Activity in the market for stock options is hitting a fever pitch, with many rushing to trades expiring within mere hours or days to play the wild market swings.

Options contracts that expire in less than a week make up about half of all activity in the U.S.-listed options market, according to the derivatives-analytics firm SpotGamma. That is up from around 45% last year and roughly a third of all activity in 2019.

Options give traders the right to buy or sell shares at a stated price, by a specific date. Scooping up short-dated options allows traders to turbocharge their wagers during one of the most volatile years since the 2008 financial crisis.

For some, the short-lived trades are a way to profit from the sharp one-day moves that have become a feature of the market this year and to ride the intraday momentum. Others have tapped the trades to manage risk in their portfolios during a turbulent period.

"Speculators love them," said Steve Sosnick, chief market strategist at the electronic brokerage Interactive Brokers, on options with the shortest expiries. "If you're speculating, you don't necessarily want to think about the move in three months -- you want to think of the move tomorrow."

The S&P 500 just logged its worst performance through the first nine months of any year since 2002. And the head-spinning stock moves have continued at the start of the fourth quarter. The market index has gained 5.5% to start the week, including its best two-day return since April 2020. It is still down 21% in 2022.

The sharp swings haven't been limited to the broader market. Twitter Inc. shares jumped 22% on Tuesday after Elon Musk indicated that he would move forward with his deal to buy the company. On Wednesday, more than 1.1 million options contracts tied to the stock exchanged hands, a greater than sixfold increase from typical levels, according to Cboe Global Markets. The most actively traded contracts were those expiring Friday.

Options have boomed in popularity in recent years, with many institutional and individual investors piling in since the onset of the Covid-19 pandemic. Overall activity is on pace for another record-breaking year, with more than 40 million contracts changing hands on an average day in 2022.

Shorter-dated options can be cheaper to trade, while giving traders the opportunity for explosive returns if their bets prove correct, Mr. Sosnick said.

The price of an option can change rapidly as it approaches the expiration date, allowing buyers to profit quickly if the market moves in their favor. Alternatively, the approaching expiration date can be attractive for sellers looking to lock in income earned from selling an options contract, if its value collapses. These approaches can be risky and saddle traders with big losses.

Julien Stouff, founder of the hedge-fund firm Stouff Capital in Geneva, said he bought S&P 500 options that expired the same day to profit from the stock rally at the beginning of the week. He embarked on the trade before the U.S. stock market's opening bell Monday and tapped a similar trade Tuesday.

Mr. Stouff said the trades allow him to manage his risk in a tricky market, one that has been prone to big swings in both directions and in which rallies so far have been short-lived. Even though he said he thinks this week's rebound will eventually fizzle, the options have allowed him to profit from the momentum higher.

"This market is very dangerous," Mr. Stouff said. "Everyday is a new day, it's a new market."

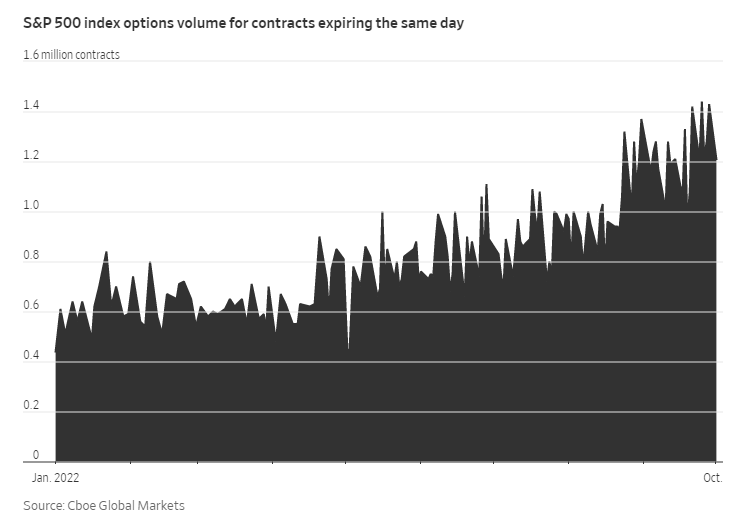

Cboe Global Markets has introduced extra weekly options expiration dates this year, fueling greater activity and helping to send S&P 500 index options volume for contracts expiring within a day to a high in September.

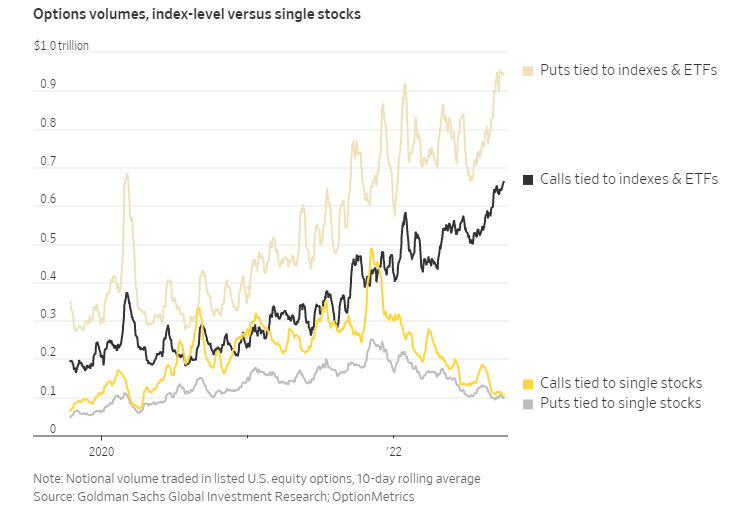

Of course, many traders have also looked to profit from declines in the market or hedge their portfolios. The latest bout of volatility has been dotted with heavy activity in put options trading, which has surged to the highest level since 2008. That suggests many traders are turning to bearish trades to profit from market declines or protect themselves from further losses.

Facing one of the most uncertain times for the economy in years, traders have turned to index options, rather than options on individual stocks, to place broad-based bets on the market. That is a shift from the meme-stock-mania and excitement surrounding shares of individual companies that dominated markets in early 2021.

More than 60% of options trades tied to indexes are those expiring in nine days or less, up from around 40% in January 2021, according to the data provider OptionMetrics. In total, options tied to roughly $1.6 trillion of stock indexes and exchange-traded funds change hands each day, nearly eight times the $204 billion of individual stocks, according to a Goldman Sachs analysis of OptionMetrics data.

It isn't all speculation. Another reason short-dated options have become so popular is risk management, said Benn Eifert, chief investment officer of the hedge-fund firm QVR Advisors, which uses complex derivatives strategies.

"Every market maker, large Wall Street bank and hedge fund like us uses short-dated options on a day-to-day basis to manage risk more precisely, " said Mr. Eifert.

Comments