During times of uncertainty, it can help to look at what happened during other down cycles for stocks.

True, we don't know when the stock market will hit bottom during this cycle, or if it already has. But you might want to tilt toward a sector that has fared well during previous downturns. You might miss out on some recovery upside, but you might also lower your risk.

So which groups of stocks fared the best from a market top through a bear-market bottom and back to good times when new highs were set?

One might look to the previous recession, brought about by the coronavirus pandemic in 2020. But that market downturn reversed quickly when investors realized the Federal Reserve and federal government would provide unprecedented stimulus to help consumers and businesses survive. Let's look further back.

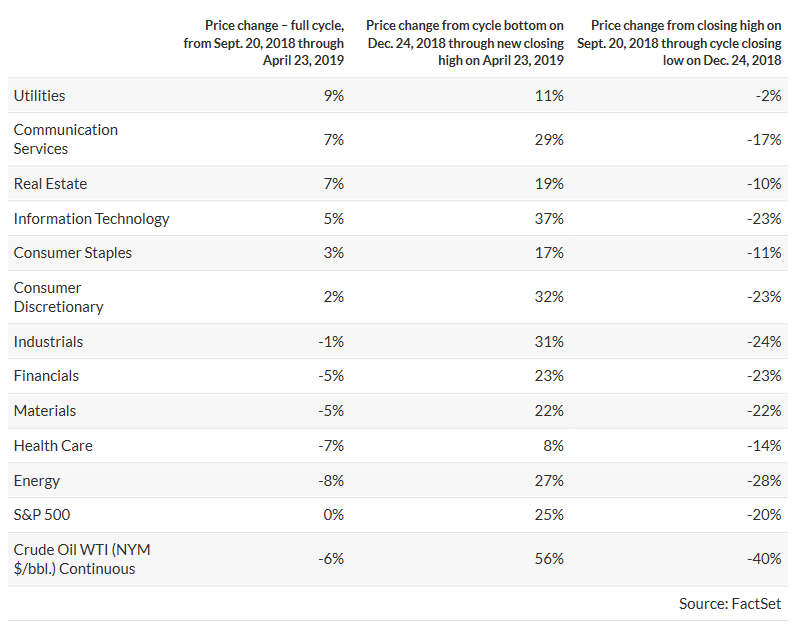

This is what happened from the S&P 500's then-record closing high on Sept. 20, 2018, through the benchmark index's bear-market closing low on Dec. 24, 2018, and then through April 23, 2019, when it resumed setting new all-time highs.

The chart shows the 11 sectors of the S&P 500, sorted by how well they performed (excluding dividends) through the entire 2018-2019 bear market and recovery cycle, with the full index and continuous front-month quotes for West Texas Crude Oil at the bottom:

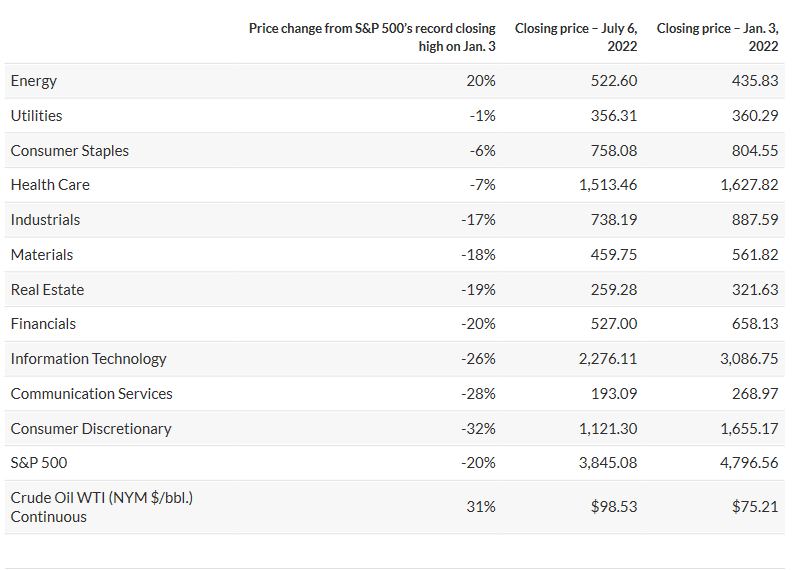

So far in 2022, here's how the sectors have performed from the S&P 500's closing record on Jan. 3 through the close on July 6:

But the utilities sector has shined again, while featuring a weighted estimated annual dividend yield of 3.13%, based on consensus estimates among analysts polled by FactSet.

There is something to be said for being paid to wait through a bear market, while receiving dividends that put you in the black as seven sectors and the entire index suffer double-digit declines.

One easy way to invest in the space is the Utilities Select Sector SPDR Fund $(XLU)$, which holds all the stocks in this sector of the S&P 500.

Screening the 'bulwark' sector

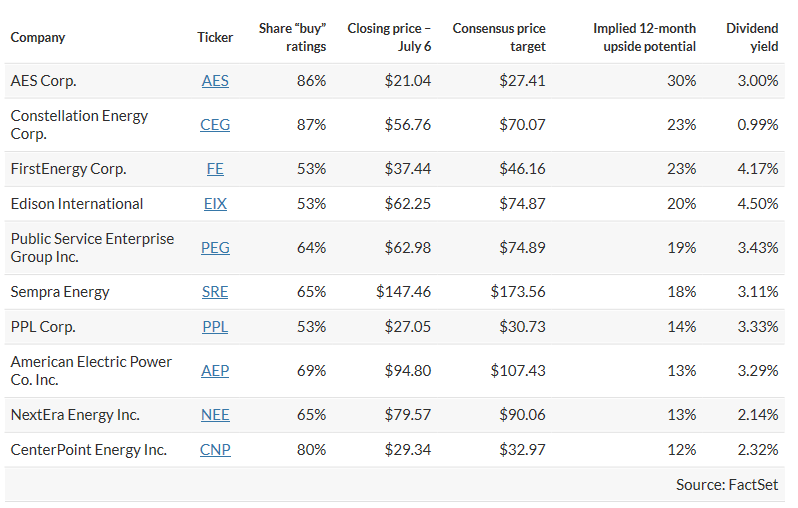

But you might want to dig into the 29 stocks in the S&P 500 utilities sector. Here at the 10 with majority “buy” or equivalent ratings among analysts polled by FactSet that have the most upside potential implied by consensus price targets:

Comments