.

Goldman Sachs & Co, Morgan Stanley and J.P. Morgan are among the underwriters for the offering.

Comments