This year has been brutal for U.S. stocks, but that goes double for high-growth technology stocks.

A mix of rising bond yields and recession worries have weighed on the tech sector since late last year.

The Nasdaq Composite has fallen 22% in 2022, compared with a 13% drop for the S&P 500 index. The pain has been felt across the board -- from social media firms such as Meta Platforms and Snap, to streamers such as Netflix $(NFLX)$, and semiconductor firms such as Nvidia.

The Nasdaq-100 index -- which features the largest nonfinancial firms listed on the Nasdaq -- has fallen 22%.

The specter of rising yields have weighed on tech stocks because they essentially lower the value of future profits. Recession worries, meanwhile, have hampered companies focused on advertising and discretionary consumer spending -- such as social media and e-commerce firms.

With stocks inching back in recent days from the brink of bear market territory, bargain hunters may think it's time to scoop up shares of strong businesses at steep discounts.

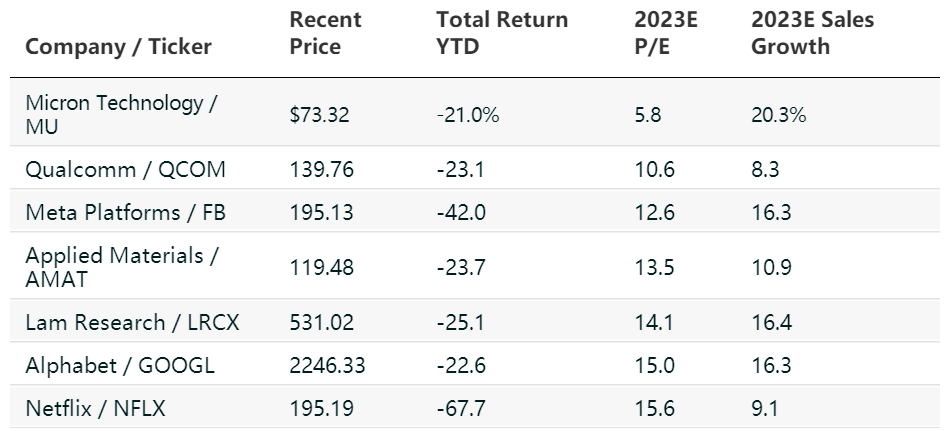

That is why Barron's screened for Nasdaq100 firms that have fallen more than 20%, including dividends, this year. We then filtered out firms with a forward price-to-earnings multiple greater than the S&P 500's average of 16.7 times estimated 2023 earnings, according to Bloomberg. Lastly, we narrowed the screen to firms with estimated 2023 sales growth of 8% or more, per Bloomberg estimates.

The Technology Stock Bargain Bin

These Nasdaq 100 stocks have fallen more than 20%, are cheaper than the S&P 500, and are expected to grow sales by more than 8% in 2023.

Qualcomm has fared even worse this year with a 23% decline. The wireless chip maker has seen shares tumble amid a broader semiconductor selloff. The company is investing in reducing its dependence on its business providing chips to Apple devices, to things such as cars, virtual reality devices, and computers.

Speaking of virtual reality, Meta Platforms saw shares sink in 2022 as its results showed how much a pivot to "the metaverse" will cost. The company's advertising business has also faced challenges from TikTok and Apple's privacy changes, which upended how the firm tracks the success of advertising on mobile devices. But with shares trading at 12.57 times 2023 estimated earnings with expectations of 16% sales growth, there is an argument to be made that the stock is cheap.

Applied Materials and Lam Research are the next two on the list. The semiconductor equipment manufacturers have fallen sharply this year as semiconductor stocks were hit by lockdowns in China and worries about demand. They trade at 13.51 and 14.05 times forward earnings estimates, respectively.

Rounding out the list are Alphabet and Netflix -- the last two stocks on the FAANG group of technology giants. Alphabet stock trades at 15.93 times estimated 2023 earnings and is expected to grow sales by 16% in 2023. That doesn't mean it's all rosy for the Google parent. Macroeconomic concerns could weigh on the firm's search and cloud businesses in the coming months.

Netflix saw shares sink as the firm revealed it was losing subscribers. It now trades at 15.6 times earnings expectations for 2023 compared with expected sales growth that year at 9.1%.

Comments