Chinese electric-vehicle makers continued their recovery from a Covid-19 induced slump. That's good news for U.S. EV maker Tesla too.

NIO (ticker: NIO), XPeng $(XPEV)$, and Li Auto $(LI)$ on Wednesday each reported delivery figures for May that improved from April and looked good enough to investors. The shares of the three companies were rising in premarket trading.

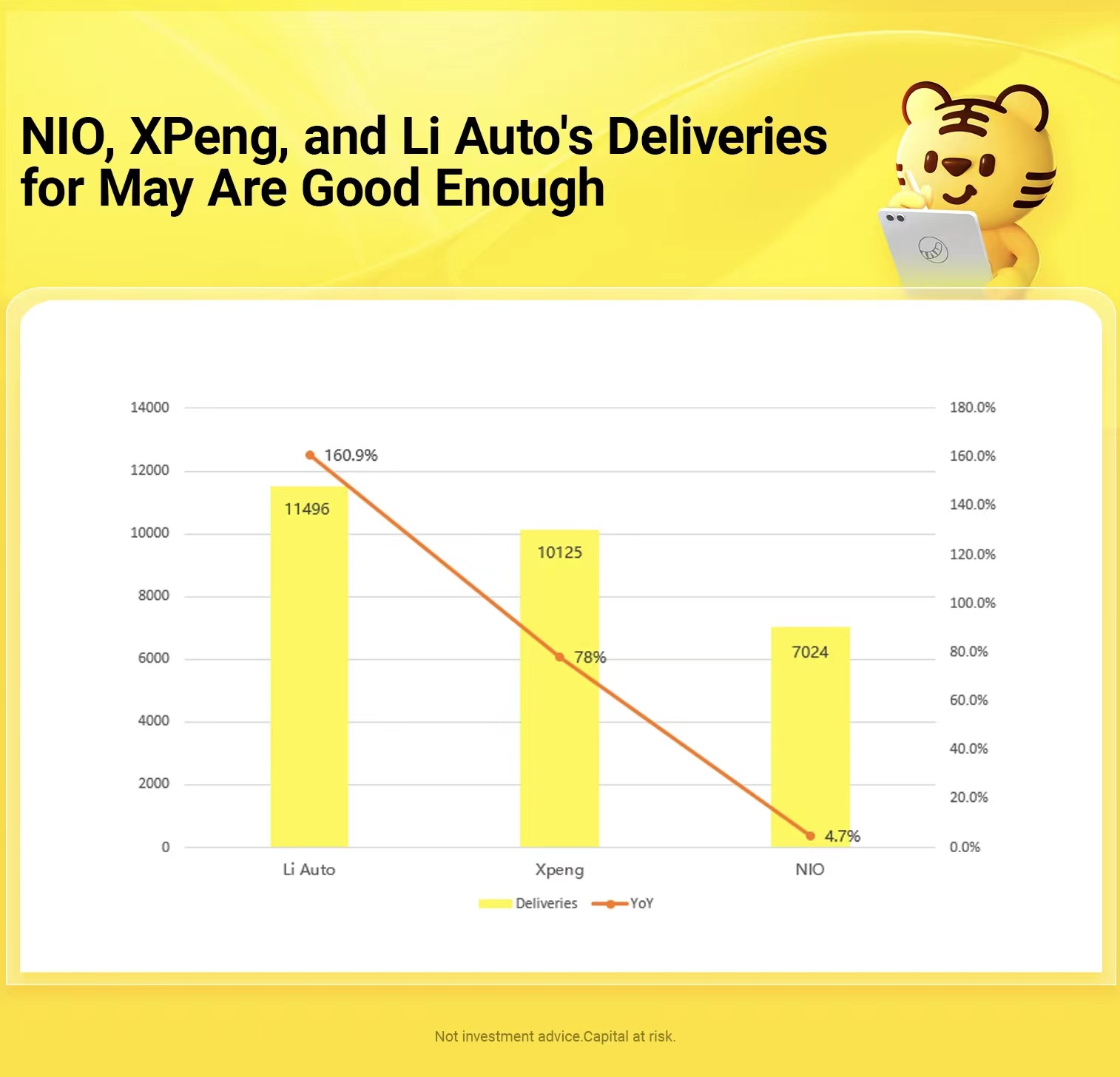

XPeng delivered 10,125 vehicles in May, up from 9,002 vehicles delivered in April. In late May, XPeng management said it expected to deliver 31,000 to 34,000 vehicles in the second quarter. That means June deliveries should come in between roughly 12,000 and 15,000 units. The high end of the range would be one of XPeng's best months for deliveries on record.

Li Auto delivered 11,496 vehicles in May, up from 4,167 vehicles in April. Li guided for second-quarter deliveries to fall between 21,000 and 24,000 vehicles. That leaves between roughly 5,300 and 8,300 to be delivered in June. Li said it was still seeing parts shortages because of Covid that are impacting production.

NIO delivered 7,024 vehicles in May, up from 5,074 delivered in April. NIO reports first-quarter earnings next week. The company hasn't given second-quarter delivery guidance yet.

Taken together, the three companies delivered 28,645 EVs in May, up from 18,243 vehicles delivered in April. The 28,000-plus figure is the best result since March, just before a Covid resurgence impacted auto production across the country.

NIO stock was up about 1.8% in premarket trading early Wednesday. XPeng shares gained 1.2%. Li stock rose 2.1%. S&P 500 and Dow Jones Industrial Average futures were up 0.2% and 0.4%, respectively.

Coming into Wednesday trading, all three shares have been badly beaten up. The trio is down 40% this year, on average. Rising interest rates and inflation has sapped some investor enthusiasm for growth stocks.

Tesla $(TSLA)$ stock has declined about 28% in 2022. The delivery news from NIO, XPeng and Li is good news for Tesla too. It shows Chinese Covid-related slowdowns are slowly abating.

Tesla's Shanghai facility was shut for part of April and is still operating below its design capacity because of local Covid restrictions. Tesla manufactured roughly 10,000 cars in Shanghai in April. That plant produced more than 70,000 vehicles in December 2021.

Improvement is good, but Tesla stock isn't getting a bump Wednesday like the shares of the Chinese companies. Tesla stock was down 1.3% in premarket trading.

There doesn't seem much to pin the drop on, except recent performance. Tesla stock has jumped 21% over the past week.

Comments